- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Nope. Don't need to do that. You can still do the summary totals and make an adjustment for that one entry that shows in a Box E. Here is how.

- Open or continue your return (if it's not already open) and search for stock sales.

- Select the Jump to link in the search results.

- Answer Yes to Did you sell stocks, mutual funds, bonds, or other investments in 2020?.

- If you land on Your investment sales summary, select Add more sales.

- On the OK, what type of investments did you sell? screen, select Stocks, Bonds, Mutual Funds, then Continue.

- When asked how you want to enter your 1099-B, select I'll type it myself.

- Answer the questions until you can select Enter sales section totals rather than entering sales one at a time.

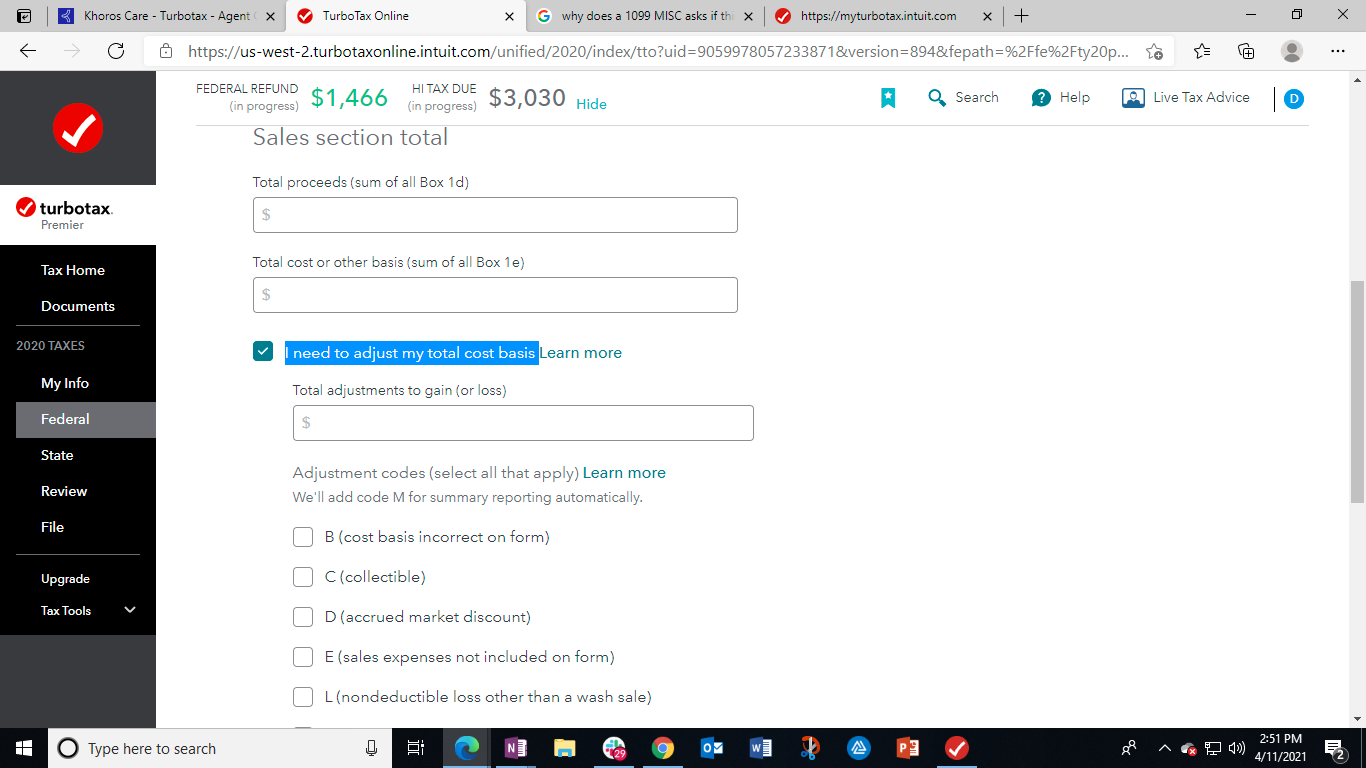

- When you begin entering summary totals, you will reach a screen that says sales section totals. then you will check a box that says I need to adjust my total cost basis

- Here you will put the amount that is in Box 1G and the adjustment code that follows. Here is what the screen looks like.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 11, 2021

2:54 PM