- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do I correct the Taxable IRA distribution worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I correct the Taxable IRA distribution worksheet

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I correct the Taxable IRA distribution worksheet

By editing the 1099-R information if entered incorrectly.

What needs changing?

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I correct the Taxable IRA distribution worksheet

Thank you so much for taking the time to reply. I've entered the 1099-R information correctly. In fact, I've deleted them entirely and re-entered them to see if it would resolve the issue. The error that I'm getting during the Review process reads as follows:

Check This Entry

Taxable IRA Distribution Worksheet -SP: Your calculations could not be completed: Reference code: 6-059-525.

The issue seems to be that the calculation was done on the 8606 itself (last year, Turbotax used the distribution worksheet to handle the calculation and transferred the result to the 8606). In this case, it would seem the Taxable IRA Distribution Worksheet is completely unnecessary, but it doesn't appear there's anything I can do about it - yet Turbotax won't allow me to e-file without the issue being resolved. Not sure if the 'reference code' has some secret meaning to somebody out there, but I couldn't find any information on it and haven't had success reaching a live person with Turbotax. Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I correct the Taxable IRA distribution worksheet

Did you enter a new Traditional IRA contribution for 2019?

I assume the 1099-R has the IRA/SEP/SIMPLE box checked.

Do you have a non-deductible carry forward basis from line 14 on a prior 8606? Or enter basis?

If you are answering yes to the non-deductible basis question then be sure that the total 2019 year end value of all IRA accounts is entered.

Rather then edit the 1099-R I suggest totally deleting it.

If after deleting the 1099-R, the 8606 is still present, then also delete the "IRA Contributions worksheet" and the 8606 form.

Then re-enter and IRA contributions in the contributions section and then enter the 1099-R.

Delete the forms this way if using online - if using the CD/download version switch to the forms mode to delete.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I correct the Taxable IRA distribution worksheet

So I actually deleted both 1099-R forms (one for me, one for my spouse), both 8606 forms, and all IRA-related forms and worksheets - then started all over again entering our 1099-R forms.

We did make new traditional IRA contributions for 2019 (made in 2020)

The IRA/SEP/SIMPLE box is checked on both 1099-R forms.

We do have a non-deductible carryforward basis from line 14 on last year's 8606 (entered amount and verified ending balance of traditional IRA accounts at 12/31/19)

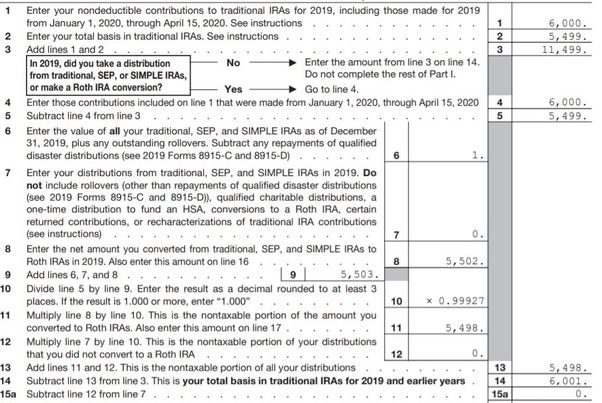

After re-entering everything, I'm still getting the same exact error. If it helps, below is a snapshot from the 8606 form generated for 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I correct the Taxable IRA distribution worksheet

Line 3 says you had a total basis of $11,499, but line 8 says the only distribution was $5,502.

Then line 6 says that the December 31, total value of ALL existing Traditional IRA, SEP or SIMPLE accounts you had was $1.

What happened to the other $5,998 that was in the IRA?

(11,499 - 5502 + 1) = 5,998

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

afoote

New Member

kgsundar

Level 2

kgsundar

Level 2

ecufour

Returning Member