- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Box 10 contains the Bond Premium amortization allocable to interest payments. This amount is considered the Amortized Bond Premium on the covered security for the current year. This amount is to be subtracted from the reported interest amount on Schedule B (Form 1040) as a separate “ABP Adjustment.” Did you receive or report any interest from the security whose bond premium is in Box 10? If so, reduce that amount by the amount of the bond premium to report the net.

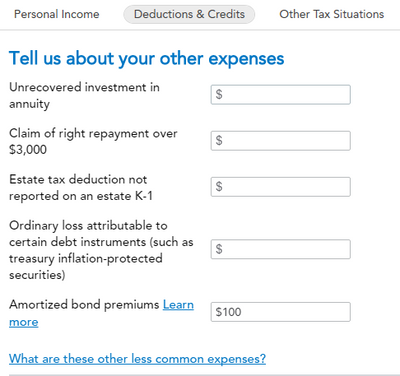

If the amount in Box 10 (premium) is more than Box 2 (interest), you have to reduce the amount to be equal to Box 2 and the difference is an itemized deduction on Schedule A. To take the itemized deduction in TurboTax, use the Other Deductible Expenses category in Other Deductions and Credits. You will come to screen titled ''Tell us about your other expenses'' and amortized bond premiums is the last one on that page.

If you do not itemize deductions (you take the standard deduction), you will not see a change in tax liability or refund from the deduction. For more information, see pub 550.

**Mark the post that answers your question by clicking on "Mark as Best Answer"