- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Perhaps. If you received a Form 1099-R, since it was an IRS, and if it was a direct rollover (trustee to trustee), then the code in Box 7 should handle the rollover as being nontaxable.

- Code G—Direct rollover and direct payment.

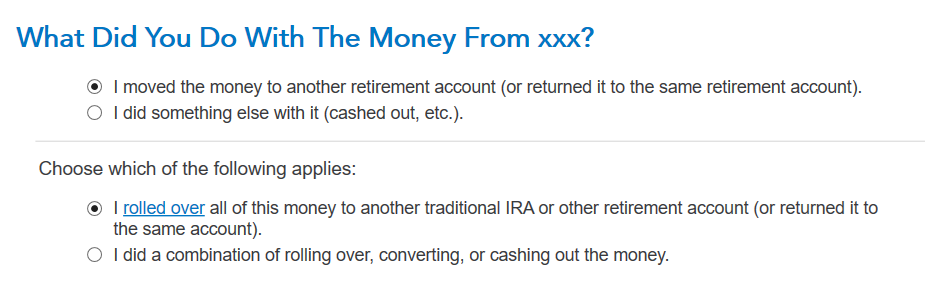

If that code is not shown in Box 7, then you will be asked about what you did with the money, then you can answer the questions. The image below will be the questions asked.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 13, 2023

9:19 AM