- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

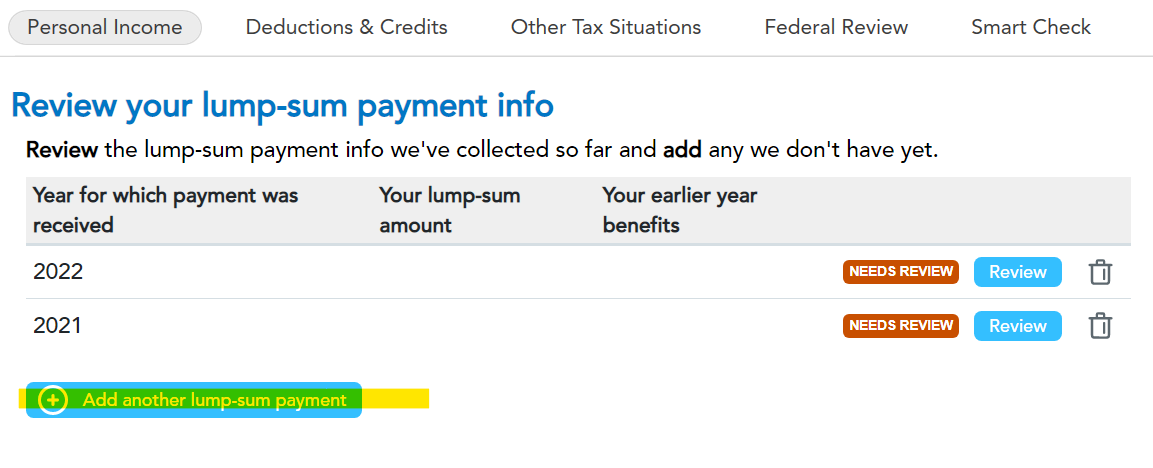

Enter 0 or leave those fields blank, when asked about prior year tax return amounts. If she is required to file, enter each year as a separate payment. After you enter your SSA-1099 information, we'll ask if she received a lump-sum Social Security payment. You can list 2021 and 2022 separately.

Her SSA-1099 lump-sum section breaks down the payments into what amount was received for each preceding year. You can only enter one year at a time. If you need to enter benefits received for a different tax year, select Add another lump-sum payment.

An unmarried dependent student must file a tax return if his or her earned or unearned income exceeds certain limits. To find these limits, refer to "Dependents" under "Who Must File" in Publication 501, Dependents, Standard Deduction and Filing Information.

You can also refer to Do I Need to File a Tax Return? to see if her income requires her to file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"