- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Railroad Retirement RRB-1099-R Step-by-Step Questions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

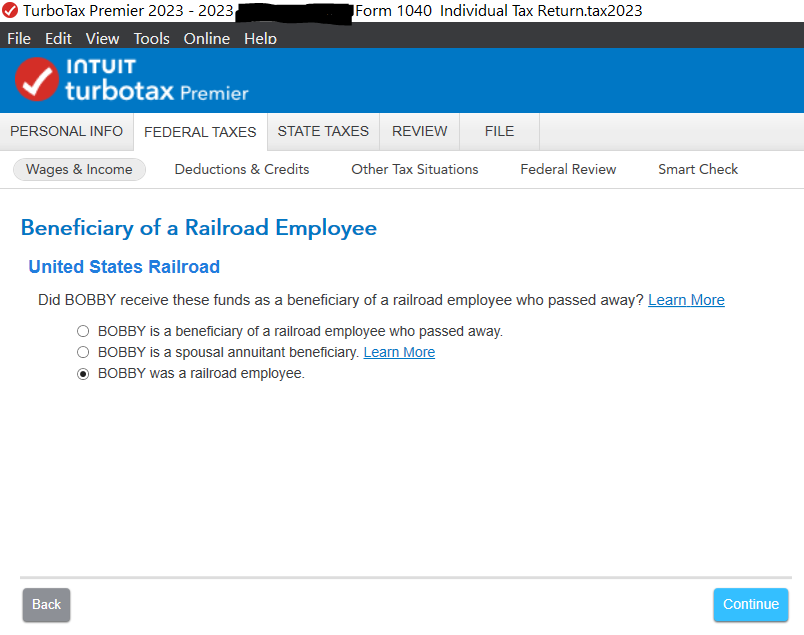

This pertains to the questions I am getting when filling out the RRB-1099-R. After filling out the initial information page it asks the question: Did Bobby receive these funds as a beneficiary of a railroad employee who passed away?

Choice of answers are:

Bobby is a beneficiary of a railway employee who passed away.

Bobby is a spousal annuitant beneficiary.

Bobby was a railroad employee.

Why is the program presenting questions as if I am dead?

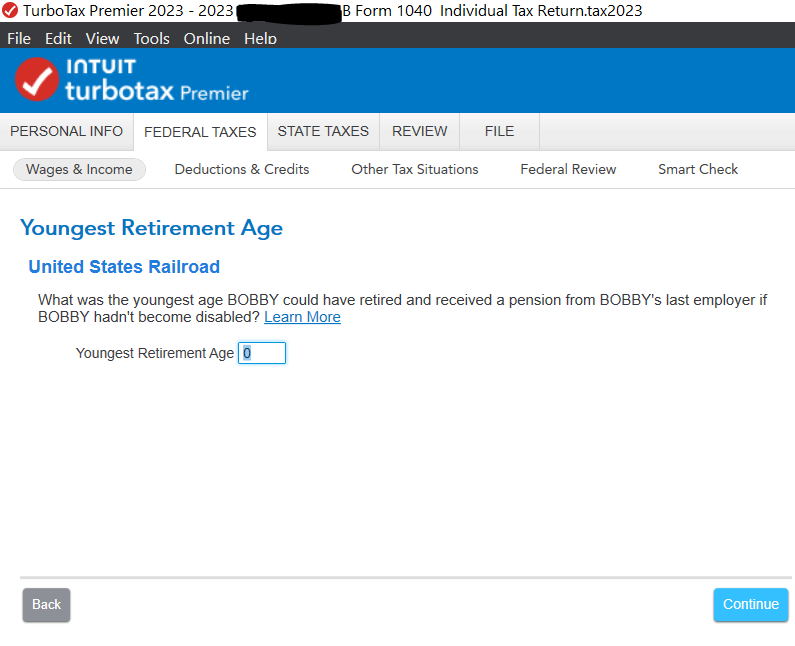

Onto the next question program asks;

What was the youngest age Bobby could have retired and received pension from Bobby's last employer if Bobby hadn't become disabled?

Now the program thinks I am disabled, I am not disabled. How can I answer these questions truthfully?

Bob

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

We are exploring this issue further.

However, in the meantime, you should be able to manually change that code to a 7.

I was able to change the 3 to a 7 using the following steps:

- Exit Forms Mode and go back to the step-by-step instructions.

- Delete your Form RRB-1099-R and re-enter it.

- Go back to forms mode and change the 3 to a 7 in the form you showed us.

This should allow your pension to be calculated as a normal distribution.

Click here for how to delete a form in TurboTax Desktop.

Click here for how to delete a form in TurboTax Online.

Please feel free to come back to TurboTax Community with additional information or questions or click here for help in contacting Turbo Tax Support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

Please clarify your question.

- I was not able to find this question on the RRB-1099 screen.

- What steps did you go through to get to those questions?

