- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

Hi,

I've contacted multiple agent through TT however this complicated problem is not fully resolved. I hope this forum can shed some light on my case 🙂

Timeline of events:

- 2017: First year me and my wife both contributed $5.5K through Vanguard, into Traditional, then immediately rolled over to Roth. No issue there

- 2018: We mistakenly each put post tax money of $5.5K into Roth directly. Our income level (high) does not allow us to directly contribute. We screwed up.

- 2019: Similar to 2018, screwed up again, this time $6K each.

- In April, 2019, I realized the mistakes we made in 2018/2019, so I called Vanguard. They told me they'd do a recharacterization. Essentially, they moved the 2018/2019 Roth money to Traditional and then did a backdoor conversion into Roth.

- In my 2019 return, I see three1099-R forms from Vanguard.

- From Roth 1099-R: ~$6200 with code N (contribution in 2019, recharacterized in 2019)

- From Roth 1099-R: ~$6100 with code R (contribution in 2018, recharacterized in 2019)

- From Traditional 1099-R: ~$13000 with code 2 (early distribution)

- Apparently the system believes that I contributed more to Traditional than I'm allowed. So I'm taxed again for ~$7000 ($13000 - $6000) at the highest tax bracket (same applies to my wife).

- I funded everything to Vanguard through my checking account which is post-tax already

- It looks like the $13000 is the screwup. It looks like a 2 year contribution lump sum. Did Vanguard make a mistake here by not separating them out?

I tried to input in turbotax in different ways, talking with TT agents, but couldn't sort this issue out. In reality I know the money shouldn't be taxed as my income twice but I just can't sort this out. I may owe some capital gain tax because the money stayed in Roth for a while - that's the cost for this lesson learned.

I know this is a very unique case but I'd appreciate any insights

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

Your case is not unique or unusual.

Funds for a prior year you want to convert , you must elect non-deductible for the year you made the contribution.

These amounts will go on Form 8606 filed for those years.

Then your conversion of those funds in 2019 will not be taxed.

only additional earnings, if any, will be taxed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

You should probably request an extension of time to file while you work on the correct way to report all this. Don't rush it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

If you haven't filed 8606, you must prepare sign and send to the IRS Form 8606 for the applicable prior years.

Then you can attach a correct 2019 Form 8606 to your 2019 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

Thanks so much for replying @fanfare . That makes a lot of sense and aligns with what I expect - only tax on additional earnings. Now, I'm not very familiar with the process - are you suggesting amend my 2018 tax? I went back to check my tax statement in Vanguard for 2018 and I only see form 5498. Should I call Vanguard so they can issue me a form in 2018 that I can use for the amendment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

Here is my plan - I'm going to call Vanguard on Monday to hear what they have to say? and then I will file an extension. In terms of 8606, will Vanguard send that to me or it's available for me to sign? Does it also need to be submitted prior to 7/15?

Thanks so much

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

you don't have to amend because the IRA gurus here point out that Form 8606 can be filed alone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

you get forms for prior years at www.irs.gov

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

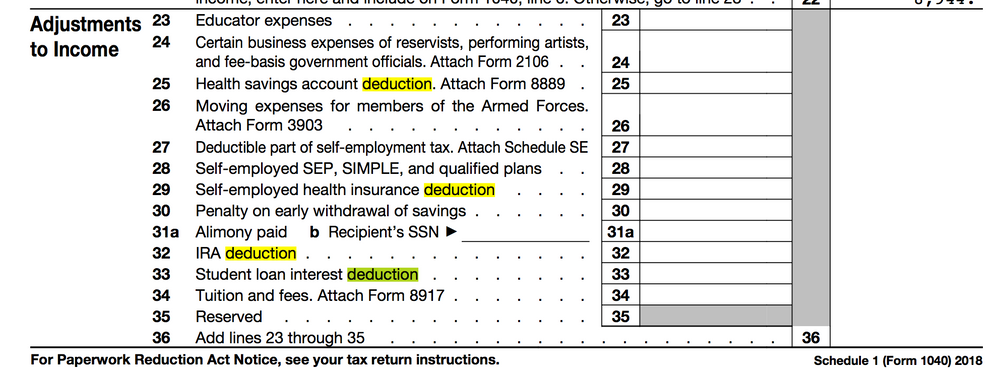

It doesn't look like I deducted the amount in 2018. This is the screenshot from my 2018 submission.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mistakenly Contributed into Roth IRA, Called Vanguard to rech to traditional, which resulted in additional tax.

