- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Previously the IRS had a 1099-MISC and box 3 was used for various types of miscellaneous income and box 7 was used for non-employee compensation. They changed in 2020 (or 2019? time flies) to create a separate 1099-NEC for non-employee compensation.

The 1099-NEC should only be used to report compensation for services rendered. If this was not such, you certainly have a case to ask the payor to cancel the 1099-NEC and issue a 1099-MISC.

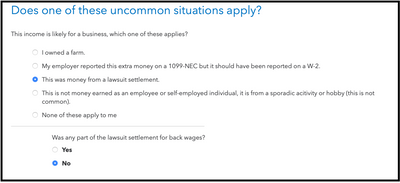

Turbotax should also allow you to report a 1099-NEC as issued in error, and report the income as miscellaneous income. That's the function of the "hobby" question and the settlement question on the following page.

Since the question is there, it should work correctly in the program. (The way Turbotax handles 1099s changed for the worse when the IRS split up the 1099-MISC and the 1099-NEC.)

If you can get the 1099 re-issued, you would face a much smaller chance of getting an inquiry from the IRS. The question is, will they do it and how long will it take?

You can likely also file as if this was a 1099-MISC, if you don't want to wait for the bug to be fixed (or if TT denies it's a bug). But you may get an inquiry from the IRS.