- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlemen...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

Investment statements that are included on your return are reported on Form 1099-B. What you have may just be a statement. Normally, investment firms don't have their forms ready this early in the year. You may also receive a consolidated form which could include amounts from 1099-INT and 1099-DIV.

Please see this link form more information. https://ttlc.intuit.com/turbotax-support/en-us/help-article/import-export-data-files/enter-investmen....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

This didn’t address the subject as well as the second answer I received later which included the SEC more in depth explanation. With the SEC explanation emailed to me, I was able to talk to a Schwab representative who now had a better understanding of this fair fund distribution and advised that I do have the ability to roll the distribution over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

THANK YOU! This absolutely helped in answering my tax questions. With this SEC explanation in hand, I was able to speak with a Schwab representative and roll over the SIPP Fair Fund Distribution due to having IRA accounts that qualified.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

I also received this Schwab fair fund distribution from a qualified account (IRA) and deposited it into the same account. Thus the distribution is not taxable. However, does this need to be reported somewhere even though no taxes are incurred? Is so, where/how? For example, is it reported as a rollover?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

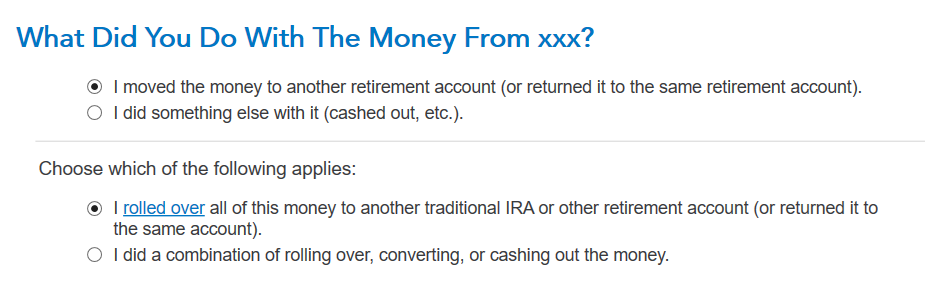

Perhaps. If you received a Form 1099-R, since it was an IRS, and if it was a direct rollover (trustee to trustee), then the code in Box 7 should handle the rollover as being nontaxable.

- Code G—Direct rollover and direct payment.

If that code is not shown in Box 7, then you will be asked about what you did with the money, then you can answer the questions. The image below will be the questions asked.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

Thank you for your thorough answer. I should have mentioned that I did NOT receive a 1099R , and there is no reference to this being a rollover. I mentioned rollover because I'm familiar with that term and how it's handled.

The following is the explanation provided by Schwab. I have bolded the portion that applies to my situation.

"If the distribution is related to a Qualified account (such as an IRA), the distribution will not be taxable if it is deposited in the same Qualified account or another Qualified account you hold. If the distribution is related to a non-qualified account (such as a taxable brokerage account), this distribution may be taxed and you may receive a Form 1099."

I'm beginning to think I don't I need to do anything further, but if I should, how to report this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

Report your Schwab Intelligent Portfolio Fair Fund Distribution as Other Income if you do not receive any forms.

To report Other Income:

- Click Federal in the left column

- Click Wages & Income

- Scroll down to Less Common Income. Tap Show more

- Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable income

- Say Yes to Any Other Taxable Income?

- Enter a description (Schwab Intelligent Portfolio Fair Fund Distribution) and amount ($xxx)

Schwab says you may receive a 1099-INT based on the amount of the interest paid with the distribution. You may also receive a 1099-MISC if your distribution is greater than the reporting requirement of $600. If those apply, enter the amounts according to the form you receive.

See Schwab Intelligent Portfolios Fair Fund Information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is the Schwab Intelligent Portfolio Fair Fund Distribution recently mailed out as a settlement taxable, and should it be reported on 2022 tax forms and where?

Thanks to all who responded. I just found an excellent 1/23 article on how to proceed: https://www.barrons.com/articles/charles-schwab-settle[product key removed]-[phone number removed]

Key points from that article:

ARE THE CHECKS TAXABLE?

Checks expire on March 30, 2023 and should be cashed or deposited before then, according to the distribution website. What you do with your check, and whether it will be taxed, will depend on the type of account it was associated with.

If the distribution is associated with a retirement account such as an IRA, then it will not be taxable as long as it’s deposited back into the same type of account, whether at Schwab or another institution. To avoid complications, a check associated with a traditional IRA would have to go into a traditional IRA, and a check associated with a Roth IRA would have to go into a Roth.

WILL YOU GET A 1099?

If you receive a check relating to a retirement account, you may receive a 1099-R form. Then, if you roll over that money into a retirement account, you will receive a Form 5498 from the receiving institution.

If you receive a check relating to a taxable brokerage account of an amount greater than $600, you will receive a 1099-MISC and/or 1099-INT.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rooksmith

Level 2

sth508

Returning Member

lyonbj9-gmail-co

New Member