- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions t...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

First discovered my issue about 2 weeks ago while doing my 2021 taxes. What I learned so far is the following:

- A little knowledge is a dangerous thing.

- Don’t assume you understand your situation. You just wandered into a mine field. Proceed with caution. There are other mines out there.

- Acting hastily can make your situation worse.

- Just when you think you understand your situation you will discover a new twist that changes everything.

- In the future don’t add to your Roth IRA for year ‘x’ until year ‘x+1’ when you understand your year ‘x’ tax situation.

- Be careful acting on information received from your Roth IRA broker. They may want to be helpful but they do not understand your full financial situation.

- It will be hard to find someone with exactly your same situation especially if the problem goes back more than 2 years.

- If you are used to using a tax application to do your past returns and are not familiar with all the tax terms and jargon, prepare to enter into a dark netherworld. It will be like learning another language.

Here’s my situation discovered while doing my 2021 taxes. I’m over 59 1/2.

- I over contributed $6500 to my 2018 Roth IRA. The entire amount must be removed. This account is over 5 years old.

- I contributed $7000 to my 2019 Roth IRA. I can only do a partial contribution. This account was only 1 year old.

- I contributed $7000 to my 2020 Roth IRA. I can only do a partial contribution. This account was only 2 years old.

- I contributed $7000 to my 2021 Roth IRA. The entire amount must be removed. This account was only 3 years old.

- I contributed $7000 to my 2022 Roth IRA. Don’t know yet how my earnings will affect this. This account will only be 4 years old.

Here are my misunderstandings when I reacted before having a decent understanding of the situation.

- I mistakenly tried to do a recharacterization moving money from my Roth IRA to my regular IRA partly due to incomplete internet research and partly due to information from brokerage firm. I have a qualified retirement account at work and this would have made my issue worse! Luckily I realized my mistake within the first 24 hours and was able to cancel my request.

- I decided to remove all my contributions from 2019, 2020, 2021 and 2022 since they were in the same account thinking this would be easiest. I did a Return of Excess for each of those years. As my research continued I grew more concerned about this decision. I contacted my account holder the day it was to be executed and asked them to reverse my requests for years 2019, 2020 and 2022 as I believe I should at least partially fund the Roth IRA for these years. They indicated this could be done but it is still in progress as I write this and hope this decision does not come back to haunt me. I would eventually come to understand that I can only do a Return of Excess for years 2021 and 2022. Would need to do a normal distribution for 2019 and 2020.

- I decided to do a Return of Excess from 2018. This account is more complicated and was with another brokerage, different from the others. This would eventually get rejected. This rejection was a good thing as it woke me up to the complexity of my situation. It also let me understand that I can only do a Return of Excess for years 2021 and 2022. It also led me to cancel 3 of my 4 requests with my other account holder.

What I plan on doing. If anything sounds wrong here please let me know.

- Do a normal distribution for 2018. Have a question on this but the question is listed later as to keep all the questions together.

- Do a normal distribution for 2019.

- Do a normal distribution for 2020.

- Complete a Return of Excess for 2021

- Wait possibly until 2023 to decide how to handle my 2022 contribution and if needed do a Return of Excess. Understand that if I increase my contributions to my qualified retirement account at work it will decrease my MAGI so will be doing that in anticipation of what my 2022 MAGI will be.

Here are my questions that I’m having trouble with. Note that I have TurboTax for 2019, 2020 and 2021. I ordered 2018 but it hasn’t arrived yet which is why some of my questions are about TurboTax. Waiting for 2018 TT before starting.

- Are earnings on the Excess Roth IRA contribution also subject to the 6% penalty. I assume they are not. Assume they will need to be reported as income for the year of the contribution.

- Since for 2018, 2019 and 2020 I need to do a normal distribution how do I accurately determine earnings. How do I report this accurately when filing the amended returns that I would like to do soon when the 1099-R won’t appear until 2023. Assume that since these are normal distributions the eventual 1099-R won’t show the distribution code J or P since you cannot do a Return of Excess for those years. Assume it will show a 7 for Normal Distribution. Note this answer may tie in with the next question.

- Do I also need to withdraw earnings for 2018, 2019 and 2020 since it is more than 2 years in the past? I thought I did until I saw multiple references to this article from H&R Block which states “After the extended due date of your return, you will be subject to the 6% excise tax each year the excess remains in the account at the end of the year (by December 31) until it is removed. You do not need to remove any earnings made on the excess.”. Is this correct??

https://www.hrblock.com/tax-center/income/retirement-income/excess-ira-contributions - I’ve never done an amended return. Will TurboTax successfully walk me through this? Are there any gotcha’s that I need to worry about.

