- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

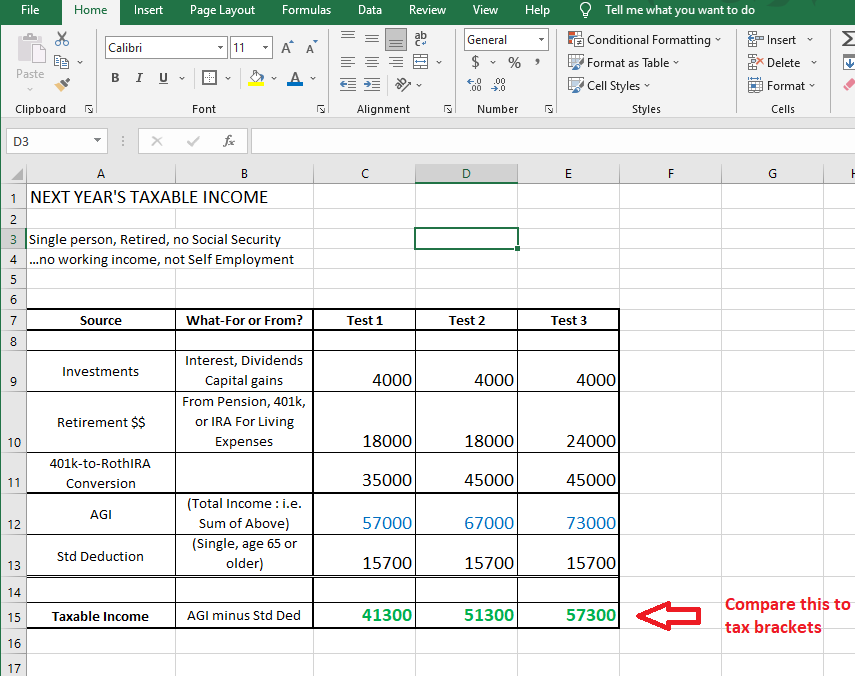

Well, if you wanted to keep it simple, I would just create a simple spreadsheet, either in tax software you might have (EXCEL) or even on a sheet of lined paper. Something like shown below. then you can compare the final line of taxable income to the tax brackets for 2023.

2023 Tax Brackets and Federal Income Tax Rates | Tax Foundation

_________________

Yeah, you'd have to update the Std Ded line every year, and check each year's tax brackets, but this keeps it simple. Not worth worrying about going from 10% to 12% tax, but 12% to 22% is a significant jump.....and you have to remember that only the $$ that go over each break point are taxed at the higher rate....so if you accidentally go a few hundred or a thousand over into a rate you don't want to be in for a particular year, it won't be too much of a hit.

And you haven't really indicated what you are living on until age 70....if the $$ are coming from your personal savings (i.e. NOT from a 401k, Pension or IRA)...then those $$ go nowhere on the spreadsheet. And it's unlikely you can live on $2000/yr from investment income.....Perhaps 2,000/month (24,000/yr) in certain living locations....it is a bit squeaky, but in the right situation???

____________