- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

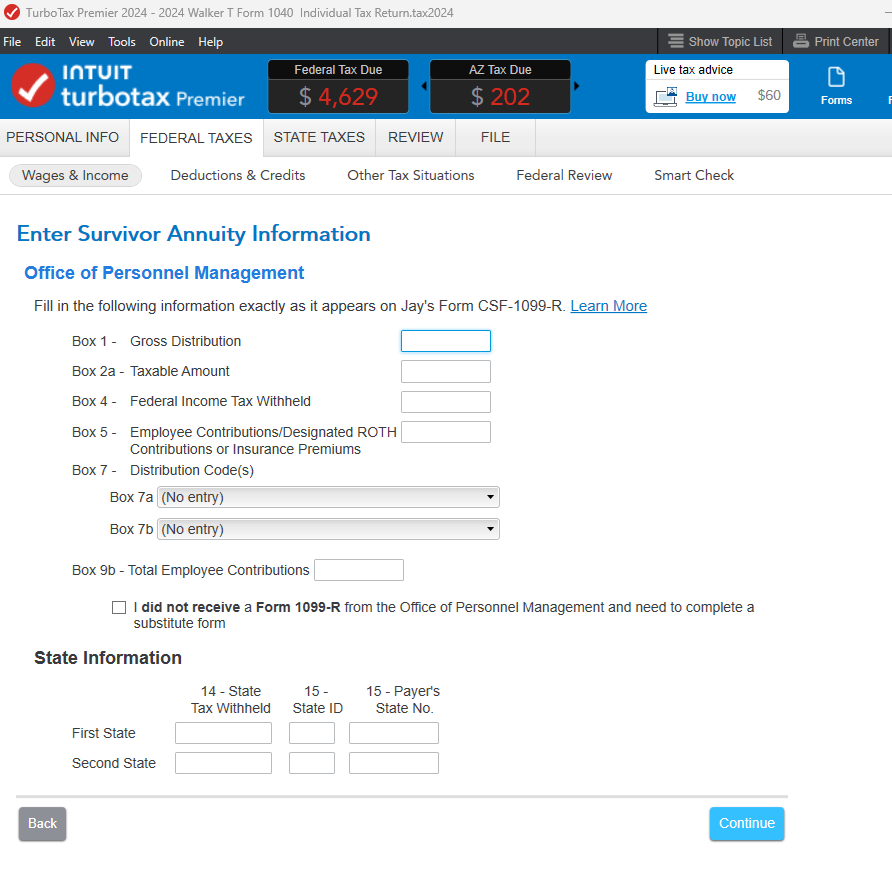

The CSF 1099R is used by the OPM to report a retiree’s spousal survivor benefit income.

When you enter your 1099R make sure you select the correct form.

- Log in to your account.

- Select Federal from the left menu.

- Go to Wages and Income then Income and Expenses.

- Scroll down Retirement plan and Social Security.

- Select Edit next to IRAs,401K, Pension plans 1099R.

- Select Delete next to the 1099R.

- Select Add a 1099R.

- Continue to the screen Tell us Which 1099R you have and make sure to select the correct one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

Using TurboTax Business, where are you suppose to record a CSF 1099-R_LS?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

For what kind of return? Search for 1099-R to be taken to Other Income. @rtc

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

I am filing on behalf of an estate. So, i am using Turbo Tax Business.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

There is no place to put in the gross distribution or the federal income tax withheld when using the "other income".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

In your personal tax return, go to Wages & Income > I'll choose what I work on.

Then on the page listing income topics, scroll down to Retirement Plans and Social Security > IRA, 401K, Pension Plan Withdrawals (1099-R). Choose Start/Update.

On the next screen, choose I'll type it myself and Continue.

On the next page, select CSF-1099-R. and enter Payer Info on the next page, Continue.

The next page will have entry boxes for Gross Distribution and Federal Tax Withheld. Enter exactly as shown on your form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

I received a small one-time lump sum death benefit from my brother's estate. It was for the three weeks of his last months annuity before he passed (he was retired federal). I entered the 1099-R_LS with Distribution Code 7 (Death Benefit) from the Office of Personnel Management - yet Turbo Tax thinks that I retired and is asking me about my "retirement plan" and "annuity start date, plan cost, etc." Please help me, I would appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How am I supposed to record a CSF 1099 R_LS? It is a small one time death benefit.

Are you sure that the distribution code is 7, not 4 for Death Benefit? Did you report this as a 1099-R? If you reported this payment in that section as distribution code 7, that's for a normal distribution, not a death benefit. Please respond with any additional information concerning the form that you received.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lmunoz101923

New Member

MamaC1

Level 3

Squishpea123

New Member

AIN22

New Member

VolvicNaturelle

Level 3