- Will I need to do amended state returns in addition to the federal amended returns? I assume the answer to this is yes.

- When I start to do the amended return for the problem years will TurboTax build the 5329 form. Assume it will. Will it just be using section IV of form 5329 or will other sections also be filled out.

- When I start to do the amended return will TurboTax have to create a form 8606? I don’t think this is needed but I’m confused about this form. Understand there is a $50 penalty if this form is required and it is not submitted.

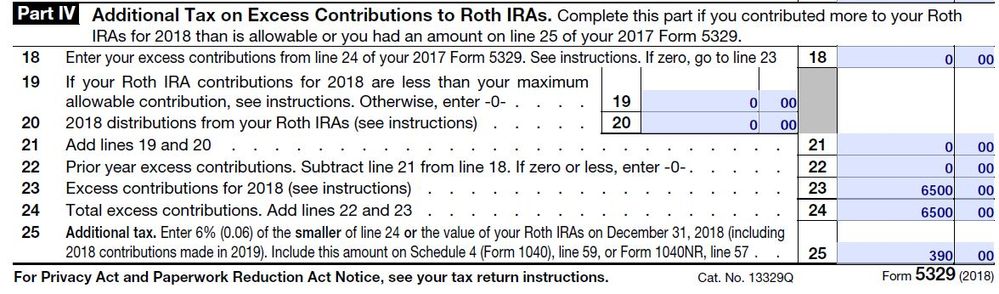

- Is this how the 2018 5329 form will look since the problem started in 2018?

Thanks for any help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

1. Earnings are not subject to the 6% penalty. Only the excess contribution is subject to the 6% penalty. You will have a penalty for 2018, 2019, 2020, and 2021 because the excess contributions from 2018, 2019, and 2020 were not removed by December 31, 2021.

In 2018 you will just enter your contribution under Deductions & Credits and TurboTax will give you a warning about the penalty and create Form 5329.

In 2019 you will enter your contribution and your prior year’s excess contribution ($6,500) during the interview in the Deduction & Credit section. TurboTax will calculate the penalty on Form 5329.

In 2020 you will enter your contribution and your prior year’s excess contribution ($6,500 + excess from 2019) during the interview in the Deduction & Credit section. TurboTax will calculate the penalty on Form 5329.

In 2021 you will enter your contribution and your prior year’s excess contribution ($6,500 + excess from 2019 + excess from 2020) during the interview in the Deduction & Credit section. On the penalty screen, you will enter the 2021 contribution amount you plan to remove by the due date. TurboTax will calculate the penalty on Form 5329.

For example, on your 2020 return, the steps are:

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Enter the 2020 Roth contribution amount

- On the "Do you have any Excess Roth Contributions" answer "Yes"

- On the "Enter Excess Contributions" screen enter the total excess contribution from 2018 and 2019.

2. You do not need to calculate the earnings for the excess contribution for the years 2018, 2019, and 2020. For the excess contributions from 2018, 2019, and 2020 you only need to remove the excess contribution amount as a regular distribution without the earnings. You will get a 2022 Form 1099-R next year and this will be entered on your 2022 tax return. Your code in box 7 will be either T or Q since it is a Roth IRA and you are older than 59 ½.

3. Yes, you can leave the earnings in the Roth account for the 2018, 2019, and 2020 excess contributions.

4. Yes, TurboTax will walk you through the amendment and it is similar to the interview when filing your taxes with TurboTax.

5. It depends on your state if you will have to amend your state as well. But TurboTax will walk you through this.

6. Yes, TurboTax will fill out Form 5329 Part IV for the excess contribution.

7. No, you will not need Form 8606 when you amend your returns.

8. Yes, this is how the 2018 5329 form will look

For the 2021 excess contribution, you have until the due date to request the withdrawal of the 2021 excess contribution plus earnings.

You will get a 1099-R 2022 in 2023 with codes P and J for the withdrawal of excess contribution and earnings. This 1099-R will have to be included on your 2021 tax return and you have two options:

- You can wait until you receive the 1099-R 2022 in 2023 and amend your 2021 return or

- You can report it now in your 2021 return and ignore the 1099-R when it comes unless there is Box 4 Federal Tax withholding and/or Box 14 State withholding. Then you must enter the 2022 1099-R into the 2022 tax return since the withholding is reported in the year that the tax was withheld. The 2022 code P will not do anything in 2022 tax return but the withholding will be applied to 2022.

