- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Lump Sum SS payment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lump Sum SS payment

My daughter used to receive SSI and as a result has never had to file taxes before. Last year, she was switched to SSDI on a child rider and received a 1099 which includes backpay for 2022 and 2021. While putting this information into Turbo Tax to determine if she owes any taxes on the backpay, it is asking for 1099 information for 2022 and 2021. She never received a 1099. How can I complete the tax forms if this information is not available?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lump Sum SS payment

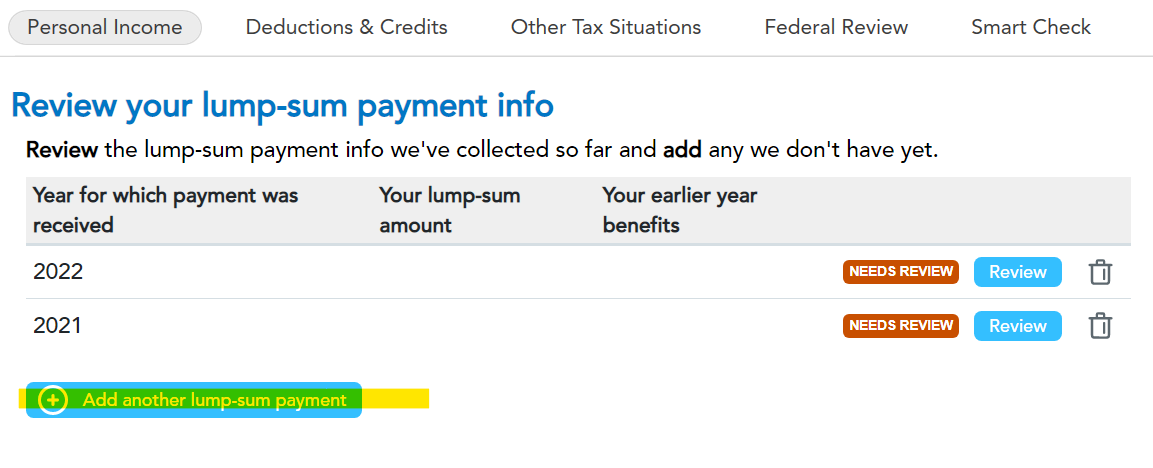

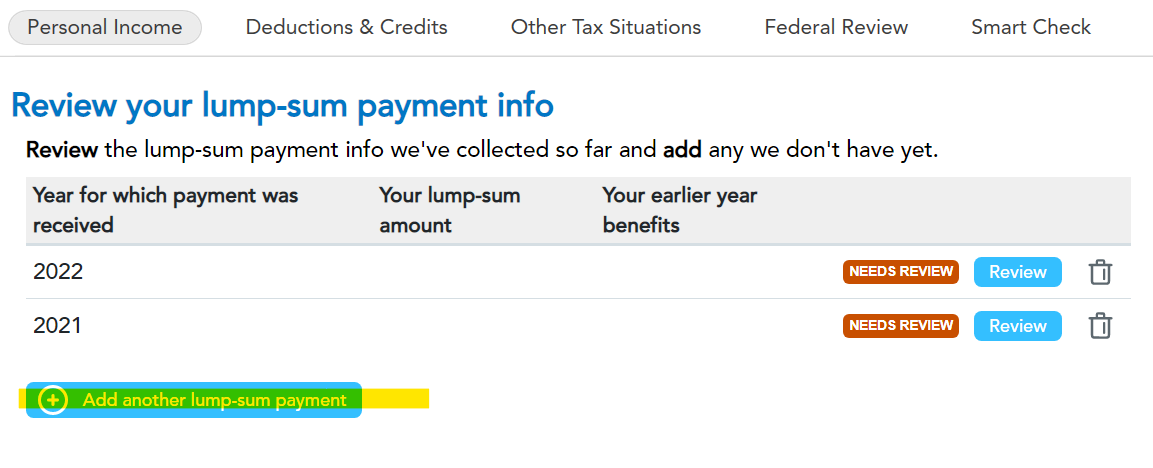

Enter 0 or leave those fields blank, when asked about prior year tax return amounts. If she is required to file, enter each year as a separate payment. After you enter your SSA-1099 information, we'll ask if she received a lump-sum Social Security payment. You can list 2021 and 2022 separately.

Her SSA-1099 lump-sum section breaks down the payments into what amount was received for each preceding year. You can only enter one year at a time. If you need to enter benefits received for a different tax year, select Add another lump-sum payment.

An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. To find these limits, refer to "Dependents" under "Who Must File" in Publication 501, Dependents, Standard Deduction and Filing Information.

You can also refer to Do I Need to File a Tax Return? to see if her income requires her to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lump Sum SS payment

Do not enter the SSA1099 for your child on your own tax return. Someday if the child has other income (after school job, etc.) and is filing a tax return, for that tax year he will need to include the SSA1099 on his own return. Until then, it does not get entered anywhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lump Sum SS payment

Enter 0 or leave those fields blank, when asked about prior year tax return amounts. If she is required to file, enter each year as a separate payment. After you enter your SSA-1099 information, we'll ask if she received a lump-sum Social Security payment. You can list 2021 and 2022 separately.

Her SSA-1099 lump-sum section breaks down the payments into what amount was received for each preceding year. You can only enter one year at a time. If you need to enter benefits received for a different tax year, select Add another lump-sum payment.

An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. To find these limits, refer to "Dependents" under "Who Must File" in Publication 501, Dependents, Standard Deduction and Filing Information.

You can also refer to Do I Need to File a Tax Return? to see if her income requires her to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lump Sum SS payment

Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lgwalker59

New Member

ivanthomas

New Member

nfriarson53

New Member

davidburkstrand77

New Member

tinawalkerusa

New Member