- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

If I did an IRA to ROTH conversion that is now 5 years old, and I did another that is 2 years old, even if I am over 59.5 I believe I must wait to take out earnings, from the conversion that is only 2 years old, tax and penalty free but from the IRA conversion that is 5 years old I should be able to take out earnings without tax and penalties. Is that correct? I am only talking about conversions here. The desire is to withdraw an amount that exceeds all the conversion amounts so I have to take out some earnings. How would the IRS know that the contributions taken come from the first conversion? Do I have to create separate IRA accounts for every conversion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

So are you all also saying......but if you opened a ROTH like 10 years ago, with a contribution or conversion, and then made a Traditional IRA to ROTH conversion at age 58, upon turning 60 you can take out the earnings from that conversion tax free and penalty free without having to wait "the 5 year-rule" because the account is like 12 years old at this point?

Yes, that's correct (actually age 59½, not 60). People get confused because there are two different 5-year rules that apply to Roth IRAs established in different parts of the tax code, one that applies to conversions and one that applies to qualified distributions. Once the requirements for qualified distributions are met, including satisfying the 5-year rule for distributions to be qualified distributions, the 5-year rule for conversions is no longer relevant; the 5-year rule for conversions effectively no longer applies.

The Investopedia article does nothing to help understand the difference between the two different 5-year rules. The article is a bit misleading because it assumes, without saying so, that the Roth IRA that the 58-year-old opened with a Roth conversion is the individual's first Roth IRA. In that example it also keeps referring to "the" Roth IRA, when, in fact, the 5-year holding period for determining qualified distributions is determined by the individual's entire history of having Roth IRAs, not just the account that received the Roth conversion.

§ 408A(d)(2) defines a qualified distribution, which includes the definition of the "nonexclusion period," the period during which distributions are not permitted to be treated as qualified, as beginning with the year the the individual first made any contribution to any Roth IRA. Contributions include regular contributions, conversion contributions and rollover contributions, all of which are reported on Form 5498 for the year for which the contribution was made. (Conversion and rollover contributions are made "for" the year in which the deposit to the Roth IRA occurs while regular contributions for a particular year can be made up until the regular filing deadline for the individual's income tax return.)

That is the only thing that you need to get you out of paying tax on the earnings before 5 years go by is that your ROTH needed to be started with like $1, 5-years prior?

And you meet that age 59½ or disability requirement (or, for your beneficiaries, you die).

My 86 year old mother is opening a ROTH, her first ROTH, she will have to wait 5 (really 4) years now for tax free distributions just because she never started even a tiny one earlier.

Correct. That's why I encourage everyone to start at least a small Roth IRA as soon as practical, or at least by the year they reach age 55. If they think that they will ever purchase a home, it makes sense to make a Roth IRA contribution at least 5 years prior to that since up to $10k of earnings distributed for the purpose of purchasing a home can be treated as qualified (penalty free and tax free) if the 5-year qualification period has been completed, regardless of the individual's age.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

The 5-year holding requirement for conversions ends at age 59½. Since you are now over age 59½ and it has been more than 5 year since the beginning of the year for which you made your first contribution to a Roth IRA (in this case by Roth conversion, presumably), any distribution you make from any of your Roth IRAs is a qualified distribution, tax and penalty free. Qualified distributions from a Roth IRA don't go on Part III of Form 8606 because the ordering rules are no longer relevant; the IRS has no need to know the breakdown of the distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

Since you have owned any Roth IRA longer then 5 years and are over age 59 1/2 then any Roth distribution is qualified and not subject to any tax or penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

Thanks for trying to answer but I'm sorry but you are wrong. Conversions are ALWAYS subject to the 5-yr rule. Contributions are not always subjected to it, its based on your first ROTH opening instead. The IRS makes a big difference between conversions (through a Traditional IRA to a ROTH) and contributions (to a ROTH directly). They sound like they are the same but are not.

I just can't figure out what happens in the scenario I posted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

Nope. Once you reach age 59½, distributions are no longer subject to an early-distribution penalty, the only thing to which the 5-year holding period for conversions applies (unless you are still under age 59½, in which case completing the 5-year holding period for a particular conversion also makes the amount converted be equivalent to a regular Roth IRA contribution).

The different 5-year holding period for determining qualified distributions starts January 1 of the year for which you first make a regular Roth IRA contribution or in which you deposit funds as a Roth conversion (or as a roll over from a qualified retirement plan). Qualified distributions are always free of tax and penalty. Because you have met the requirements for your distributions from your Roth IRAs to be qualified distributions, any distribution you now receive from any of your Roth IRAs is tax and penalty free.