To create a 1099-R in your 2021 return please follow the steps below:

- Login to your TurboTax Account

- Click on the "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Answer "Yes" to "Did you get a 1099-R in 2021?"

- Select "I'll type it in myself"

- Box 1 enter total distribution (contribution plus earning)

- Box 2a enter the earnings

- Box 7 enter J and P

- Click "Continue"

- On the "Which year on Form 1099-R" screen say that this is a 2022 1099-R.

- Answer all follow up questions carefully.

Please be aware, code P will say in the drop-down menu "Return of contribution taxable in 2020" you can ignore that since the follow-up question will tell TurboTax that it will be taxable in 2021.

If you have any further questions please feel free to comment and we will be happy to assist you further.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

1. Earnings are not subject to the 6% penalty. Only the excess contribution is subject to the 6% penalty. You will have a penalty for 2018, 2019, 2020, and 2021 because the excess contributions from 2018, 2019, and 2020 were not removed by December 31, 2021.

In 2018 you will just enter your contribution under Deductions & Credits and TurboTax will give you a warning about the penalty and create Form 5329.

In 2019 you will enter your contribution and your prior year’s excess contribution ($6,500) during the interview in the Deduction & Credit section. TurboTax will calculate the penalty on Form 5329.

In 2020 you will enter your contribution and your prior year’s excess contribution ($6,500 + excess from 2019) during the interview in the Deduction & Credit section. TurboTax will calculate the penalty on Form 5329.

In 2021 you will enter your contribution and your prior year’s excess contribution ($6,500 + excess from 2019 + excess from 2020) during the interview in the Deduction & Credit section. On the penalty screen, you will enter the 2021 contribution amount you plan to remove by the due date. TurboTax will calculate the penalty on Form 5329.

For example, on your 2020 return, the steps are:

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Enter the 2020 Roth contribution amount

- On the "Do you have any Excess Roth Contributions" answer "Yes"

- On the "Enter Excess Contributions" screen enter the total excess contribution from 2018 and 2019.

2. You do not need to calculate the earnings for the excess contribution for the years 2018, 2019, and 2020. For the excess contributions from 2018, 2019, and 2020 you only need to remove the excess contribution amount as a regular distribution without the earnings. You will get a 2022 Form 1099-R next year and this will be entered on your 2022 tax return. Your code in box 7 will be either T or Q since it is a Roth IRA and you are older than 59 ½.

3. Yes, you can leave the earnings in the Roth account for the 2018, 2019, and 2020 excess contributions.

4. Yes, TurboTax will walk you through the amendment and it is similar to the interview when filing your taxes with TurboTax.

5. It depends on your state if you will have to amend your state as well. But TurboTax will walk you through this.

6. Yes, TurboTax will fill out Form 5329 Part IV for the excess contribution.

7. No, you will not need Form 8606 when you amend your returns.

8. Yes, this is how the 2018 5329 form will look

For the 2021 excess contribution, you have until the due date to request the withdrawal of the 2021 excess contribution plus earnings.

You will get a 1099-R 2022 in 2023 with codes P and J for the withdrawal of excess contribution and earnings. This 1099-R will have to be included on your 2021 tax return and you have two options:

- You can wait until you receive the 1099-R 2022 in 2023 and amend your 2021 return or

- You can report it now in your 2021 return and ignore the 1099-R when it comes unless there is Box 4 Federal Tax withholding and/or Box 14 State withholding. Then you must enter the 2022 1099-R into the 2022 tax return since the withholding is reported in the year that the tax was withheld. The 2022 code P will not do anything in 2022 tax return but the withholding will be applied to 2022.

To create a 1099-R in your 2021 return please follow the steps below:

- Login to your TurboTax Account

- Click on the "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Answer "Yes" to "Did you get a 1099-R in 2021?"

- Select "I'll type it in myself"

- Box 1 enter total distribution (contribution plus earning)

- Box 2a enter the earnings

- Box 7 enter J and P

- Click "Continue"

- On the "Which year on Form 1099-R" screen say that this is a 2022 1099-R.

- Answer all follow up questions carefully.

Please be aware, code P will say in the drop-down menu "Return of contribution taxable in 2020" you can ignore that since the follow-up question will tell TurboTax that it will be taxable in 2021.

