- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

Box 1g on form 1099-B is Wash Sale Loss Disallowed.

The box for 1g is on the second page of the entry screen. Boxes 1a - 1 e are on the first page, and there is an additional grouping on the second page.

If the entry to 1g is zero it may not go through. If that happens, this is the work around.

To enter a disallowed Wash sale:

Income & Expenses

- Scroll to Stocks, Mutual Funds, Bonds, Other

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?

- On the OK, what type of investments did you sell? screen, select Stock, Bonds, Mutual Funds. Then select Continue.

- From here, you can import or manually enter your 1099-B.

- Answer the questions about your sales. Choose to Enter sales one by one when asked.

- On the Now, we'll enter one sale on your 1099-B screen, enter your info.

- Check I have other boxes on my 1099-B to enter and enter the disallowed wash sale loss in box 1g.

- Select Continue and answer any follow-up questions.

Note: You'll need TurboTax Premier, TurboTax Live Premier, or TurboTax Self-Employed, TurboTax Live Self-Employed, to add any 1099-B forms.

- A wash sale occurs when an investor sells or trades a security at a loss, and within 30 days before or after, buys another one that is substantially similar.

- It also happens if the individual sells the security at a loss, and their spouse or a company they control buys a substantially similar security within 30 days.

- The wash-sale rule prevents taxpayers from deducting a capital loss on the sale against the capital gain.

- Wash Sale Rule

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

John,

Thanks for the quick response. I do have the Turbo Tax Self Employed edition, but still don't have the option to add any data from box 1G. It only allows me to add boxes 1D and 1E, but no worries the wash sale amount is only about $350, so we are just going to submit without entering this.

Kim

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

When you enter form 1099-B, on the Now, we'll enter one sale on your XXX 1099-B screen, scroll down to I have other boxes on my 1099-B to enter and put a check mark. This will show Box 1g - Wash sale loss disallowed.

Note:

- A wash sale is where you sell stock at a loss, and purchase substantially identical stock within 30 days before or after the sale.

- The wash sale rule prevents you from taking that capital loss during the year of the sale, if you buy the same (or a substantially identical) security 30 days before or after the sale.

- If some of the loss from your stock sale is disallowed due to the wash sale rules, report it here. Your financial institution will generally provide this information for you. However, if the amount reported by the financial institution is not correct, or they have not reported a disallowed wash sale amount even though it applies, you should enter the correct amount of disallowed wash sale amount here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

I have another question in this subject.

I have only one sale with box 1g. I always used to do the summary, not one sale at a time. Does it mean I have to enter every sale one at a time now because Turbo Tax didn’t add these additional boxes option to the summary entry?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

Nope. Don't need to do that. You can still do the summary totals and make an adjustment for that one entry that shows in a Box E. Here is how.

- Open or continue your return (if it's not already open) and search for stock sales.

- Select the Jump to link in the search results.

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?.

- If you land on Your investment sales summary, select Add more sales.

- On the OK, what type of investments did you sell? screen, select Stocks, Bonds, Mutual Funds, then Continue.

- When asked how you want to enter your 1099-B, select I'll type it myself.

- Answer the questions until you can select Enter sales section totals rather than entering sales one at a time.

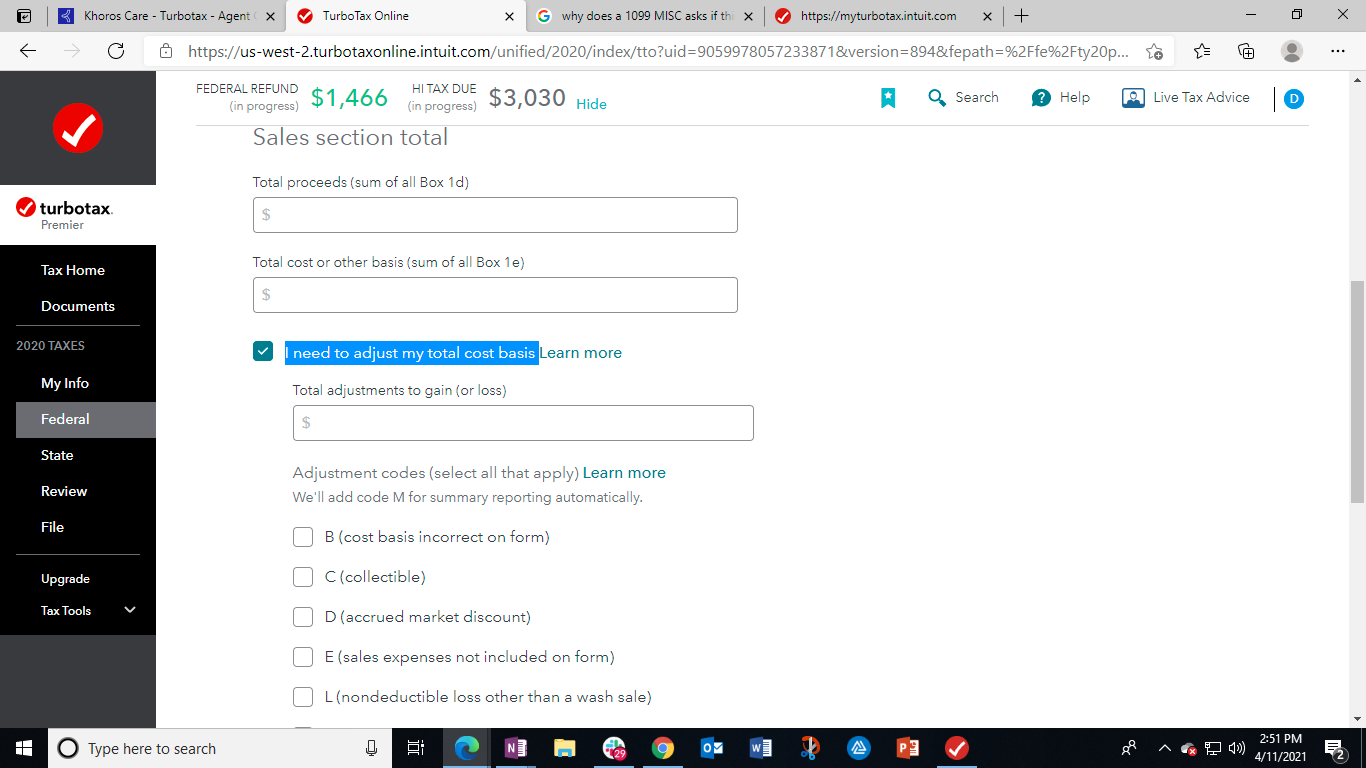

- When you begin entering summary totals, you will reach a screen that says sales section totals. then you will check a box that says I need to adjust my total cost basis

- Here you will put the amount that is in Box 1G and the adjustment code that follows. Here is what the screen looks like.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

Thank you Dave. Do I have to select W in this case?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099-B shows an amount in box 1G but Turbo Tax has no where I can enter that. What can I do?

Yes, if it is a wash sale, then you will select code W.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Joanne9rose

New Member

MaxRLC

Level 3

MaxRLC

Level 3

seple

New Member

rkplw

New Member