- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Filing the US tax for parents earning retirement income and paying taxes in India

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Hi,

My dad worked and retired in India a while back. He is getting his retirement income in India and is paying his taxes there for that income. He got his permanent residency in the United States last year. He is going to file his tax in the U.S. for the first time now (for 2019). Questions:

1. Where should he report his retirement income and the taxes paid in TurboTax? Does he report his retirement income under "Foreign Earned Income and Exclusion" under the "Less Common Income" section?

2. Does he report the taxes paid in India under the foreign tax credit deduction section?

3. Is entering that information and filing the tax good enough to get the Premium Tax Credit (PTC) for the health insurance marketplace?

Your help is greatly appreciated.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

1. You would not report the income under foreign earned income exclusion as that is just for foreign wages.

You would not use the foreign paid tax credit in your case. Pension from India is taxable either in the US or in India, but not in both countries. This is based on the tax treaty between the US and India. You would have to claim the tax treaty exemption in the country where the pension would not be taxable.

You would report the pension on form 4852, substitute for form 1099R.

If your pension is taxable in the US, you enter the full amount as taxable amount.

If your pension should be taxable only in India, you would then enter Zero as the taxable amount ad write "Us India tax treaty Article XX" as explanation.

2. He would not need to report foreign tax credit as his pension income is only taxed in the US or India but not both

3.The premium tax credit program uses the federal poverty line as a basis for income range for credit eligibility. The range is 100 percent to 400 percent of the federal poverty line amount for the size of your family for the current tax year. For example, an individual earning between $12,490 and $49,960 in 2019 meets income criteria to qualify, while a family of four qualifies with household earnings between $25,750 and $103,000 (as of publication). Even if your income indicates eligibility, you must meet the other qualification criteria as well.

What is the Premium Tax Credit? I do not know

IRS Eligibility for the Premium Tax Credit

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Thanks Karen. Should I search for form 4852 in TurboTax and fill that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Once the return is open:

- Click on Federal

- Click on Wages & Income

- Scroll down to Retirement Plans and Social Security

- Click on Visit all if available on 1099-R, IRAs, 401(k), early withdrawals

- When you see screen Tell US Which 1099-R You Have, click on I need to prepare a substitute 1099-R

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Great. Thank you very much. Appreciate your help on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

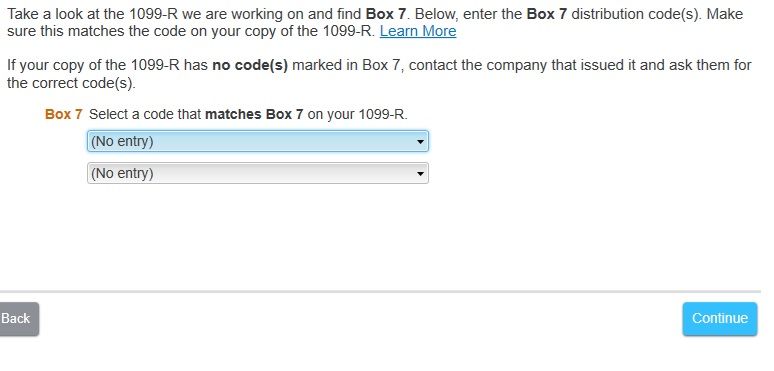

I followed the steps you mentioned, TurboTax said "Fill out the form 1099-R on the next screen as accurately as possible. Later we will have you complete the required explanation statement on form 4852". I went to the next screen and entered the payer information and Gross distribution on 1099-R and now it's not letting me go further without selecting a code for Box 7 (picture below). Any help is appreciated. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Box 7 would be code 7 normal distribution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Thank you. I got past that and now I am hitting another road block. It's asking for Payer's I.D. It says "The state of Illinois requires an entry in this field in order to complete the state tax return". I am still in federal tax, but I will be filing the state tax also after federal. I tried giving the PAN number which is the ID in India and it's alphanumeric whereas it's expecting a numeric value for Payer's ID. It didn't take that. It didn't take 0 either. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

You can print and mail the Illinois state return and see if you can e-file the federal return. When you are doing the review, you need to ignore the review issue regarding the state Payer's ID.

I know Illinois exempts nearly all retirement income however only for qualified plans.If he is receiving retirement income only from India, it would not be a qualified plan.

The other option is to enter the income as other miscellaneous income:

-

Open your return in TurboTax

-

Click on Wages & Income

-

Scroll down to All Income

-

Scroll down to Less Common Income

-

Scroll down to Miscellaneous Income, 1099-A, 1099-C

-

Click start

-

Scroll down to Other reportable income

-

Answer yes

-

Enter retirement income description and amount

Hope this works for you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Thank you, I will look into those options. Appreciate your help on this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Karen J2, you have been very patient in your explanation to this problem. i had a question do i follow the above steps to file for my dad (is having a similar situation) in the US after he has filed taxes in india ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

If I use the other income route, where do I enter tax credit so the income from India is not taxed in US again?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

Yes, claim the Foreign Tax Credit by going to, Go to wages and income>deductions and credits>estimates and other taxes paid>foreign taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

For my parents and in-laws, we file using 1099R, then select the option that says "I need to file a substitute 1099R" and use form 4852 to explain that the pension is already taxed in Indian and due to the India-US tax treaty, they are not required to pay the tax here. I convert the pension amount from Indian rupees to USD using the current conversion rate and enter it in box 1 Gross distributions and enter 0 in the taxable amount and select code 7 for box 7.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing the US tax for parents earning retirement income and paying taxes in India

ASUB, can you please list the steps of filing tax for pensioners from India in detail in this thread.

It will help all of us to understand where there are challenges in the sequence of steps. If there are no challenges at least we will know that this is the process to be followed

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mysert

Level 1

Birdiebridge

New Member

leia-gomes8

New Member

lmlazar

New Member

joseph61

New Member