If you have any further questions please feel free to comment and we will be happy to assist you further.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

Thanks DanaB27 for the answers and the quick reply! This information will come in handy once I begin this exercise!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

Took me a while to digest this great information! Which leads me to a follow up question. For 2018, 2019 and 2020 since there aren't any earnings involved for the Roth IRA I assume this means there will be no changes that need to be made to my original 1040s for those years. Are 1040x (amended) returns still required for those years? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

Please be aware, that the 6% penalty still applies for the excess contribution amounts from 2018, 2019, and 2020. If you had entered all the excess contributions in those years and the 6% penalty is correctly calculated on Form 5329 Part IV then you do not need to amend these years.

Please verify:

1.That you had entered the contribution on your 2018 tax return and got the penalty calculated on Form 5329.

2. That you entered the contribution on your 2019 tax return plus the excess contribution from 2018 and got the penalty calculated on Form 5329.

3.That you entered the contribution on your 2020 tax return plus the excess contribution from 2018 and 2019, and got the penalty calculated on Form 5329.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

Have another question. I removed the $6500 from my Roth IRA for 2018. Where do I document that amount? Somehow I need to let the IRS know that the situation for 2018 has been corrected.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

You will receive a form 1099-R reporting the ROTH IRA distribution in the year following the distribution. It should be coded "8" in box 7 Excess contributions plus earnings/excess deferrals (and/or earnings) taxable in 2022, for instance. That will tell the IRS that the excess contributions have been withdrawn.

Also, to comply with the distribution rules of the excess contributions, you just need to have adjusted your current year contributions to be under the allowed contributions for the current year, taking into consideration the balance of excess contributions going into the current year.

For instance, if you had $7,000 of excess contributions going into the current year, and you made no contributions for the current year, then you would by default have distributed the excess, assuming your limit on contributions for the current year is $7,000.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

Thanks! Since for 2018 I was unable to do an Excess Removal and had to do a normal distribution, won't box 7 of the 1099-R have a code of 7 for 'Normal distribution'?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

Yes, Box 7 of the 1099R should have a code 7 for a normal distribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

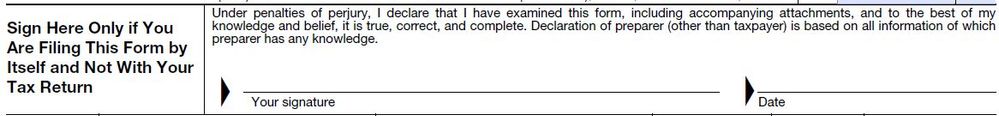

Hoping this is my last question. Was wrapping up my 2018 amended return and making sure I signed everything. Noticed on page 2 of the 5329 form the signature section at the bottom of the page. The 5329 form says 'Sign Here Only if You Are Filing This Form by Itself and Not With Your Tax Return'. I had signed here but now wondering if I should print out an unsigned version instead. Thought it odd that it would indicate not to sign on the signature line. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

You would sign the form if you were submitting this as a stand alone document. If you are sending an amended return, then this wouldn't be signed.

With this said, I don't think it will make much of a difference to the IRS. Since you are mailing the return, you may wish to put in a note and attach it with your amended return stating you accidently signed it before reading the instruction. I should suffice as it won't make a difference one way or another.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

it's easier to print an unsigned copy

than to prepare a note, print that and attach to your return.

IRS says:

do not attach extraneous material to your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

That's what I wound up doing. I actually had it already printed out trying to decide which was the proper route. Sent to the IRS about 30 minutes ago. Thanks for everyone's help!! This is a great forum!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

I was informed by my financial services to report my excess 401k contribution in the 2021 tax filing but NOT the Earnings and to report the Earnings in 2022. They also told me I will get two 1099Rs in 2022, one for the excess contribution and the other for the earnings.

How to I file in 2021 without a 1099R?

I understand you have given us step by step to create our own 1099R for reporting in 2021. However, it asks for Entry under Box 1a to enter "Total Distribution" which includes both excess contribution and earnings; Under Box 2a; do I leave it blank for Earnings?

Appreciate the advice.

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

You can enter the return of excess 401(k) deferrals in the Less Common Income section:

- Open or continue with your return

- Click on Show more next to Less Common Income in the Income & Expenses section

- Click on Start/Revisit next to Miscellaneous Income, 1099-A, 1099-C

- Click on Start/Revisit next to Other income not already reported on a Form W-2 or Form 1099

- Select Yes on the next screen and Continue

- Skip to the screen that says Any Other Earned Income, select Yes

- On the next screen Enter Source of Other Earned Income, select Other

- Enter "Excess 401(k) Deferrals" as a description and enter the amount that was returned to you. See the screenshot below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

xiaochong2dai

Level 3

jliangsh

Level 2

likesky1010

Level 3

neutron450

Level 3

srtadi

Returning Member