Also, creating separate Roth IRAs for various contributions and conversions doesn't change anything. For these purposes, the tax code treats all of your Roth IRAs in aggregate as if they were a single Roth IRA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

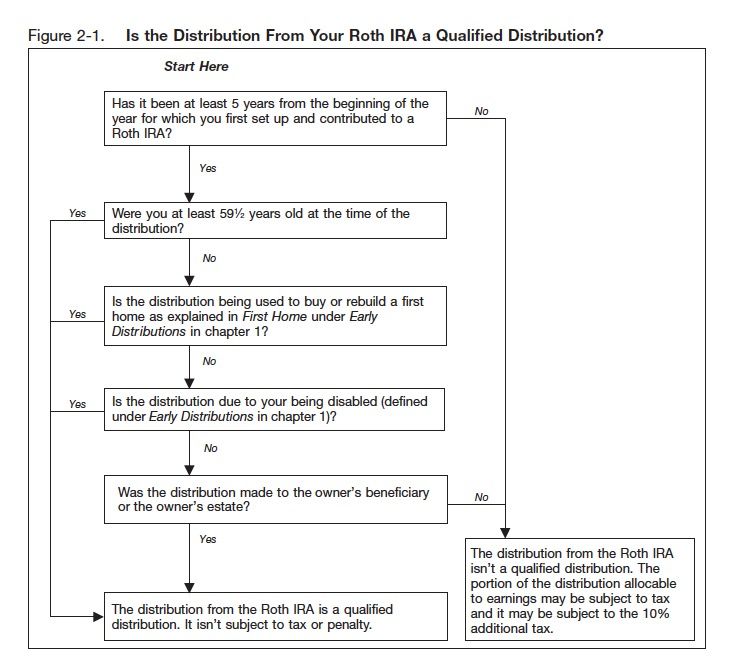

See "Are Distributions Taxable" in Chapter 2 of IRS Pub 590-B:

https://www.irs.gov/publications/p590b#en_US_2019_publink1000231061

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

See IRS Pub 590B Fig 2-1 page 30 for ordering rules.

Also page 28 for qualified distributions and *early distributions* and note that the 5 year conversions rules is under "Additional tax on early distributions" that can only occur of under age 59 1.2.

https://www.irs.gov/pub/irs-pdf/p590b.pdf

Yes - It has been 5 years since you set up ANY Roth IRA.

Yes - You are over age 59 1/2.

Therefore - It is a qualified distribution not subject to tax or penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

OK. So I have this from Investopedia.....https://www.investopedia.com/roth-ira-withdrawals-read-[product key removed]62

"The Internal Revenue Service (IRS) outlines the specific requirements for taking qualified distributions from a Roth IRA. If you reach the required age but have held the IRA for less than five years, you still avoid the 10% penalty, but you will need to pay income taxes on any earnings pulled out of your account (you already paid income taxes on the money you initially put into the Roth, so withdrawals of the contribution amount are always tax-free).

Say you opened a Roth account at age 58 with a $5,000 contribution and earned $1,000 in gains over a two-year period. If at age 60, you decide to withdraw all that money, you can do so penalty-free. But since you only owned the IRA for two years, you still face income taxes on the $1,000 in earnings. So in order to maximize your return, it behooves you to wait until you meet both the age and ownership conditions."

So are you all also saying......but if you opened a ROTH like 10 years ago, with a contribution or conversion, and then made a Traditional IRA to ROTH conversion at age 58, upon turning 60 you can take out the earnings from that conversion tax free and penalty free without having to wait "the 5 year-rule" because the account is like 12 years old at this point?

That is the only thing that you need to get you out of paying tax on the earnings before 5 years go by is that your ROTH needed to be started with like $1, 5-years prior?

I think that is what you are saying, but because it sounds kind of inconsistent, I think I am having a hard time absorbing the answer. I mean you just have to have started an account? that's all?

My 86 year old mother is opening a ROTH, her first ROTH, she will have to wait 5 (really 4) years now for tax free distributions just because she never started even a tiny one earlier.

Please just confirm if I have it right now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

So are you all also saying......but if you opened a ROTH like 10 years ago, with a contribution or conversion, and then made a Traditional IRA to ROTH conversion at age 58, upon turning 60 you can take out the earnings from that conversion tax free and penalty free without having to wait "the 5 year-rule" because the account is like 12 years old at this point?

Yes, that's correct (actually age 59½, not 60). People get confused because there are two different 5-year rules that apply to Roth IRAs established in different parts of the tax code, one that applies to conversions and one that applies to qualified distributions. Once the requirements for qualified distributions are met, including satisfying the 5-year rule for distributions to be qualified distributions, the 5-year rule for conversions is no longer relevant; the 5-year rule for conversions effectively no longer applies.

The Investopedia article does nothing to help understand the difference between the two different 5-year rules. The article is a bit misleading because it assumes, without saying so, that the Roth IRA that the 58-year-old opened with a Roth conversion is the individual's first Roth IRA. In that example it also keeps referring to "the" Roth IRA, when, in fact, the 5-year holding period for determining qualified distributions is determined by the individual's entire history of having Roth IRAs, not just the account that received the Roth conversion.

