- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

To enter the exception, please perform the following steps.

- Log into turbo tax

- Go to federal>income and expenses

- Retirement plans and Social Security>show more

- Ira (401K), pension plan Withdrawals(1099R) Start

- After entering your 1099R you will scroll through several screens until you reach a screen that says Tell us if any of these uncommon situations apply

- Here you will select the first choice

- I took out this money because of a qualified disaster (includes COVID-19)

- Scroll through the next few screens until you reach a screen that says is this a withdrawal due to COVID-19 or a Qualified Disaster Distribution?

- You will say yes, this was withdrawn due to COVID 19

- Next screen says COVID-19 distribution Here you will indicate that all or some was a COVID 19 withdrawal.

- Eventually you will reach a screen that says Let's check if you're exempt from additional taxes. How you answer these questions will determine if your exempt from additional taxes such as the early withdrawal penalty.

[Edited 03-02-2021|05:40 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

I took out a 401k covid 19 withdrawal . My question is where and when do I get the option to spread out my owed taxes over the course of 3 years. I have my taxes all done on turbo tax online app. I’m just holding off on finalizing them before I am sure I can pay it over 3 years? Does this option show up once I submit my taxes? Any feed back or direction would be greatly appreciate. I really don’t want to have to do my taxes elsewhere. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

@Rodas1987 wrote:

I took out a 401k covid 19 withdrawal . My question is where and when do I get the option to spread out my owed taxes over the course of 3 years. I have my taxes all done on turbo tax online app. I’m just holding off on finalizing them before I am sure I can pay it over 3 years? Does this option show up once I submit my taxes? Any feed back or direction would be greatly appreciate. I really don’t want to have to do my taxes elsewhere. Thank you.

You have to enter the Form 1099-R. After entry of the form you will be asked a series of questions. If the distribution was due to Covid-19 you can then have this distribution spread out over three years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

I did answer those questions. But I still don’t see that option when it’s says to finalize my taxes. I just would hate to finalize it and not be able to pay it over 3 years. Is that option only when I finalize it and submit it???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

@Rodas1987 wrote:

I did answer those questions. But I still don’t see that option when it’s says to finalize my taxes. I just would hate to finalize it and not be able to pay it over 3 years. Is that option only when I finalize it and submit it???

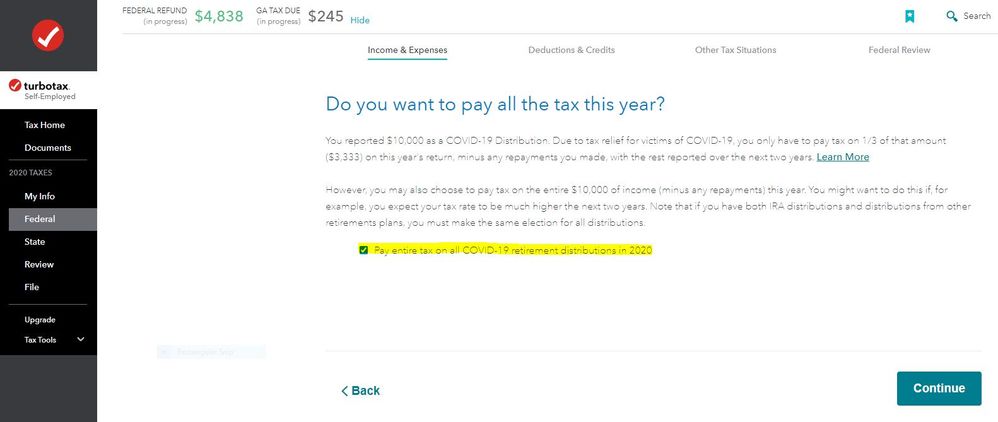

Back in the Federal Review section if you answered that the distribution was due to Covid-19 there would have been a screen asking you if you wanted to have all of the distribution reported on the 2020 tax return or have it spread out over three years. If you did NOT check the box to have it on the 2020 return then only 1/3 will be on the 2020 tax return, 1/3 on the 2021 return and the final 1/3 on the 2022 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