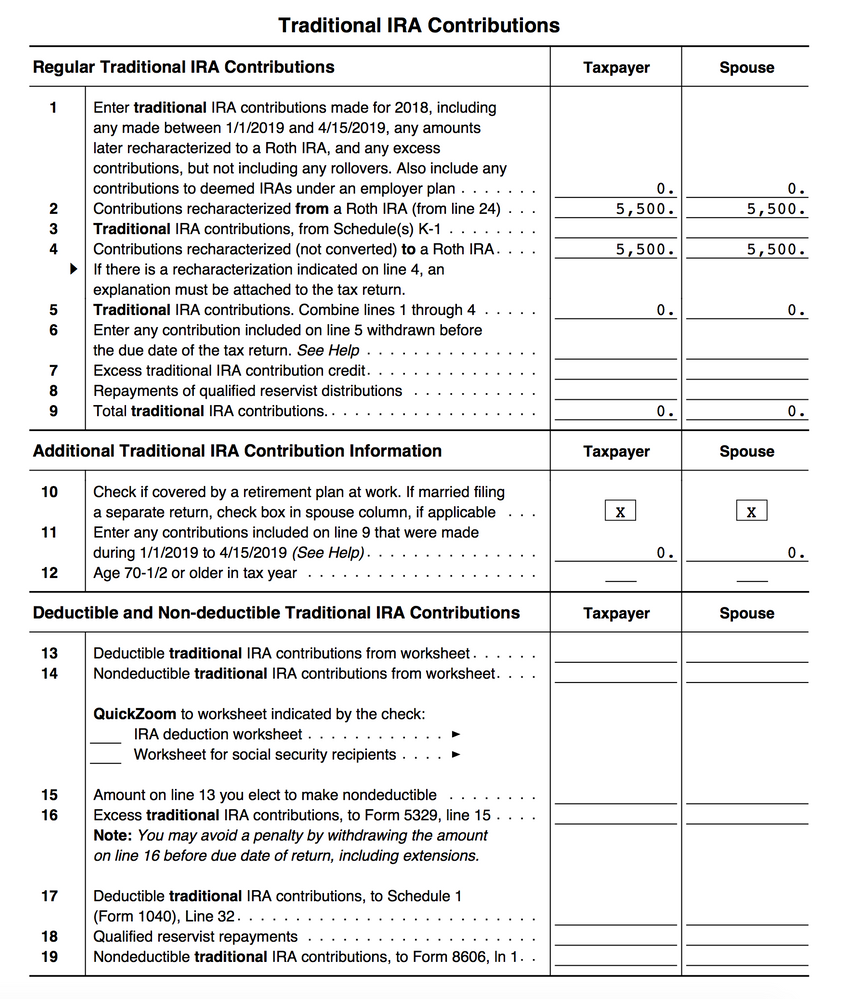

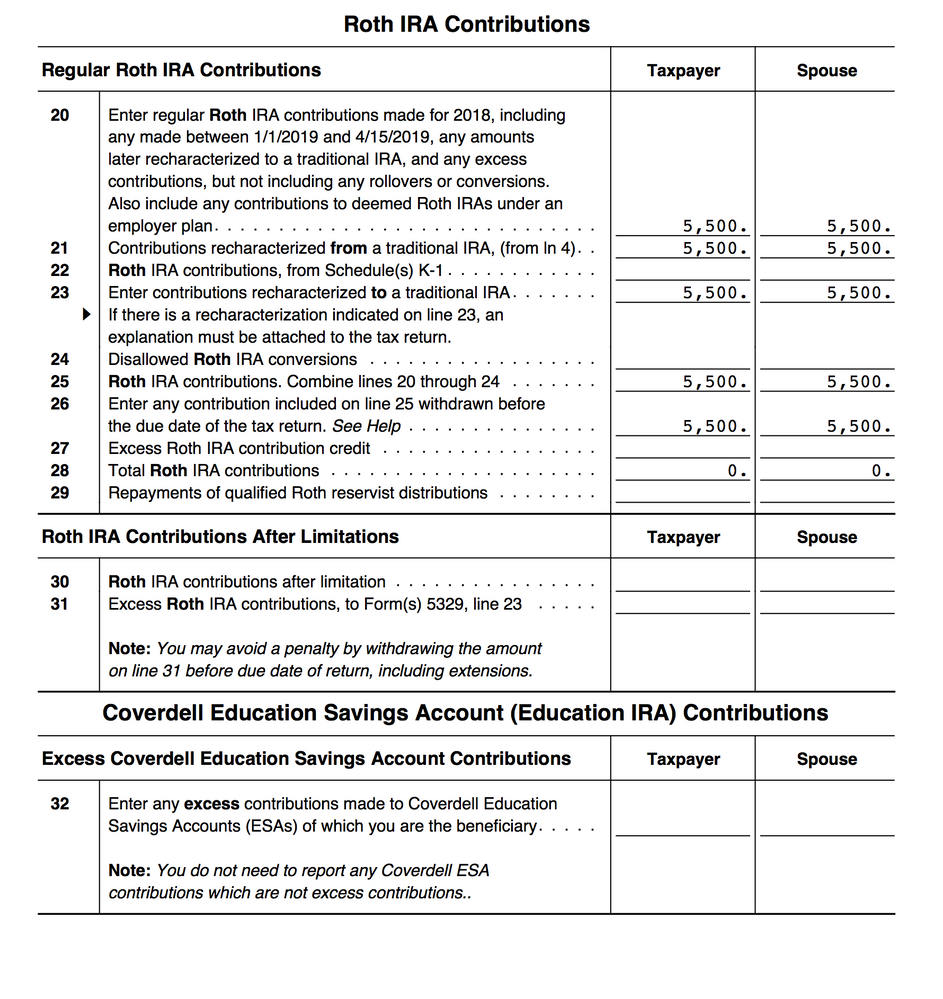

Did I mess up my 2018 retirement section?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

simoneporter

New Member

curlytwotoes

Level 2

VAer

Level 4

VAer

Level 4

VAer

Level 4