To clarify, did you make Traditional IRA contribution in 2025 for 2024? If did not make the contribution in 2025 but you show an amount on line 4 of Form 8606 then you will need to go back to the IRA contribution interview and edit your entry.

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “traditional IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution?”

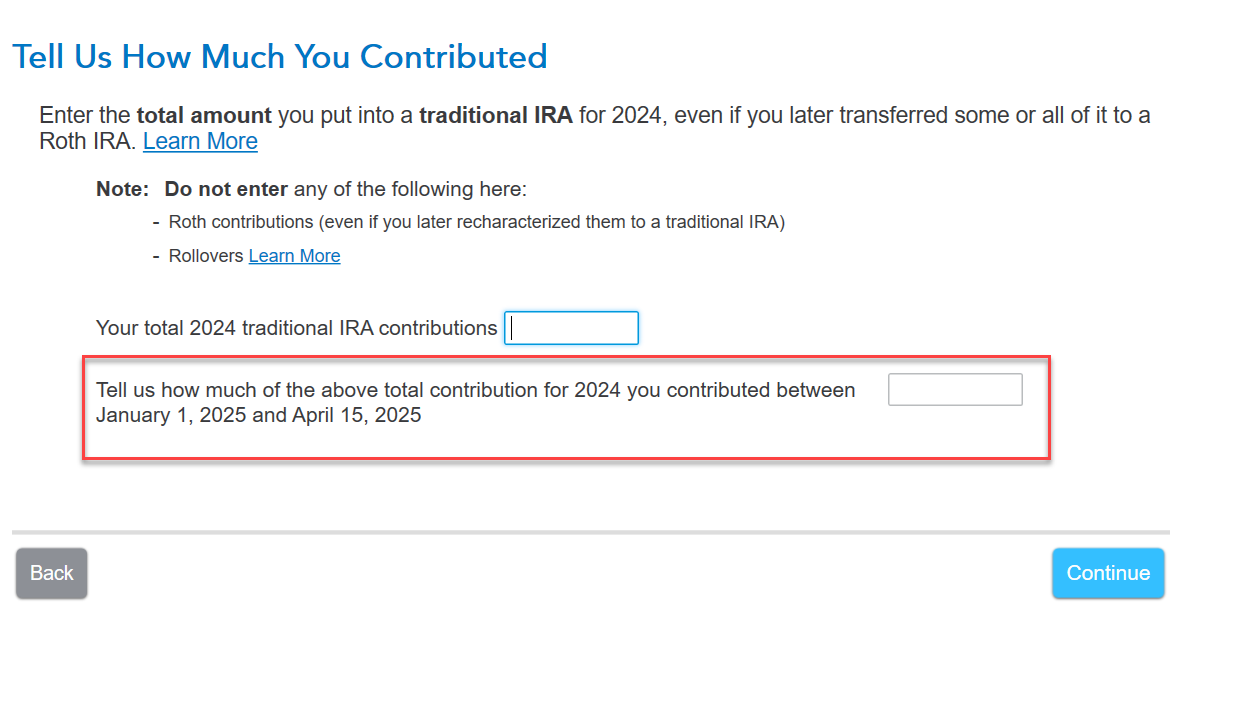

- Delete the entry under "Tell us how much of the above total contribution for 2024 you contributed between Jan 1, 2025 and April 15th, 2025."

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"