- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

You can Delete your 1099-NEC and enter it in the Business Income section, which is reported directly on Schedule C.

Type '1099-nec' in the Search area, then click on 'Jump to 1099-nec'.

Use the Trash Can Icon to delete the form.

Then type 'schedule c' in the Search area and click on 'Jump to schedule c'.

EDIT your Business, then choose 'Add Income'.

On the next screen, you can indicate you received a 1099-NEC and enter the info.

Click this link for details on Reporting Self-Employment Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

Hi MarilynG1,

Thank you for your prompt reply. The steps you describe are the exact steps I have been taking, multiple times, in a circle 😕. After much more trial and error, the below steps led to success.

EDIT: The steps I outlined below (in Courier New font) DID NOT work 😑.

As I should have expected, I get to the end of the line, pay the TurboTax fees, am ready to file, and then...

- The following message appears: "Let's make sure everything is accurate"

A) I select "Fix Federal Return"

- I have returned to this step (again)

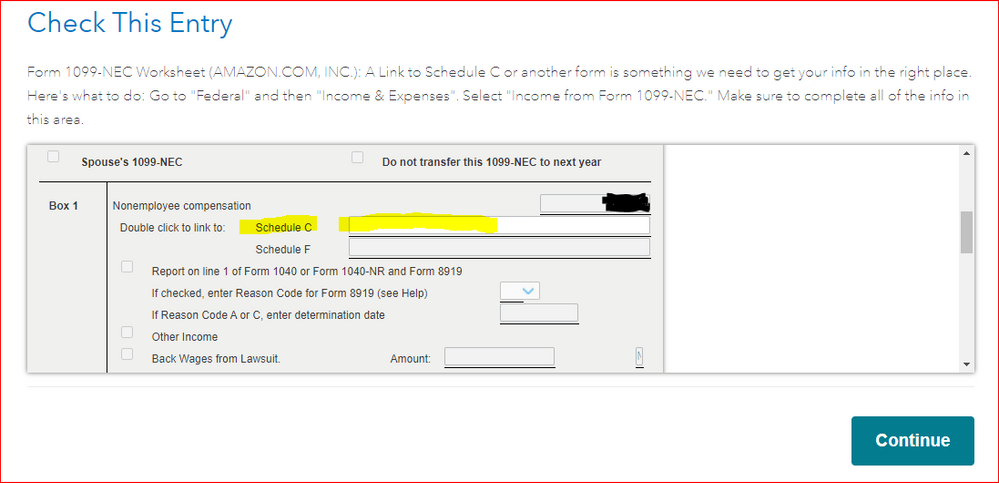

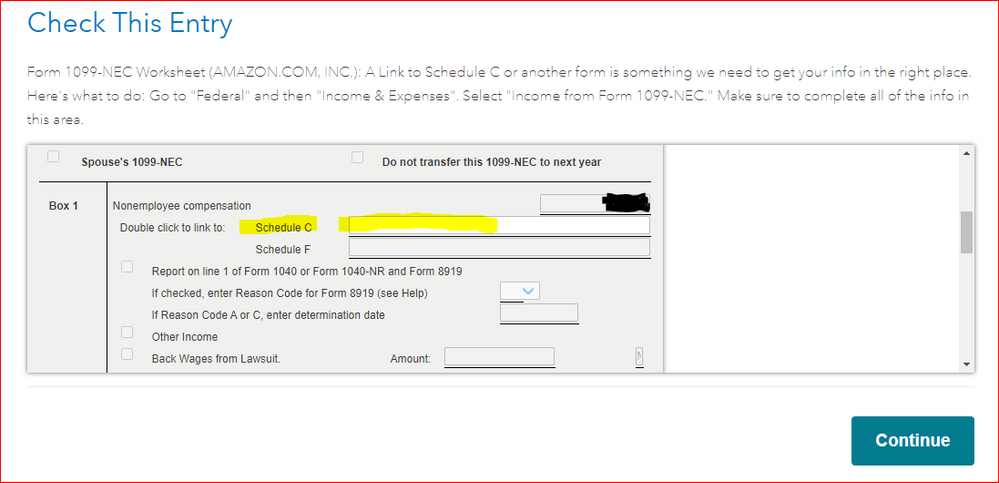

- The following message appears: "Check This Entry"

I DO NOT KNOW WHERE TO PROCEED FROM HERE.

Any help is greatly appreciated. And no (in case anyone thinks of mentioning it), I shouldn't have to File by Mail when this appears to be a TurboTax issue.

----------------------------------------------------------------------------------------------------------------------------------------------------------

(For anyone else encountering this issue, see if these steps work for you) -- screenshots included for reference 🙂.

