- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Thank you for your assistance.

I followed your process, however, I still have a problem with the design of how Turbo Tax forms the sentence structures in this area. They insinuate that I am either dead or disabled. I am of course not either dead or disabled.

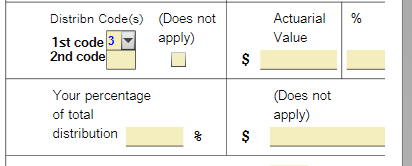

On your 3rd sentence you asked about my retirement age. I was allowed to retire at 60 because I had more than 30 years of service. However, when going to the Upper Right Hand side to "Forms", then clicking on 1099-R (United States Railroad), then looking to the right of "Recipients Name", you will see a box for Distribution Code and it displays the No. 3 which is for "Disabled". According to IRS Publication 575, I should be using Code 7 for "Normal Distribution". Turbo Tax is showing that I am disabled on this form no matter how I answer the above questions, even if I change it manually. I believe this is a flaw in the programming.

Please advise.