§ 408A(d)(2) defines a qualified distribution, which includes the definition of the "nonexclusion period," the period during which distributions are not permitted to be treated as qualified, as beginning with the year the the individual first made any contribution to any Roth IRA. Contributions include regular contributions, conversion contributions and rollover contributions, all of which are reported on Form 5498 for the year for which the contribution was made. (Conversion and rollover contributions are made "for" the year in which the deposit to the Roth IRA occurs while regular contributions for a particular year can be made up until the regular filing deadline for the individual's income tax return.)

That is the only thing that you need to get you out of paying tax on the earnings before 5 years go by is that your ROTH needed to be started with like $1, 5-years prior?

And you meet that age 59½ or disability requirement (or, for your beneficiaries, you die).

My 86 year old mother is opening a ROTH, her first ROTH, she will have to wait 5 (really 4) years now for tax free distributions just because she never started even a tiny one earlier.

Correct. That's why I encourage everyone to start at least a small Roth IRA as soon as practical, or at least by the year they reach age 55. If they think that they will ever purchase a home, it makes sense to make a Roth IRA contribution at least 5 years prior to that since up to $10k of earnings distributed for the purpose of purchasing a home can be treated as qualified (penalty free and tax free) if the 5-year qualification period has been completed, regardless of the individual's age.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

Great article!

So, I started my initial Roth IRA about 15 years ago with regular contributions. Subsequently, started additional Roth IRA after the initial one.

In January of 2019, I was 58 yrs old and during the market downturn, I converted traditional IRA funds to my Roth IRA. Since the 2019 conversion, the market has bounced back and I have substantial gains. I have not contributed any additional funds to my Roth IRA. I am currently 61 1/2 and would like to use the conversion funds and the gains from the Roth in 2023.

I have always interpreted the 5 year rule on conversions to mean that my Roth IRA gains are not accessible (without penalty) until January of 2024. Based on this article, since I am over 59 1/2, I can access all of my Roth IRA funds (as qualified distributions) without penalty at anytime.

Is this correct? Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

@setneupm wrote:

Great article!

So, I started my initial Roth IRA about 15 years ago with regular contributions. Subsequently, started additional Roth IRA after the initial one.

In January of 2019, I was 58 yrs old and during the market downturn, I converted traditional IRA funds to my Roth IRA. Since the 2019 conversion, the market has bounced back and I have substantial gains. I have not contributed any additional funds to my Roth IRA. I am currently 61 1/2 and would like to use the conversion funds and the gains from the Roth in 2023.

I have always interpreted the 5 year rule on conversions to mean that my Roth IRA gains are not accessible (without penalty) until January of 2024. Based on this article, since I am over 59 1/2, I can access all of my Roth IRA funds (as qualified distributions) without penalty at anytime.

Is this correct? Thanks!

When you withdraw from a Roth, you withdraw contributions first, then conversions second, and earnings last. You can't just decide to withdraw a conversion--the only way you can withdraw a conversion is if you have already withdrawn all the regular contributions. You must aggregate all your Roth IRA balances for this purpose.

In other words, suppose you have $20,000 in account A, which represents $10,000 of contributions and $10,000 of gains. You have $30,000 in account B, of which $20,000 is a conversion and $10,000 is gains. If you withdraw $20,000 from account B, it will still be considered to represent $10,000 of contributions and $10,000 of conversion.

Now, the short answer is that after age 59-1/2, all withdrawals from a Roth account are free from income tax and the 10% penalty for early withdrawals. The 5 year conversion rule can be ignored.

The long answer is is illustrated below.

| Type of withdrawal | Subject to income tax | Subject to 10% early withdrawal penalty |

| Contributions | No | No |

| Conversions | No | Yes, if less than 5 years and under age 59-1/2, no if over age 59-1/2 |

| Earnings | Yes if under age 59-1/2, no if over age 59-1/2 | Yes if under age 59-1/2, no if over age 59-1/2 |

The idea is that, suppose you are age 40. If you withdraw from a traditional IRA, you pay income tax plus the penalty. If you convert to a Roth at age 40, you pay income tax. If you then withdraw from the Roth at age 41, you should not be allowed to dodge the 10% penalty. The 5 year rule is present to discourage this kind of "cheating" by making it impossible to use a Roth IRA conversion to avoid the 10% penalty. But since the 10% penalty doesn't apply to a traditional IRA after age 59-1/2, it also doesn't apply to a conversion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

setneupm, because you established your first Roth IRA more than 5 years ago and are over age 59½, any distribution from your Roth IRAs is tax and penalty free. Roth conversion clocks no longer apply after age 59½ because Roth conversion clocks relate only to early-distribution penalties and being age 59½ is already an exception to that penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to take ROTH earnings out , after age 59.5, if you have multiple conversions some more than 5 yrs old others less than

dmertz - Thank you for the follow on post! Good confirmation! 👍🏼

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LMTaxBreaker

Level 2

jliangsh

Level 2

Darenl

Level 3

vjr2985

Level 1

TaxInquiries34578

Level 1