- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

In your personal tax return, go to Wages & Income > I'll choose what I work on.

Then on the page listing income topics, scroll down to Retirement Plans and Social Security > IRA, 401K, Pension Plan Withdrawals (1099-R). Choose Start/Update.

On the next screen, choose I'll type it myself and Continue.

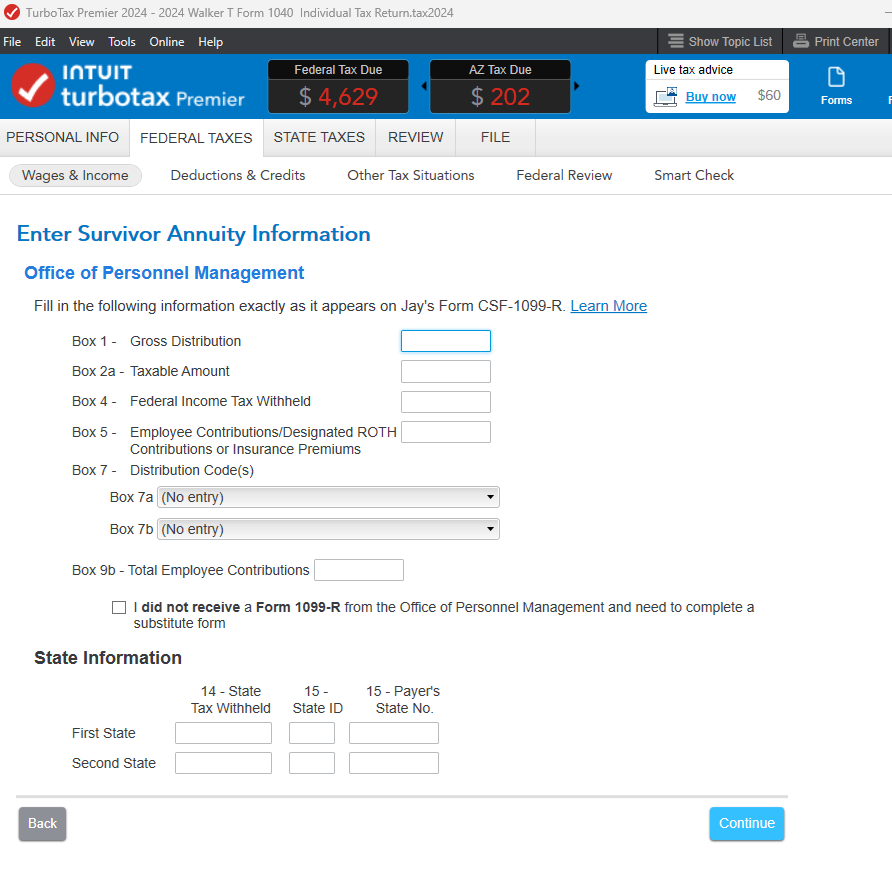

On the next page, select CSF-1099-R. and enter Payer Info on the next page, Continue.

The next page will have entry boxes for Gross Distribution and Federal Tax Withheld. Enter exactly as shown on your form.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 22, 2025

12:24 PM