- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

We are exploring this issue further.

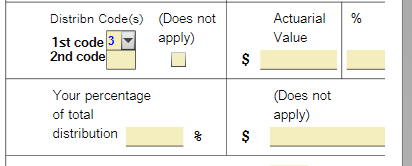

However, in the meantime, you should be able to manually change that code to a 7.

I was able to change the 3 to a 7 using the following steps:

- Exit Forms Mode and go back to the step-by-step instructions.

- Delete your Form RRB-1099-R and re-enter it.

- Go back to forms mode and change the 3 to a 7 in the form you showed us.

This should allow your pension to be calculated as a normal distribution.

Click here for how to delete a form in TurboTax Desktop.

Click here for how to delete a form in TurboTax Online.

Please feel free to come back to TurboTax Community with additional information or questions or click here for help in contacting Turbo Tax Support.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 4, 2024

4:30 PM