- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

What exactly is the settlement for? Back wages or something else? Or is it for more than one thing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

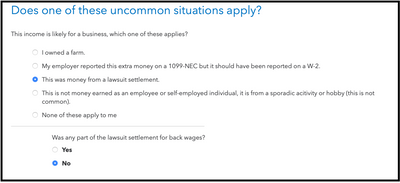

Not back wages. I selected "legal settlement" when given a choice of answers. That is correct, but if you are suggesting a different choice would alleviate the "missing info!" error message, please advise. Another option I've considered is asking prior employer to issue 1099-MISC instead. Not sure why they decided to use NEC. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

If not wages, then what is it for? Settlement income is taxable according to the type of income it represents. Back wages or lost wages are taxed as if they were wages and are subject to social security and Medicare Tax. A non-wage settlement (such as, reimbursement for required clothing and protective equipment that they should have paid for) would be taxable as miscellaneous income. If the settlement includes interest, that portion is taxable as interest. If the settlement is for physical injury or property damage, it will generally not be taxable at all, unless it is more than your loss. (For example, if a company truck damaged your car in the parking lot and the company paid your deductible, that's not taxable. If they paid you $2000 but it only cost you $1800 to fix the damage, then $200 is deductible.)

What tax you pay and how you report it on turbotax depends on what the settlement was actually for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

The prior employer agreed to pay me a sum of money effectively to avoid my employment discrimination lawsuit. It was not "severance" or based upon lost compensation. For purposes of answering my question about reporting the receipt of this money on 1099-NEC, you can assume that I don't owe social security or medicare taxes on this money. It was a lump sum cash payment based upon a settlement agreement, plain and simple. My assumption is that I owe taxes on this money as ordinary income, so again my question is whether I need to report it in a particular way for TurboTax to accept the information. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

It looks like a bug to me, I sent a report. If you report it as if it was a 1099-MISC, you might or might not get an IRS letter. I can't recommend whether you should wait, or do it that way and e-file now and see what happens.

Also, I think it is possible that if you are audited, the IRS will rule this was wages. The basis of a discrimination suit would seem to be that you were underpaid, or denied a promotion, for some discriminatory reason. That would make the settlement considered as wages. Maybe the settlement was for bad comments around the workplace and you were never actually denied wages or a promotion, just made to be the object of hurtful comments. In that case, you will want to make sure you save all the relevant documentation in case of audit. Before the pandemic, there was a very high chance of getting an IRS letter whenever you had a 1099-NEC and did not report self-employment tax on schedule SE. I don't know if the IRS is still sending out as many letters as before, but you will want to have your documentation ready in case you get a letter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

@Opus 17 Not sure this is a bug, it sounds like the wrong form was issued. @Threedogdays should have received a 1099-MISC and not a 1099-NEC. It might be necessary to go back and ask for the form to be corrected.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

Thanks for making the "bug" report. Am I correct that miscellaneous income such as I am describing is better reported on 1099-MISC? I was never a contingent worker or independent contractor, which I understand is one of the reasons form NEC was reintroduced. The settlement was expressly not related to lost income or any notion of compensation for work performed, and while I understand your suggestion that "wages" might be implied, the facts under which I left my employment just don't support the concept. As an attorney myself I certainly have full documentation if I were audited, but if asking the prior employer to reissue a MISC form would minimize the potential for a "red flag" with the IRS, I am willing to try that approach. Please advise if you have further thoughts on this idea. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

Since the funds were representing a settlement and not non-employee compensation, you should request the payer to provide a corrected 1099. It should be reported as a 1099_MISC as you stated above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

@DanielV01 wrote:

@Opus 17 Not sure this is a bug, it sounds like the wrong form was issued. @Threedogdays should have received a 1099-MISC and not a 1099-NEC. It might be necessary to go back and ask for the form to be corrected.

Agree on that, however...