Is that one desktop. I’m doing mine on my phone. Maybe I’ll try it on my tablet. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

I did this same thing in 2020, but now for 2021 what do I need to do to continue spreading out the tax for year 2 of the tax payments?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

To report the 2021 CARES Act retirement plan distribution for 2020 that gave you 3 years to repay it back, follow these steps:

With your federal return open:

- In the search box, type 1099-r, then Jump to 1099-r

- On the next screen, select No if you did not receive a 1099-R in 2021

- On the next screen, select Yes to Have you ever taken a disaster distribution before 2021?

- Select Yes, I took a disaster distribution between 2017 and 2020 on the next screen

- The message below is what you will see because the form is not ready as of today. The new form is expected sometime in March.

You'll need to revisit this area

Unfortunately, IRS instructions related to repayments of disaster distributions weren't ready in time for us to include them in this release. Please revisit this area later.

@GuyGiantic

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

Hello,

I’m trying to file my taxes but keep getting a message about the 401k 3 year payment plan. It’s says “Unfortunately, IRS instructions related to repayments of disaster distributions weren’t ready in time for us to include them in this release. Please revisit this area later”. Does this mean I have to wait until March when it’s available to file my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

Yes, if you deferred 2/3 of your1099R distribution on your 2020 return, you are to pay 1/3 this year. Turbo tax uses a 8915-F to report this repayment and that won't be ready until 3/31.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

That form is available now on the IRS website. To make people wait until 3/31 is a really long time. I guess I will have to go elsewhere then because honestly that’s ridiculous when the form is readily available now. I literally have it sitting right next to me. And also, that means TurboTax can’t fully service ALL of their customers with certain needs or different situations which is highly disappointing. But thank you for your quick response.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

Hello

I have withdrawn all of my 401K plan and used the funds to pay off my mortgage. Other than paying off mortgage, I have not used it for any other purpose. Is there a tax discount that I am eligible for.

Thanks.

[PII removed]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

No. Withdrawal of funds to pay your mortgage is not one of the exceptions to the penalty. If you had a hardship, review the details in the link below to see if you might qualify under that section. The following are the list of exceptions to the premature distribution penalty if you are under age 55.

No.Exception

01 Qualified retirement plan distributions (doesn’t apply to IRAs) you receive after separation from service when the separation from service occurs in or after the year you reach age 55 (age 50 for qualified public safety employees).

02 Distributions made as part of a series of substantially equal periodic payments (made at least annually) for your life (or life expectancy) or the joint lives (or joint life expectancies) of you and your designated beneficiary (if from an employer plan, payments must begin after separation from service).

03 Distributions due to total and permanent disability. You are considered disabled if you can furnish proof that you can’t do any substantial gainful activity because of your physical or mental condition. A medical determination that your condition can be expected to result in death or to be of long, continued, and indefinite duration must be made.

04 Distributions due to death (doesn’t apply to modified endowment contracts).

05 Qualified retirement plan distributions up to the amount you paid for unreimbursed medical expenses during the year minus 7.5% of your adjusted gross income (AGI) for the year.

06 Qualified retirement plan distributions made to an alternate payee under a qualified domestic relations order (doesn’t apply to IRAs).

07 IRA distributions made to certain unemployed individuals for health insurance premiums.

08 IRA distributions made for qualified higher education expenses.

09 IRA distributions made for the purchase of a first home, up to $10,000.

10 Qualified retirement plan distributions made due to an IRS levy.

11 Qualified distributions to reservists while serving on active duty for at least 180 days.

12 Other (see IRS Instructions Form 5329). Also, enter this code if more than one exception applies.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I withdrew money from a 401K or Roth IRA due to COVID 19, how do I enter this exception?

Is Turbo Tax updated yet with the coronavirus related distribution from prior year?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nstuhr

Returning Member

CRAM5

Level 2

atheiss180

New Member

in Education

Lily725

Level 2

mabk2025

Level 1

in Education