- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

TurboTax will calculate the correct amount to include on line 28 of Form IT-203. I created a “mock” return using the information you provided and was able to get the correct results on the New York return. However, in order to get the program to calculate your state return correctly, you will need to delete your 1099-R entry and re-enter it. Please follow the steps below and refer to the screenshots to get the correct results:

- Click on Wages and Income at the top of the screen

- Scroll down to IRA, 401(k), Pension Plan Withdrawals (1099-R) and click Edit/Add

- Select Delete next to your IRA distribution and click Yes to confirm

- Then select “Add another 1099-R” and enter the information from your Form 1099-R

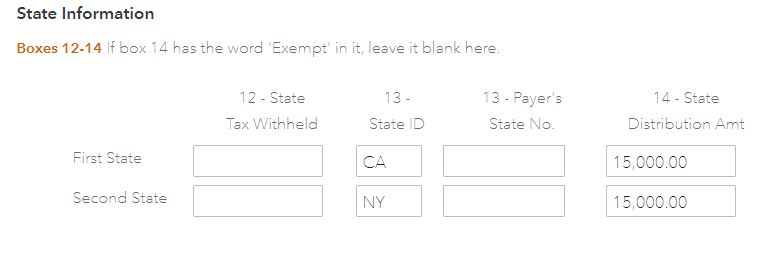

- Scroll down to the State Information section (boxes 12 – 14) and enter the State IDs in Box 13 (Enter both NY and your resident state) and the State Distribution Amounts in Box 14. (Do this even if the information is not reported on your 1099-R) This is necessary to get the program to calculate the state returns correctly. Please see screenshot below:

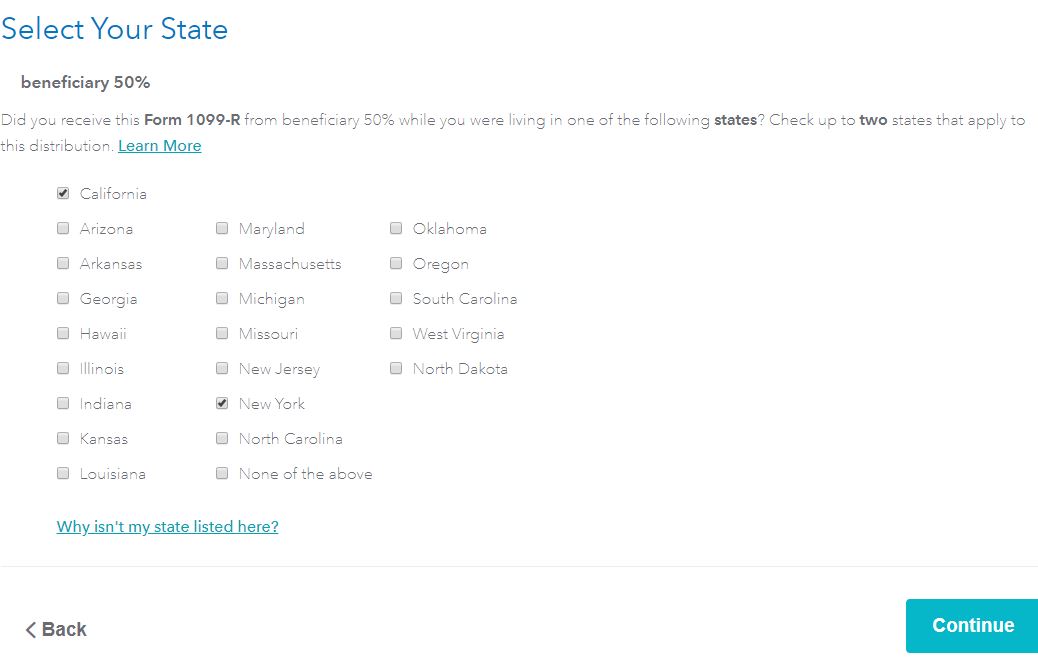

6. Scroll down and select Continue. Your next screen should look like the screenshot below:

7. Select NY and your resident state and then click Continue. Next you should see the following screen:

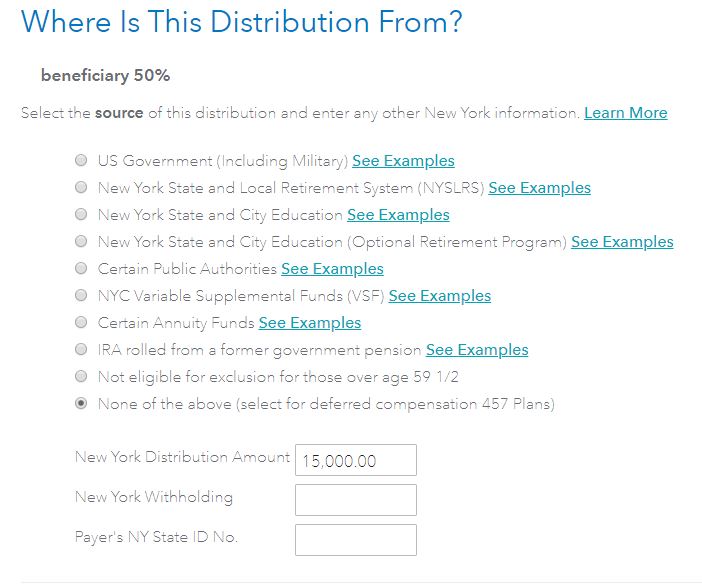

8. Select the appropriate options and enter the distribution amount. Next you will see the question “Did ‘Taxpayer’ Inherit the IRA?” Select Yes and enter the other information.

9. Keep going through the screens and selecting Continue until you get back to the “Wages and Income” section.

10. Click on State from the menu on the left-hand side and then select Edit next to New York

11. Click on “Go over New York again” at the top and answer all the questions

12. Next Click on Review to make sure there are no errors

Now you should see the correct amount ($10,000) reported in the Federal Column of line 28 on Form IT-203 and the New York column should still be 0. The federal column includes all of your income and exclusions as if you were a New York resident and the New York column only includes income and exclusions that are actually taxable to New York.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

Thanks for that very details response! I will give that a shot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

Just to follow up, I followed your instructions: deleted 1099-R and re-entered it with NY added as a state. Didn't make any difference in NY state return. It still subtracts the full IRA distribution amount despite my putting down that only 50% is my inheritance.

This really shouldn't be that hard.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

What if two people inherit an IRA and only one is a New York resident. Can the NY resident deduct the full 20K?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

"the $20,000 maximum amount of the pension and annuity exclusion must be allocated

among the beneficiaries"

It doesn't say "among the New York resident beneficiaries."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

I just went through the same thing, and spoke to an agent. She pointed out (after doing some research) that if the decedent was not a NY resident, the exclusion is not available to the beneficiary even if the beneficiary is a NY resident. Any thoughts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

That appears to be the case. The NY pension exclusion is for NY residents age 59.5 or older who receive pension and annuity income which must be:

• included in federal adjusted gross income (FAGI);

• received in periodic payments (except IRA or Keogh);

• attributable to personal services performed by the individual before their retirement; and

• from an employer-employee relationship or from an employee’s tax deductible contributions to a retirement plan.

If a NY resident is the beneficiary of a pension from a decedent who had they lived would have received the exclusion, then the beneficiary would also be eligible for the exclusion.

Therefore neither you nor the decedent meet the qualifications for the exclusion.

Here is a NY FAQ with more information. You can also verify on pages 13 and 14 in this NY Publication 36.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

In NY RMD is not taxable from an inherited IRA, how do I do that on Turbo Tax on the 1099R form or worksheet?

Thanks for pointing that out. I wasn't picking up on the fact that as a non-resident of NY, the decedent would not have been entitled to this exclusion had he lived, and therefore, the exclusion doesn't apply to the beneficiary. (In other threads, some people are saying that the decedent does not have to have been a NY resident, but I see your point and think you are correct.)

Thanks again!

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkarnes

Level 2

VolvoGirl

Level 15

tcondon21

Level 2

user17539892623

Returning Member

tcondon21

Level 2