If Turbotax allows the option to choose "this was a settlement" and "it was not for wages" then the program should act appropriately on those responses and not create errors. 1099-NEC forms can be issued in error, and previous versions of Turbotax (before the 1099-NEC was introduced) had the ability to allow taxpayers to claim that 1099-MISC box 7 income was really not compensation (and it would be up to the taxpayer to prove it if necessary.). That same functionality should be preserved now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

Yes -- I agree that there is still a problem with the TTx reporting questions for NEC even if my own situation suggests that I should have received report of "miscellaneous income" on 1099-MISC so there would be no "compensation" confusion. I am going to try to get the form replaced by prior employer, but will keep checking back to see if there is some kind of fix for the NEC reporting questions. As you say, if "legal settlement" is one of the options for explaining the purpose of the payment, then the program should not be creating error messages for that response. Many thanks for your careful analysis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

Previously the IRS had a 1099-MISC and box 3 was used for various types of miscellaneous income and box 7 was used for non-employee compensation. They changed in 2020 (or 2019? time flies) to create a separate 1099-NEC for non-employee compensation.

The 1099-NEC should only be used to report compensation for services rendered. If this was not such, you certainly have a case to ask the payor to cancel the 1099-NEC and issue a 1099-MISC.

Turbotax should also allow you to report a 1099-NEC as issued in error, and report the income as miscellaneous income. That's the function of the "hobby" question and the settlement question on the following page.

Since the question is there, it should work correctly in the program. (The way Turbotax handles 1099s changed for the worse when the IRS split up the 1099-MISC and the 1099-NEC.)

If you can get the 1099 re-issued, you would face a much smaller chance of getting an inquiry from the IRS. The question is, will they do it and how long will it take?

You can likely also file as if this was a 1099-MISC, if you don't want to wait for the bug to be fixed (or if TT denies it's a bug). But you may get an inquiry from the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

Just a quick update on the outcome of my situation. After explaining my assessment (thanks to our communications) to my prior employer, they agreed that they should have reported non-compensation legal settlement money on 1099-MISC and not on 1099-NEC. I was quick enough to intercept the incorrect NEC before they filed with IRS, so they are issuing correct 1099-MISC for "other income" in Box 3. Still possible something will go haywire, but right now it seems that I will have a way to correctly report in TurboTax as miscellaneous income. I do hope the "bug" with NEC "missing info!" gets corrected for all the reasons we discussed. Thanks again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

I'm having a similar problem. I was part of a class action suit regarding billing practices of a large hotel chain. I received $1,500 in resolution of the claim. This resolution basically paid me back the amount I was overbilled. I received a 1099-NEC from the hotel chain and entered everything that was on the form into TTx and keep getting the "Missing items" warning.

Based on this thread, I entered it as 1099-Misc and my tax liability jumped almost $600 in Federal alone. Additional on the state.

I'm having difficulty understanding how a corporation used improper billing procedures, paid me back essentially the same amount I overpaid, declared it a settlement and now I have to pay $600 in taxes on it. This doesn't seem right or just.

Should I be filing this differently?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-NEC for a legal settlement from prior employer. Tried to enter all info in TurboTax and kept getting a "missing info!" error message, but not true.

Based only on my experience with the settlement monies I discussed in the preceding chain of emails, it seems to me that the 1099-NEC is certainly the wrong form since, as others previously commented, the IRS designed this form for reporting certain work-related earnings, not other types of income. The 1099-MISC is the better form for settlement monies, and most payments in settlement of litigation are taxed as ordinary income, so it isn't surprising that you would see a tax computation appear in turbotax. What does not make sense to me is the reimbursement aspect of this settlement. If the hotel settled by agreeing to reimburse you for a calculated overpayment, then the money isn't income to you and there may be a different way to report it. Unfortunately I don't have the experience or expertise to explore that possibility -- I hope others will weigh in. Good luck.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aowens6972

New Member

Naren_Realtor

New Member

abicom

Returning Member

CGaspar6055

New Member

candycrush88

New Member