- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Like others here I find myself in the Roth IRA Excess Contribution quagmire. Have questions that I hope someone can help with.

First discovered my issue about 2 weeks ago while doing my 2021 taxes. What I learned so far is the following:

- A little knowledge is a dangerous thing.

- Don’t assume you understand your situation. You just wandered into a mine field. Proceed with caution. There are other mines out there.

- Acting hastily can make your situation worse.

- Just when you think you understand your situation you will discover a new twist that changes everything.

- In the future don’t add to your Roth IRA for year ‘x’ until year ‘x+1’ when you understand your year ‘x’ tax situation.

- Be careful acting on information received from your Roth IRA broker. They may want to be helpful but they do not understand your full financial situation.

- It will be hard to find someone with exactly your same situation especially if the problem goes back more than 2 years.

- If you are used to using a tax application to do your past returns and are not familiar with all the tax terms and jargon, prepare to enter into a dark netherworld. It will be like learning another language.

Here’s my situation discovered while doing my 2021 taxes. I’m over 59 1/2.

- I over contributed $6500 to my 2018 Roth IRA. The entire amount must be removed. This account is over 5 years old.

- I contributed $7000 to my 2019 Roth IRA. I can only do a partial contribution. This account was only 1 year old.

- I contributed $7000 to my 2020 Roth IRA. I can only do a partial contribution. This account was only 2 years old.

- I contributed $7000 to my 2021 Roth IRA. The entire amount must be removed. This account was only 3 years old.

- I contributed $7000 to my 2022 Roth IRA. Don’t know yet how my earnings will affect this. This account will only be 4 years old.

Here are my misunderstandings when I reacted before having a decent understanding of the situation.

- I mistakenly tried to do a recharacterization moving money from my Roth IRA to my regular IRA partly due to incomplete internet research and partly due to information from brokerage firm. I have a qualified retirement account at work and this would have made my issue worse! Luckily I realized my mistake within the first 24 hours and was able to cancel my request.

- I decided to remove all my contributions from 2019, 2020, 2021 and 2022 since they were in the same account thinking this would be easiest. I did a Return of Excess for each of those years. As my research continued I grew more concerned about this decision. I contacted my account holder the day it was to be executed and asked them to reverse my requests for years 2019, 2020 and 2022 as I believe I should at least partially fund the Roth IRA for these years. They indicated this could be done but it is still in progress as I write this and hope this decision does not come back to haunt me. I would eventually come to understand that I can only do a Return of Excess for years 2021 and 2022. Would need to do a normal distribution for 2019 and 2020.

- I decided to do a Return of Excess from 2018. This account is more complicated and was with another brokerage, different from the others. This would eventually get rejected. This rejection was a good thing as it woke me up to the complexity of my situation. It also let me understand that I can only do a Return of Excess for years 2021 and 2022. It also led me to cancel 3 of my 4 requests with my other account holder.

What I plan on doing. If anything sounds wrong here please let me know.

- Do a normal distribution for 2018. Have a question on this but the question is listed later as to keep all the questions together.

- Do a normal distribution for 2019.

- Do a normal distribution for 2020.

- Complete a Return of Excess for 2021

- Wait possibly until 2023 to decide how to handle my 2022 contribution and if needed do a Return of Excess. Understand that if I increase my contributions to my qualified retirement account at work it will decrease my MAGI so will be doing that in anticipation of what my 2022 MAGI will be.

Here are my questions that I’m having trouble with. Note that I have TurboTax for 2019, 2020 and 2021. I ordered 2018 but it hasn’t arrived yet which is why some of my questions are about TurboTax. Waiting for 2018 TT before starting.

- Are earnings on the Excess Roth IRA contribution also subject to the 6% penalty. I assume they are not. Assume they will need to be reported as income for the year of the contribution.

- Since for 2018, 2019 and 2020 I need to do a normal distribution how do I accurately determine earnings. How do I report this accurately when filing the amended returns that I would like to do soon when the 1099-R won’t appear until 2023. Assume that since these are normal distributions the eventual 1099-R won’t show the distribution code J or P since you cannot do a Return of Excess for those years. Assume it will show a 7 for Normal Distribution. Note this answer may tie in with the next question.

- Do I also need to withdraw earnings for 2018, 2019 and 2020 since it is more than 2 years in the past? I thought I did until I saw multiple references to this article from H&R Block which states “After the extended due date of your return, you will be subject to the 6% excise tax each year the excess remains in the account at the end of the year (by December 31) until it is removed. You do not need to remove any earnings made on the excess.”. Is this correct??

https://www.hrblock.com/tax-center/income/retirement-income/excess-ira-contributions - I’ve never done an amended return. Will TurboTax successfully walk me through this? Are there any gotcha’s that I need to worry about.

- Will I need to do amended state returns in addition to the federal amended returns? I assume the answer to this is yes.

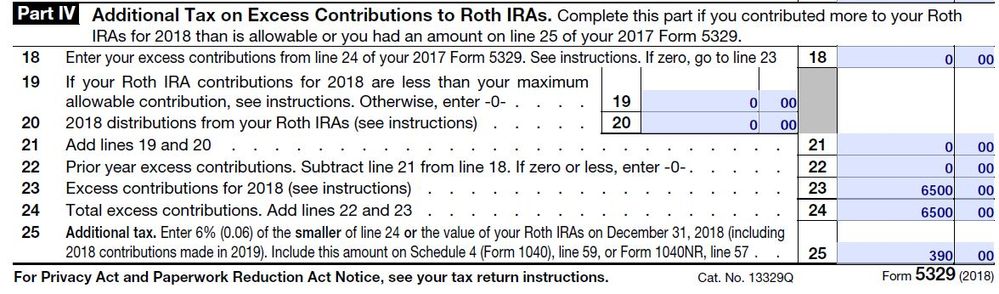

- When I start to do the amended return for the problem years will TurboTax build the 5329 form. Assume it will. Will it just be using section IV of form 5329 or will other sections also be filled out.

- When I start to do the amended return will TurboTax have to create a form 8606? I don’t think this is needed but I’m confused about this form. Understand there is a $50 penalty if this form is required and it is not submitted.

- Is this how the 2018 5329 form will look since the problem started in 2018?

Thanks for any help

February 27, 2022

11:35 AM