- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: For a full IRA withdrawal 'in-kind' where the assets are not liquidated, but leave custodians...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For a full IRA withdrawal 'in-kind' where the assets are not liquidated, but leave custodianship: Does the IRS require immediate payment or is monthly w/holding accepted?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For a full IRA withdrawal 'in-kind' where the assets are not liquidated, but leave custodianship: Does the IRS require immediate payment or is monthly w/holding accepted?

If I understand your question correctly, you want to close an IRA account, but not sell off any assets. You would like to pay the tax on the withdrawal by increasing your withholdings from your paycheck.

Yes, you can do that, just make sure you have enough withheld.

You will have to prepare and present your employer with a Form W-4.

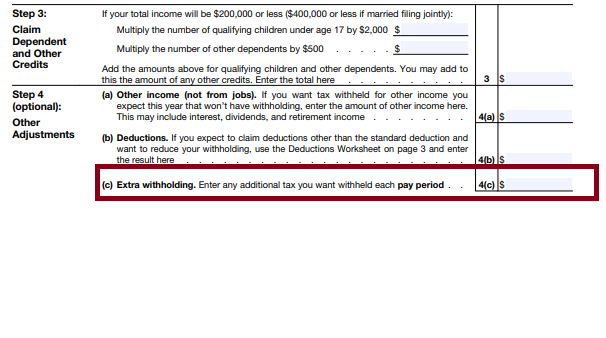

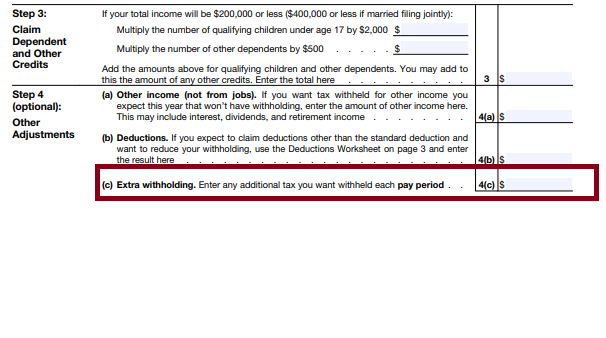

In step 4 there is an option to have an additional amount taken out with each pay period.

You can use this section to withhold the additional amount.

If this does not completely answer your question, please contact us again and provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For a full IRA withdrawal 'in-kind' where the assets are not liquidated, but leave custodianship: Does the IRS require immediate payment or is monthly w/holding accepted?

e.

have you thought about a trustee-to-trustee transfer in-kind to a custodian that does not charge maintenance fees?

There are many.

closing an IRA early has a 10% penalty.

If you move your assets from one IRA custodian to another, it is a tax-free Rollover unless you do it incorrectly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For a full IRA withdrawal 'in-kind' where the assets are not liquidated, but leave custodianship: Does the IRS require immediate payment or is monthly w/holding accepted?

If I understand your question correctly, you want to close an IRA account, but not sell off any assets. You would like to pay the tax on the withdrawal by increasing your withholdings from your paycheck.

Yes, you can do that, just make sure you have enough withheld.

You will have to prepare and present your employer with a Form W-4.

In step 4 there is an option to have an additional amount taken out with each pay period.

You can use this section to withhold the additional amount.

If this does not completely answer your question, please contact us again and provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

For a full IRA withdrawal 'in-kind' where the assets are not liquidated, but leave custodianship: Does the IRS require immediate payment or is monthly w/holding accepted?

Tax withholding on an IRA distribution is limited to the available cash. With the entire distribution being in-kind there will be no cash to withhold for taxes. If you obtain a distribution in-kind rather than doing a trustee-to-trustee transfer and you choose not to roll the shares over to another traditional IRA within 60 days, you'll have to either increase your tax withholding from other sources or make an estimated tax payment to make up any amount needed to avoid a tax underpayment penalty.

The additional tax withholding can normally be done any time during the tax year but, because estimated taxes are only credited when paid, you'll want to make an estimated tax payment for the tax quarter in which the in-kind distribution occurs.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549413515

New Member

shari-l-w-coles

New Member

eedavies4

New Member

Thomasketcherside2

New Member

banditsfrog75

New Member