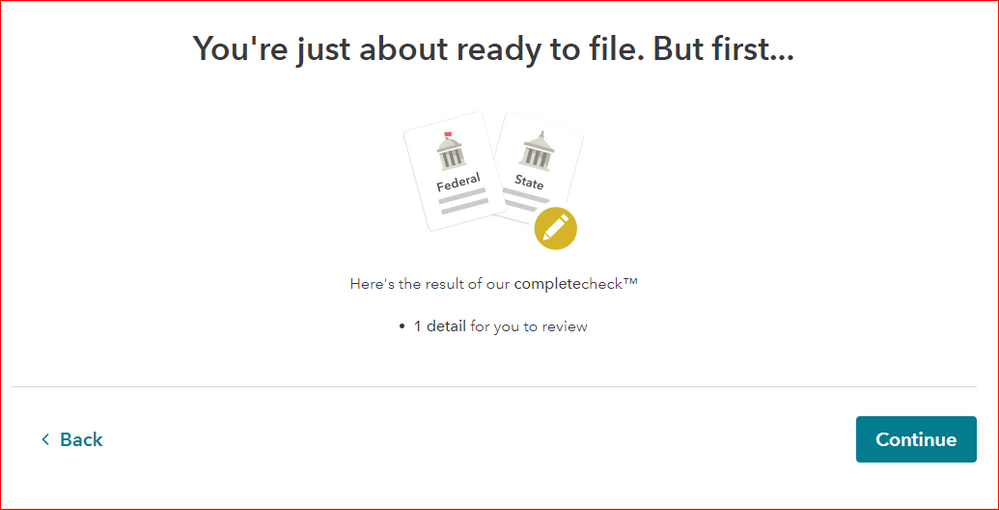

1. After completing the initial walkthrough (at the point where you are ready to submit your tax forms), everything appears to be fine. Ok, sure.

2. I select "Review"

- The following message appears: "Some of your self-employment taxes may be eligible for deferral [...]"

- There are two (2) options here: select "Back" or "Continue"

3. The scenario does not apply to me, so I select "Continue"

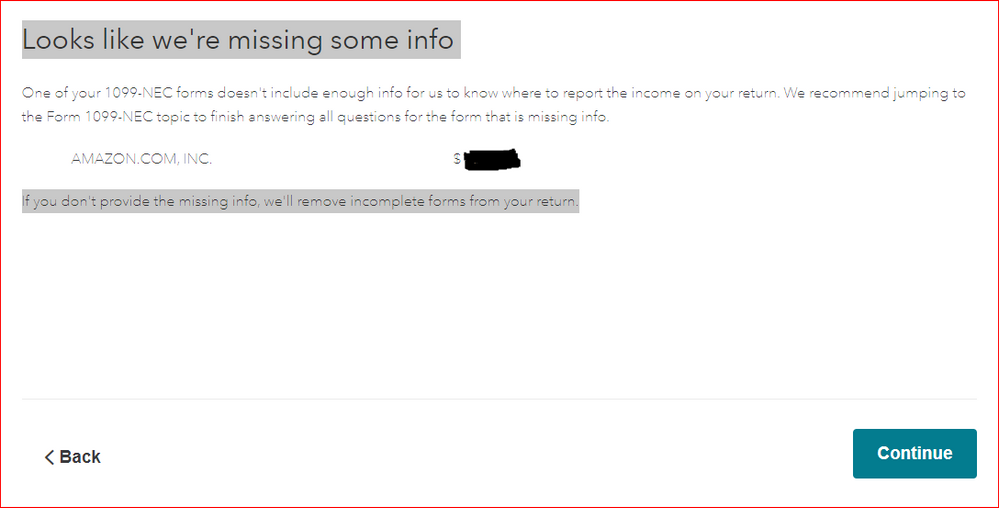

- The following message appears: "Looks like we're missing some info"