Please contact us again with any questions, and provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

I'll have to get back to you in a couple of days, I am on my laptop right now and Turbo Tax is on my desktop. I have run to Kansas City tomorrow and I might be able to work on this on Fri 2/23.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

Trying answer your questions: These screens are produced when entering RRB-1099-R, but you mentioned RRB-1099. There are two different forms. RRB-1099 is the Blue form and RRB 1099-R is the Green Form. I am talking about the Green form. The questions come up after entering box 3, 4, 6, and 9.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

These are the instructions for properly entering the RRB-1099-R (the green one). It is important that you enter it at the correct place in TurboTax. Please click here for additional help on entering your RRB-1099-R.

When you enter your form, you should see this:

The first question you are asking about is "Did Bobby receive these funds as a beneficiary of a railroad employee who passed away?"

You answered this correctly, "Bobby was a railroad employee".

The second question you are asking about is "What is the youngest age Bobby could have retired and received a pension from Bobby's last employer if Babby had not become disabled.

Normally this would be age 55 if your plan provides for early retirement, or 65, which is normal retirement age.

You can find this information by asking your employer's benefits or human resources department. This information would be found in the pension plan document. They are basically asking how early could you have retired and still receive a pension from your employer had you not become disabled.

These questions are asked to determine if the distribution is for disability or not. If you were younger than retirement age, it would indicate a disability retirement. They are reported differently on your federal tax return.

A 1099-R has a code that indicates disability, but a RRB 1099-R does not. If you retire on disability, the payments you are receiving would be taxed as wages until you reach the minimum retirement age; that's the distinction.

Click here for an explanation of Form RRB 1099-R.

Click here for Publication 575.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

Thank you for your assistance.

I followed your process, however, I still have a problem with the design of how Turbo Tax forms the sentence structures in this area. They insinuate that I am either dead or disabled. I am of course not either dead or disabled.

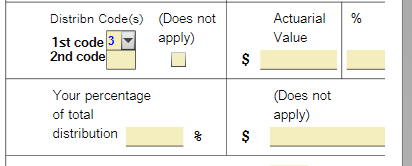

On your 3rd sentence you asked about my retirement age. I was allowed to retire at 60 because I had more than 30 years of service. However, when going to the Upper Right Hand side to "Forms", then clicking on 1099-R (United States Railroad), then looking to the right of "Recipients Name", you will see a box for Distribution Code and it displays the No. 3 which is for "Disabled". According to IRS Publication 575, I should be using Code 7 for "Normal Distribution". Turbo Tax is showing that I am disabled on this form no matter how I answer the above questions, even if I change it manually. I believe this is a flaw in the programming.

Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

I would like to take a deeper look at this, it would be helpful to have a TurboTax ".tax2023" file that is experiencing this issue. You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions: Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

Here are the instructions if you are using TurboTax CD/Download:

- Click on Online in the top left menu of TurboTax CD/Download for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number then place in this issue.

- We can then review your exact scenario for a solution.

- Please also tell us any states included in the return.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

Remember to leave your token number in a reply to this thread.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

Token: 1201354

State: KS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

We are exploring this issue further.

However, in the meantime, you should be able to manually change that code to a 7.

I was able to change the 3 to a 7 using the following steps:

- Exit Forms Mode and go back to the step-by-step instructions.

- Delete your Form RRB-1099-R and re-enter it.

- Go back to forms mode and change the 3 to a 7 in the form you showed us.

This should allow your pension to be calculated as a normal distribution.

Click here for how to delete a form in TurboTax Desktop.

Click here for how to delete a form in TurboTax Online.

Please feel free to come back to TurboTax Community with additional information or questions or click here for help in contacting Turbo Tax Support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

I got "7" to stick and it has been transmitted to the IRS. You said "This should allow your pension to be calculated as a normal distribution". How do I know this for sure? Is this calculated on the "Simplified Method Worksheet"?

Can you let me know how they resolve this issue? Seems to me they missed a couple of steps in the questioning process to determine "Disability" vs. "Normal Distribution". As stated before, I really did not like the way the questions were posed as they were not clear as what needed to be conveyed.

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Railroad Retirement RRB-1099-R Step-by-Step Questions

You should be able to tell by looking at your tax return.

If you have entered the Form RRB-1099-R as it is shown and your distribution code is a 7, then Line 5a on your Form 1040 should show the total amount of pension and annuity payments you received during the tax year, and line 5b should show the amount of line 5a that is taxable (using the simplified method).

The simplified method is used to calculate the taxable portion your retirement payments. The simplified method is simpler and more beneficial than using the ""General Rule". You are required to use the general rule in some instances, such as for a commercial annuity you bought yourself.

Here is a link to the Simplified Method Worksheet for pensions and annuities from the IRS.

If you are using TurboTax Desktop, Premier or higher you can find the Simplified Method Worksheet in your TurboTax program when you switch to forms mode. If you are using TurboTax Online you should be able to see the worksheet when you print your tax return.

The Instructions to Form 1040 for Lines 5a and 5b give a pretty good explanation of the Simplified Method, to see this click here.

Please feel free to come back to TurboTax Community with additional information or questions or click here for help in contacting Turbo Tax Support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

mjmoor60

New Member

mayra_sqvl

Level 1

jwenona

New Member

katiakitty35

New Member