- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

TurboTax will calculate the correct amount to include on line 28 of Form IT-203. I created a “mock” return using the information you provided and was able to get the correct results on the New York return. However, in order to get the program to calculate your state return correctly, you will need to delete your 1099-R entry and re-enter it. Please follow the steps below and refer to the screenshots to get the correct results:

- Click on Wages and Income at the top of the screen

- Scroll down to IRA, 401(k), Pension Plan Withdrawals (1099-R) and click Edit/Add

- Select Delete next to your IRA distribution and click Yes to confirm

- Then select “Add another 1099-R” and enter the information from your Form 1099-R

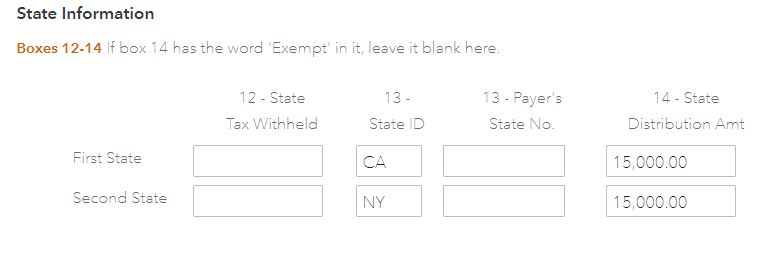

- Scroll down to the State Information section (boxes 12 – 14) and enter the State IDs in Box 13 (Enter both NY and your resident state) and the State Distribution Amounts in Box 14. (Do this even if the information is not reported on your 1099-R) This is necessary to get the program to calculate the state returns correctly. Please see screenshot below:

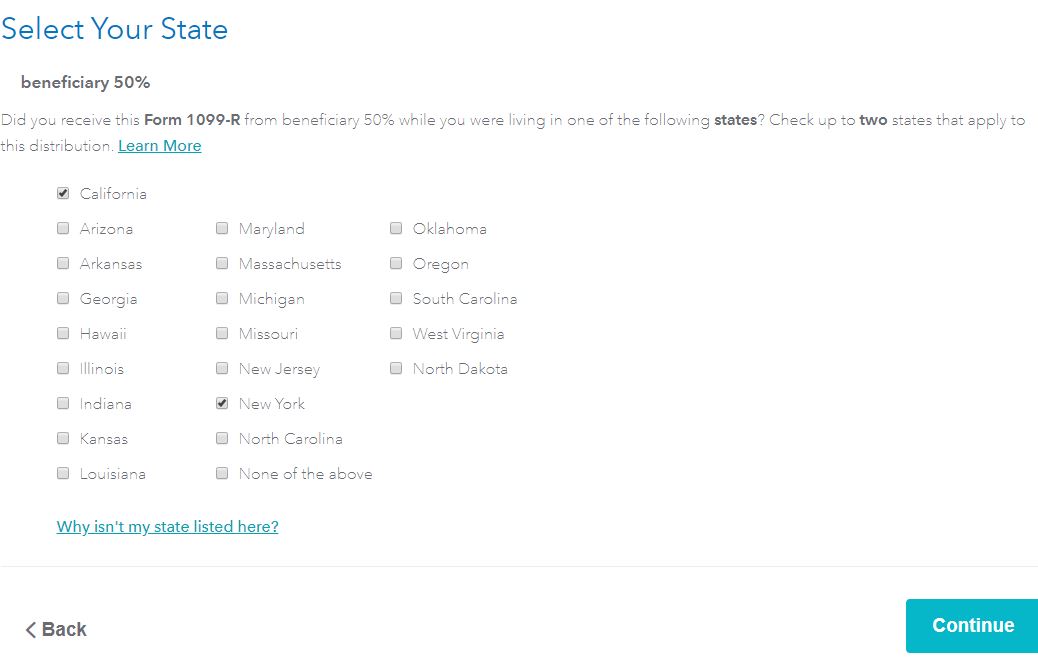

6. Scroll down and select Continue. Your next screen should look like the screenshot below:

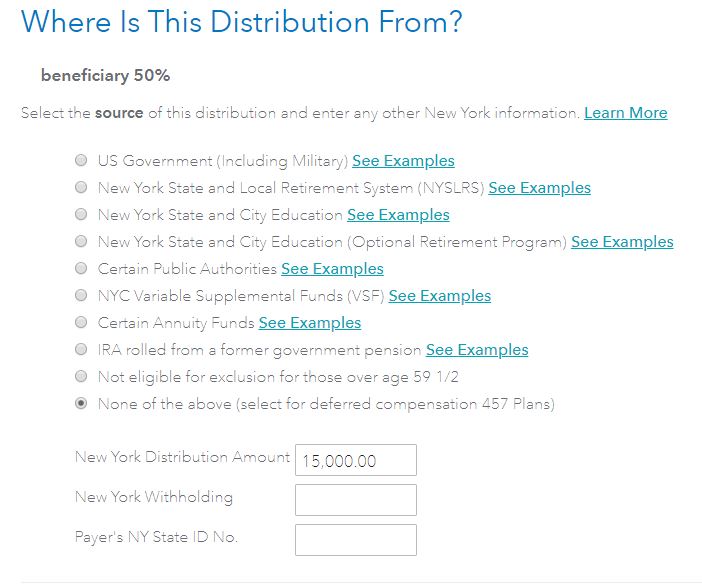

7. Select NY and your resident state and then click Continue. Next you should see the following screen:

8. Select the appropriate options and enter the distribution amount. Next you will see the question “Did ‘Taxpayer’ Inherit the IRA?” Select Yes and enter the other information.

9. Keep going through the screens and selecting Continue until you get back to the “Wages and Income” section.

10. Click on State from the menu on the left-hand side and then select Edit next to New York

11. Click on “Go over New York again” at the top and answer all the questions

12. Next Click on Review to make sure there are no errors

Now you should see the correct amount ($10,000) reported in the Federal Column of line 28 on Form IT-203 and the New York column should still be 0. The federal column includes all of your income and exclusions as if you were a New York resident and the New York column only includes income and exclusions that are actually taxable to New York.

**Mark the post that answers your question by clicking on "Mark as Best Answer"