4. I select "Continue"

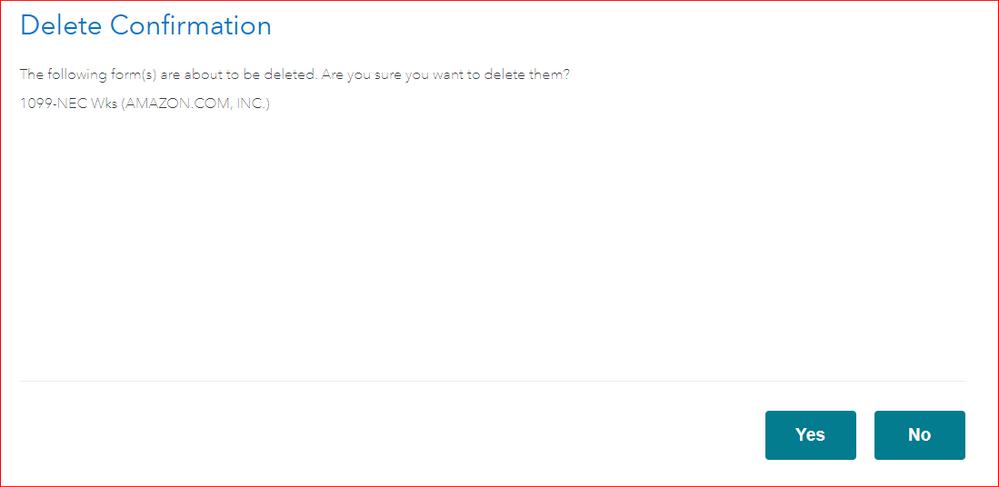

- The following message appears: "Delete Confirmation"

5. If I select "No" --

- The following message appears: "Let's comb through your returns one last time with completecheck(TM)"

6. I select "Check my info"

- The following message appears: "You're just about ready to file. But first..."

7. I select "Continue"

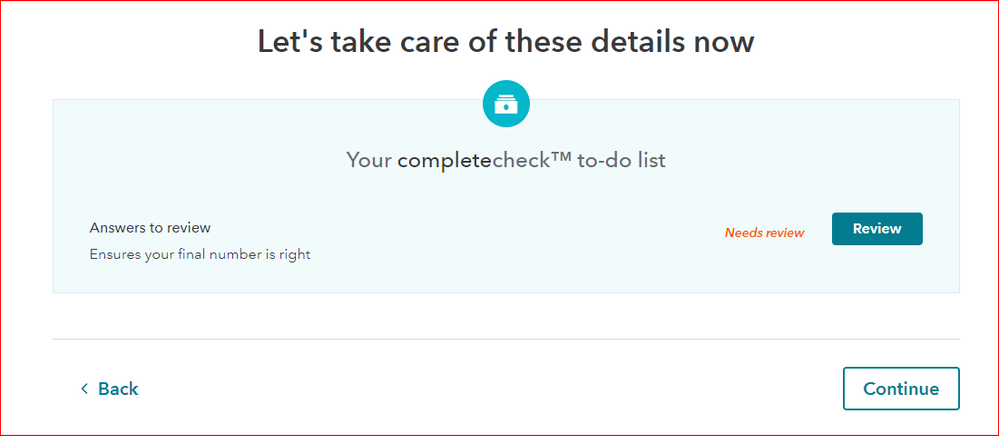

- The following message appears: "Let's take care of these details now"

8. I select "Review"

- The following message appears: "Check This Entry"

- In the blank field following "Double click to link to: Schedule C" --

- What information should be input here?

- What "link" does this refer to?

9. I leave the field blank.

10. I select "Continue"

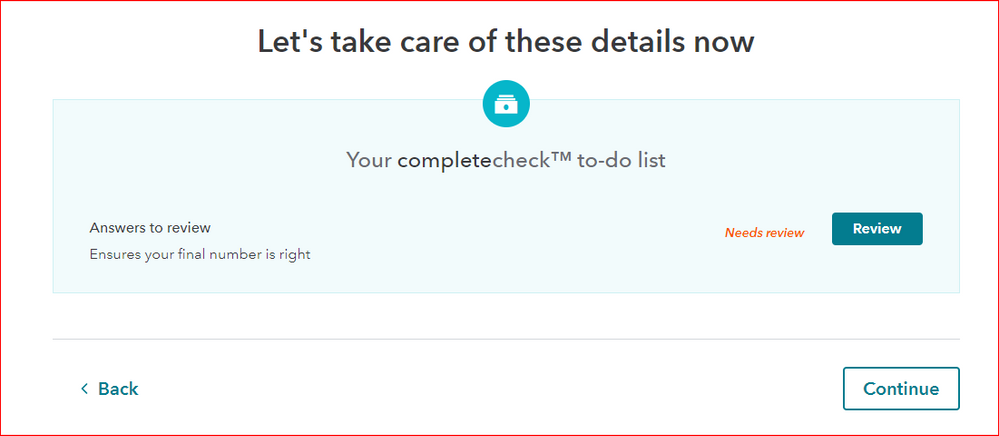

- The following message appears: "Let's take care of these details now"

- Yes, I am now taken back to this page.

