- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099-R problems

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

I have a 1099R for my rollover I received from my husbands retirement during our divorce. The amount of the 1099R says 81,750.04. This is correct, however, when I took the check to my bank to put in the IRA, I took a distribution as well. So I actually only deposited 60,000 into the IRA. How do I report this when the 1099R only shows the 81,750.04?

Thank You

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

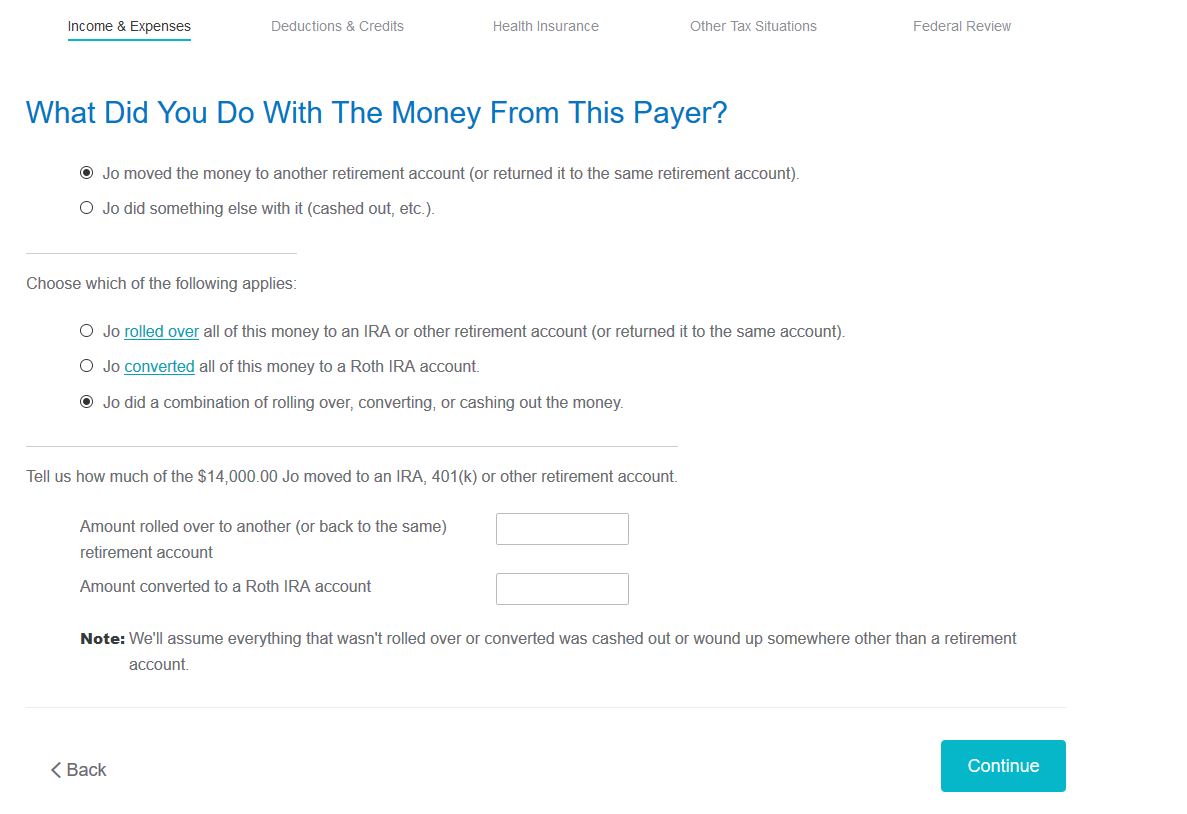

Enter the 1099-R as it is reported, then on the follow up pages answer what you did with the money. One of the selections is 'you did a combination of rolling over, converting, or cashing out the money'.

