- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099-OID

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID

Error flag on 1099-OID data imported from Schwab 1099-OID..."Box 10: Bond premuim. The bond premium adjustment of xxx reported on this Form 1099-OID (Charles Schwab composite) is greater than the interest income reported in Box 2 on this 1099-OID of 0.00. You must reduce the bond premium amount reported on this 1099-OID to the amount of interest income, and report any excess on Schedule A (subject to any required limitations)." However, there IS NO BOX 2 on 1900-OID! Called Schwab and they couldn't make sense of this either. I'm ready to file except for this one error...what do I do???

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID

Box 10 contains the Bond Premium amortization allocable to interest payments. This amount is considered the Amortized Bond Premium on the covered security for the current year. This amount is to be subtracted from the reported interest amount on Schedule B (Form 1040) as a separate “ABP Adjustment.” Did you receive or report any interest from the security whose bond premium is in Box 10? If so, reduce that amount by the amount of the bond premium to report the net.

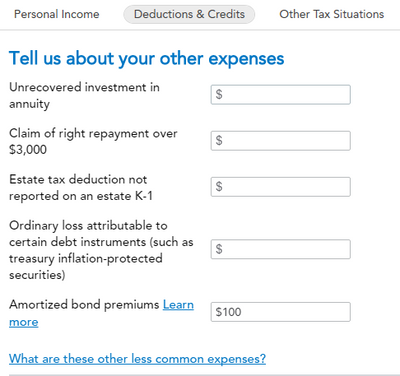

If the amount in Box 10 (premium) is more than Box 2 (interest), you have to reduce the amount to be equal to Box 2 and the difference is an itemized deduction on Schedule A. To take the itemized deduction in TurboTax, use the Other Deductible Expenses category in Other Deductions and Credits. You will come to screen titled ''Tell us about your other expenses'' and amortized bond premiums is the last one on that page.

If you do not itemize deductions (you take the standard deduction), you will not see a change in tax liability or refund from the deduction. For more information, see pub 550.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID

Box 10 contains the Bond Premium amortization allocable to interest payments. This amount is considered the Amortized Bond Premium on the covered security for the current year. This amount is to be subtracted from the reported interest amount on Schedule B (Form 1040) as a separate “ABP Adjustment.” Did you receive or report any interest from the security whose bond premium is in Box 10? If so, reduce that amount by the amount of the bond premium to report the net.

If the amount in Box 10 (premium) is more than Box 2 (interest), you have to reduce the amount to be equal to Box 2 and the difference is an itemized deduction on Schedule A. To take the itemized deduction in TurboTax, use the Other Deductible Expenses category in Other Deductions and Credits. You will come to screen titled ''Tell us about your other expenses'' and amortized bond premiums is the last one on that page.

If you do not itemize deductions (you take the standard deduction), you will not see a change in tax liability or refund from the deduction. For more information, see pub 550.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID

What if the OID was for a tax exempt security? I have nothing in box 2. The 1099-INT for all of my interest exempt income includes the interest for this security but the bond premium does not appear to be included in the the bond premium on the 1099-INT. I didn't think I could take a deduction on tax exempt securities.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-OID

Thank you! This is exactly what I needed!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lindabranon

New Member

mrskillet

Returning Member

rwstealle

Level 1

psow

New Member

papa281

Level 4