- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

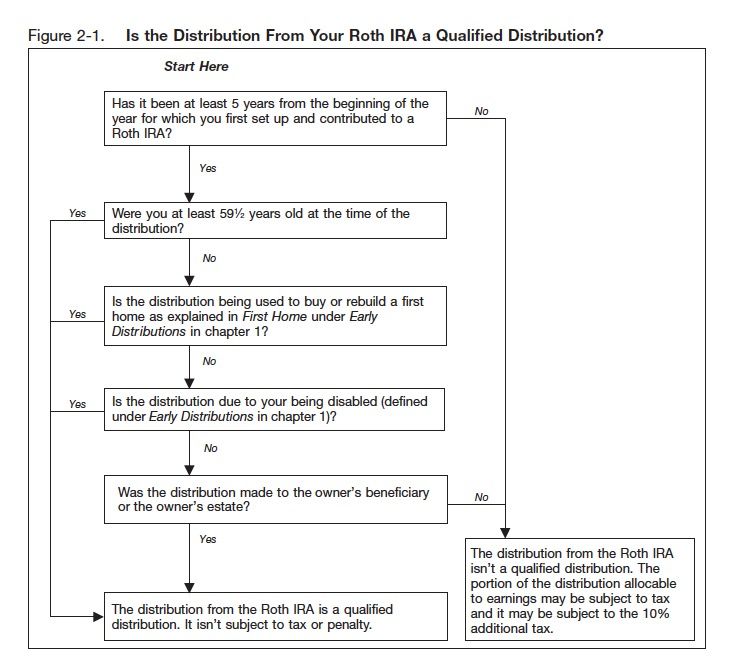

See IRS Pub 590B Fig 2-1 page 30 for ordering rules.

Also page 28 for qualified distributions and *early distributions* and note that the 5 year conversions rules is under "Additional tax on early distributions" that can only occur of under age 59 1.2.

https://www.irs.gov/pub/irs-pdf/p590b.pdf

Yes - It has been 5 years since you set up ANY Roth IRA.

Yes - You are over age 59 1/2.

Therefore - It is a qualified distribution not subject to tax or penalty.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

December 21, 2020

1:10 PM

9,837 Views