See example

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

cPaula,

Thank you for the help. The 1099r reports in box 7 the code G. So those questions do not show up. I would have to change box 7 for 1 for early withdraw for those questions to show up. I know I can't just change the 1099 info. should I create a substitute 1099r to show the taxable amount? If so, do I still report the original 1099r?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

You should check with the payer. If you were to roll the entire sum over and chose not to, then the payer will need to issue a corrected 1099-R form. Do not create a substitute 1099-R for this situation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

income tax 2018 my 2018 form 1099-R (box 2a) $32749.51 but 2018 Form 5498( just received in April 2019) ( box 2) $14000> please tell me how to get tax back in 2019 income tax-Thks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

I signed up to auto withdrawing my RMD and transferred to bank account. During year I also withdrawed more than request amount RMD money from my IRA account and thought that should reducted my RMD but when I saw RMD still automatically transfer money full money to bank account, I called my Vanguard to reversed money back to bank account but in form 1099-R 2018 still show full $32749 ( not reducted $14000 rollover back)and until April I received Form 5498 showed $14000 in Box 2. Please advice me how get money tax back in 2019 income tax because I paid over 2500 income tax with cause by form 1099-R 2018. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

You made an error on the 2018 return ... so you need to amend the 2018 return IF vanguard did the reversal as you indicated. After you enter the 1099-R you had to indicate how much was rolled back ... see the other answer above for the screen shot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

@Khaithue47 wrote:

I signed up to auto withdrawing my RMD and transferred to bank account. During year I also withdrawed more than request amount RMD money from my IRA account and thought that should reducted my RMD but when I saw RMD still automatically transfer money full money to bank account, I called my Vanguard to reversed money back to bank account but in form 1099-R 2018 still show full $32749 ( not reducted $14000 rollover back)and until April I received Form 5498 showed $14000 in Box 2. Please advice me how get money tax back in 2019 income tax because I paid over 2500 income tax with cause by form 1099-R 2018. Thanks

@Khaithue47 - If you satisfied the 2018 RMD amount and rolled the excess back as the 1098 seems to indicate, then when you entered the 2018 1099-R did you answer the follow up questions that you rolled part of the money back?

If you did then the 1040 line 4a should have the the total 1099-R box 1 amount and line 4b (the taxable amount) should have the box 1 amount minus the amount rolled back) with the word "ROLLOVER" printed next to it.

If not, then you entered it wrong and need to amend 2018 to report it properly.

Amended returns can only be mailed. It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS receives it.

See this TurboTax FAQ for detailed amend instructions:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

You can check the status of the amended return here, but allow 3 weeks after mailing.

https://www.irs.gov/filing/wheres-my-amended-return

|

Enter a 1099-R here:

(Be sure that the RMD amount question answer does not reflect any of the rollover amount or the rollover would not be permitted because a RMD cannot be rolled over by law.) |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

Khaithue47, this has nothing to do with your 2019 tax return. I assume that this is your own IRA, not an inherited IRA. When you entered the code 7 2018 Form 1099-R into TurboTax you should have indicated to TurboTax that only some of the box 1 amount was RMD ($18,749.51 based on the information that you provided [Edit: actually $12,611.90 based on what you have said below, but that doesn't change any of the other details]), that you moved some or all of the money to another retirement account (or returned it to the same account), then indicated that you rolled over $14,000. I, doing so, TurboTax would have included only $18,749.51 on 2018 Form 1040 line 4b and would have included the word ROLLOVER next to the line. If you did not do this correctly when you originally filed your 2018 tax return, you must amend your 2018 tax return:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

thank you very much !

I have same Congratulations! You've satisfied your RMD for your Vanguard accounts this year.

Your RMD calculation for 2019—IRAs

RMD amount you must take by 12/31/2019

$12,611.90

Distributions you've taken year to date1

$32,611.90

Remaining RMD amount

$0.problem in 2019 as well as 2018.

As of 11/25/2019

Date

Trade date

Account

Fund

Transaction

Shares transacted

Share price

Amount

09/12/2019

09/12/2019

Mr Tiep Van Le—Rollover IRA Brokerage—72855570

CASH

Rollover (incoming)

—

—

$12,000.00

So how to minus 12000 from Form 1099-R in tax 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

I do not see little box 1 to minus rollover amount in 1040 tax form

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R problems

Again, this has nothing to do with 2019. You asked about your 2018 1099-R that the amount in excess of yiur RMD was rolled back. That can ONLY be reported on a 2018 amended tax return, not a 2019 tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PCUTTS11315

New Member

Gronhoja

New Member

denisefowler1018

New Member

CL49

New Member

cgershen

New Member