- This time, I DO NOT select "Review"

11. I select "Continue"

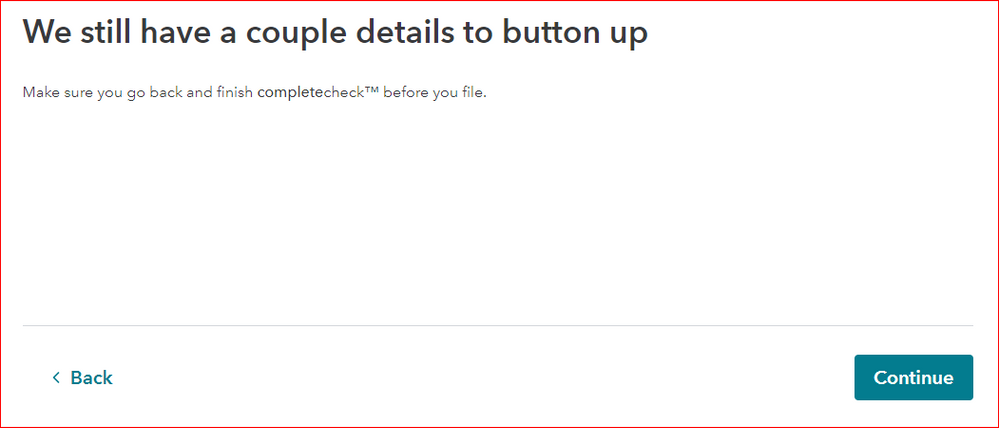

- The following message appears: "We still have a couple details to button up"

12. I select "Continue"

SUCCESS! 🎉

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

The 1099-NEC needs to link to Schedule C, which is why I advised you to enter it directly in the Business Income section, instead of the 1099-NEC entry area.

It is very often difficult to correct an error directly in the Review section. You are usually better off working with the original entry.

I'm glad you report 'Success'. Thank you for sharing!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

MarilynG1 - I think you misread the original poster's first reply: they were following your instructions and get the same error.

I can attest to this because the exact same thing is happening to me: when I enter 1099-NEC info for my spouse on the Business Income section as you instruct, it gets flagged under the Federal Review and I'm shown a loop of screens very similar to what the original poster described.

Any suggestions?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

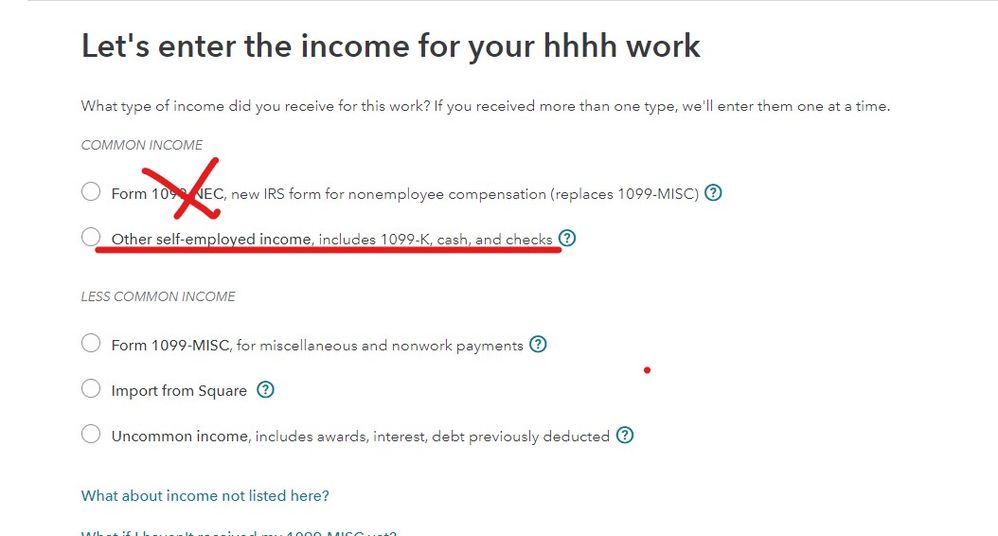

STOP trying to enter the 1099-NEC at all ... instead enter the income in the Sch C income section directly and use the OTHER income section instead ... this will get the income on the Sch C and avoid the area you are having issues with... so delete your prior entries and use the alternative path. Both ways get you to the same result on the Sch C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a glitch when inputting a complete 1099-NEC and it prompts to "complete the form" or else it will delete the 1099-NEC? ALL the 1099-NEC boxes are checked! Help.

Thank you for your reply.

Entering the amount in the "other" section occured to me but I was worried the Payer/TIN info wouldn't get passed on. Is it OK if this isn't entered? Does it ultimately not make it onto the Schedule C anyway?

I did just delete the old 1099-NEC and entered the amount in "Other self-employed income" and it seems to have kept the correct totals and I'm no longer getting the error in Federal Review so assuming the lack of TIN isn't an issue I should be all set.

Thanks again!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TrueNationalLLC

New Member

dratif77

New Member

gdstuart1

Level 3

gdstuart1

Level 3

resluder

New Member