- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- My 1099R from NYS ERS says it is exempt from state tax but when I enter it tax due increases. Is this correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099R from NYS ERS says it is exempt from state tax but when I enter it tax due increases. Is this correct?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099R from NYS ERS says it is exempt from state tax but when I enter it tax due increases. Is this correct?

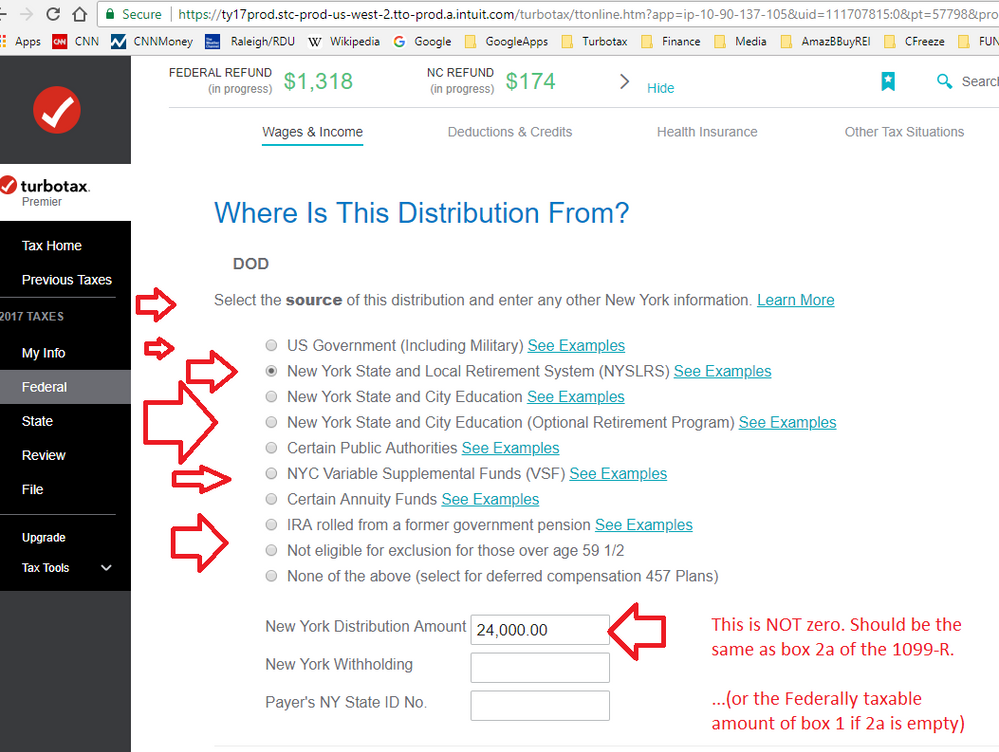

The NY tax may increase when you first put in the 1099-R, but you also need to carefully step thru ALL of the questions that follow the main 1099-R form. There is one (shown below ... but may be a bit different this year) where you need to indicate which pension system the 1099-R came from. After doing that, it should limit the NY taxes...assuming you are a member of one of the eligible NY retirement systems.

________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099R from NYS ERS says it is exempt from state tax but when I enter it tax due increases. Is this correct?

also, are you a NY state resident? If no, then it may be taxable in the state you now reside in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 1099R from NYS ERS says it is exempt from state tax but when I enter it tax due increases. Is this correct?

ooooh.....good point must be a NY resident at the time you receive the $$ to get the exemption.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17620428287

New Member

Jim_dzg5zg

Returning Member

sports fan

Returning Member

CTinHI

Level 1

Mandy1979

Level 1