in Education

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I quit my job in 2019 and unable to get a job in 2020 due to COVID. I withdrew 30K from my Traditional IRA to meet the family expenses. Am I eligible under CARES act?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I quit my job in 2019 and unable to get a job in 2020 due to COVID. I withdrew 30K from my Traditional IRA to meet the family expenses. Am I eligible under CARES act?

Topics:

posted

April 28, 2021

9:58 AM

last updated

April 28, 2021

9:58 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I quit my job in 2019 and unable to get a job in 2020 due to COVID. I withdrew 30K from my Traditional IRA to meet the family expenses. Am I eligible under CARES act?

Yes. You are a qualified individual if:

- You, your spouse, or dependent are diagnosed with COVID-19

- You experience adverse financial consequences as a result of being quarantined, furloughed, or laid off

- You had hours reduced due to coronavirus

- You are unable to work due to your child care closing or reducing hours

You can input your 1099-R in TurboTax by following these steps:

- Open your return.

- Search 1099-R with the magnifying glass tool on top of the page.

- Click on the Jump to 1099-R link at the top of the results.

- Answer yes to the question Did you get a 1099-R in 2020?

- Click continue to the page Get ready to be impressed.

- Follow the on-screen instructions.

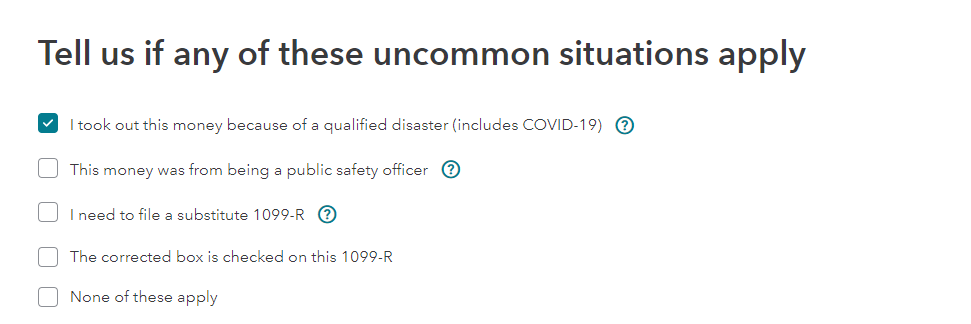

- On the page Tell us if any of these uncommon situations apply, put a check mark next to the statement I took out this money because of a qualified disaster (Covid-19). I have attached a picture at the bottom of my post for further guidance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 28, 2021

10:43 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sachinappa

Returning Member

sachinappa

Returning Member

user17573810876

New Member

nex

Level 2

xiaochong2dai

Level 3

Ask AI Concierge

Want a Full Service expert to do your taxes?