- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

So I actually deleted both 1099-R forms (one for me, one for my spouse), both 8606 forms, and all IRA-related forms and worksheets - then started all over again entering our 1099-R forms.

We did make new traditional IRA contributions for 2019 (made in 2020)

The IRA/SEP/SIMPLE box is checked on both 1099-R forms.

We do have a non-deductible carryforward basis from line 14 on last year's 8606 (entered amount and verified ending balance of traditional IRA accounts at 12/31/19)

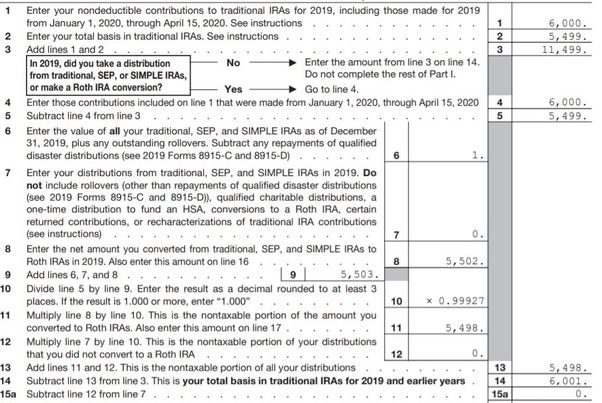

After re-entering everything, I'm still getting the same exact error. If it helps, below is a snapshot from the 8606 form generated for 2019.

July 17, 2020

8:26 PM