in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now le...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

Hello,

This question has been asked to death so far however it sounds like the 8915-E has been finalized and the relevant Turbo Tax software has been updated thusly. I'm still stuck in a "Check This Entry" logic flow limbo..

"Form 1 Penalties on IRA We're still working on updates related to penalties on IRA's, retirement plans..." ect.

Below the error message the 8915-E is shown and Line 22 on it is editable with the correct amount already prefilled- (i.e. line B x .33) the software however still doesn't think it's acceptable. I cannot submit and have been running in circles. I have gone back through and re-entered my 1099-R several times at this point. Am I still waiting for a software update on this? Any help is appreciated IMMENSELY.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

For anyone having issues with Wisconsin state taxes, the issue is fixed!!!! Was able to complete my son’s taxes last night!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

To add to this, and I apologize if this is an error on my part.. I am completely baffled by my "Gross Distribution" being listed at $5000 . When withdrawn, the pre-tax figure was $5500 and I elected to withhold $500 as indicated in box 4. Is the term Gross Distribution something I'm completely misinterpreting? Every "Gross" figure I've ever seen was pre-tax and that seems not to be the case at all here.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

On the Retirement Statements, "gross" actually just means "total/all/no adds or subtracts" - much like the SS documents that in box 5 have what you actually received, but the detail to the left begins with the amount that you are due to receive, but before other items of deduction.

The amount in box 1 "should be" the total pre-tax figure. I am not sure where you are seeing (or saw) the "pre-tax figure" of $5500 if it is not on your tax form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

Same error message for me when completing my son's taxes! This is frustrating! I am essentially getting an error message on an amount equal to .33 of 10% of the distribution ($30,000 distribution times 10% times .33). Penalty amount indicated is $990, which is not correct. There should be no penalty for early withdrawl under the CARES act due to financial hardship throughout 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

8915-e is ready. Please use the Chrome browser and clear all browsing data.

Then sign into TuirboTax

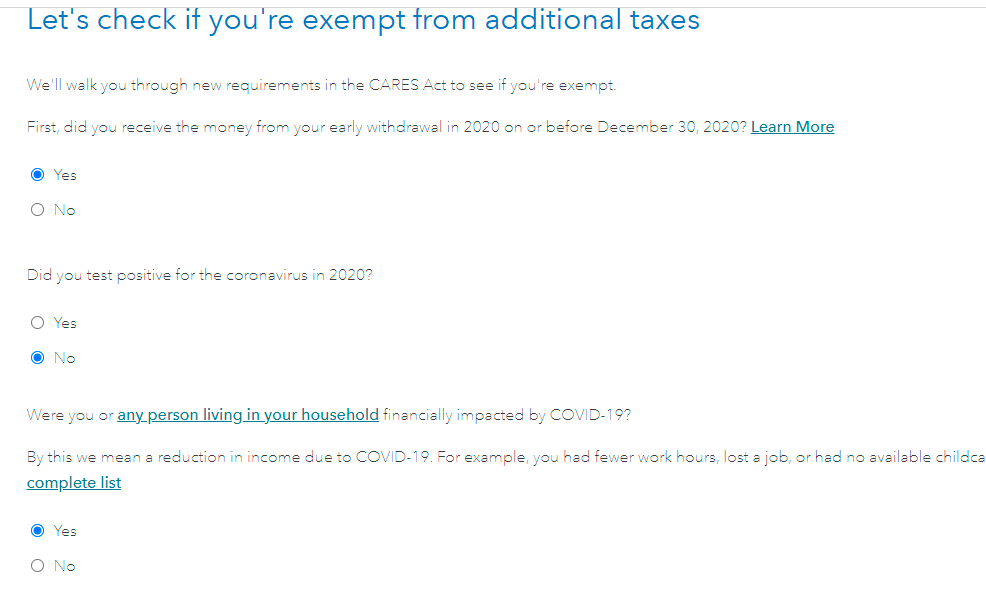

You may have to delete and reenter your 1099-R if you do not get this question when you review it

I took out this money because of a qualified disaster (includes COVID-19) - Select this question

Answer the other questions until you get to this screen

To be sure the form is created, go to Tax Tools, tools, Delete a form and your will see 8915 and 8915-E-T on the list.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

I am not using the web version of TurboTax. I am using the desktop download. Finally spoke with a customer service rep at TurboTax, and there is apparently a file logged for an issue with the Wisconsin State form. They are working on it, and I SHOULD get an e-mail when it is resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

This is what I was hoping for! If you wouldn’t mind replying here once the email has been received I’d greatly appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

Thank you for the info 😊

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

Absolutely! Would love to help!

IRS also indicated yesterday that the dealine for filing has been extended to May 17, 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

For anyone having issues with Wisconsin state taxes, the issue is fixed!!!! Was able to complete my son’s taxes last night!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401K Early Withdrawal/Covid Relief and the maddeningly dizzy spin around Line 22 of my now least favorite form ever, 8915-E

Thanks yet again! Have a great weekend 😁

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

timulltim

Level 1

wkassin

Level 2

m-kominiarek

Level 1

KELC

Level 1

wphannibal

New Member