- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I can't seem to find the EIN for Social Security Administration

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@lucie69nelson If you read the reply I sent a few minutes ago--re-read--I just realized I gave you the wrong link for entering a SSA1099 and I edited the reply--it is now correct.

Again:

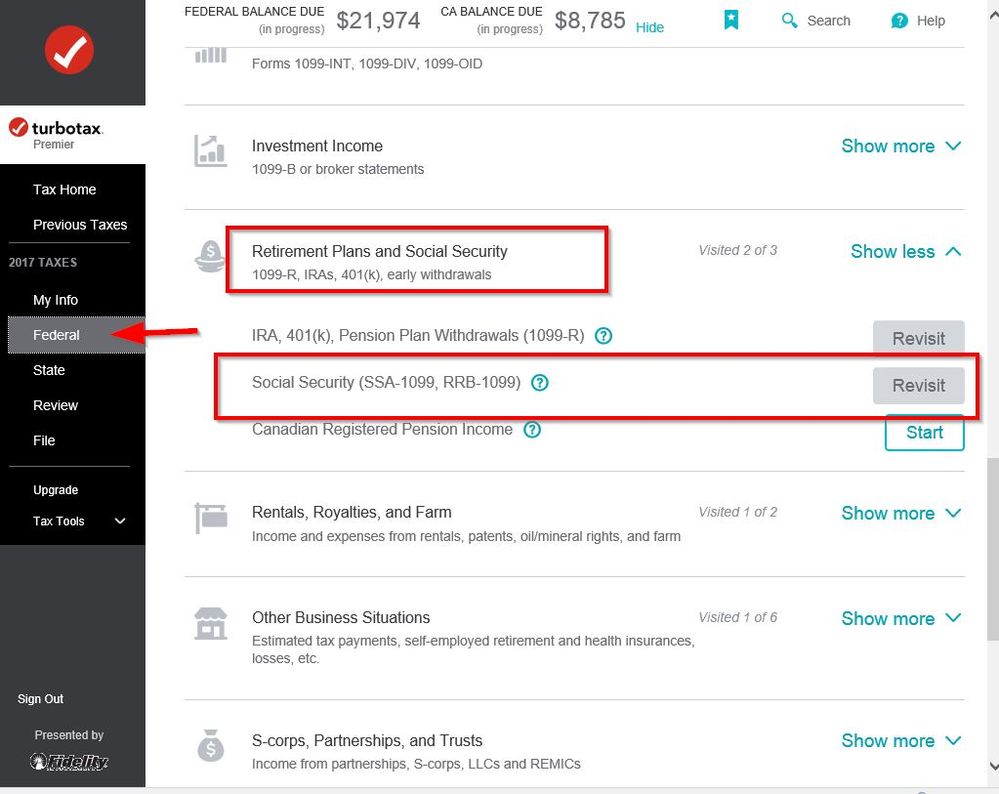

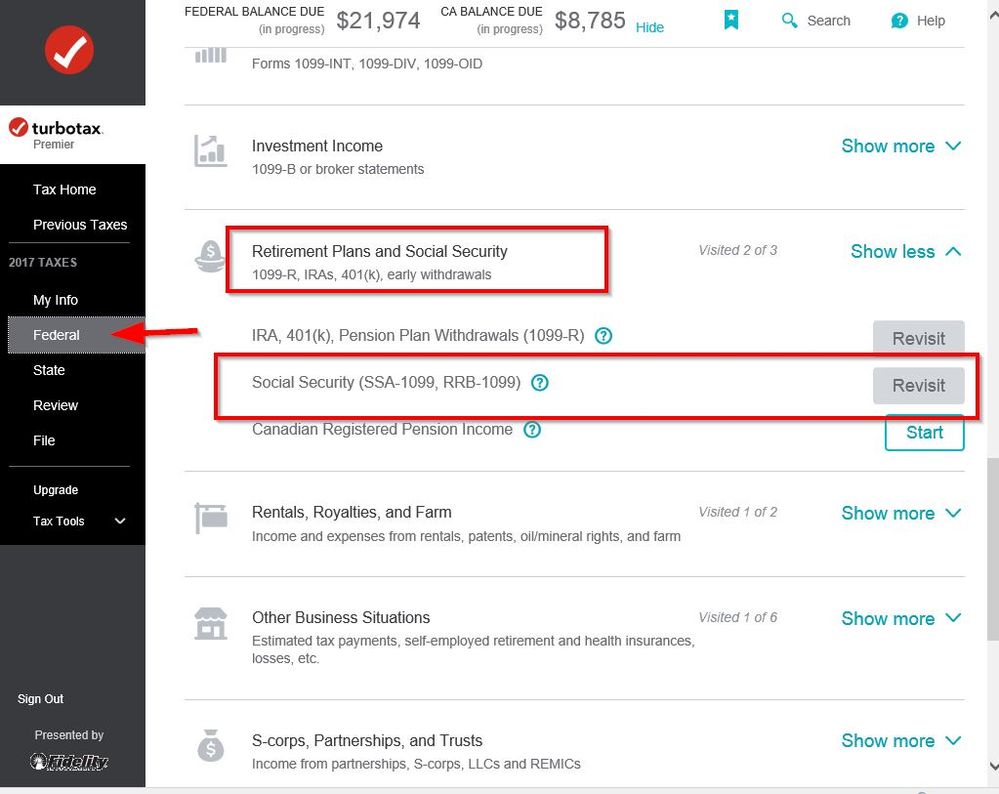

Do not try to enter your SSA1099 or RR1099RB as a W-2. Go to Federal> Wages & Income>>Retirement Plans and Social Security (SSA1099 and 1099RRB) to enter your SSA1099.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

In 2020 tax programs........... LACERTE and probably Turbo Tax too are not programmed correctly to handle the FEDERAL WITHHOLDINGS on a Social Security Form 1099-SSA. It keeps asking us to put in the EIN for SOCIAL SECURITY and there is NOT ANY EIN on that form for Social Security Administration! PLEASE GET THIS FIXED ON ALL OF YOUR SOFTWARE FOR 2020. We do NOT have to enter the EIN for SSA because it is ON THE 1099-SSA, NOT ON A 1099-MISC, or A 1099-NEC. A 1099-SSA is NOT THE SAME as those other two forms. PLEASE FIX THIS! NOW. TAX SEASON IS ALREADY UNDER WAY AND WE NEED THIS FIXED IMMEDIATELY!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@Maddygaoiran wrote:

In 2020 tax programs........... LACERTE and probably Turbo Tax too are not programmed correctly to handle the FEDERAL WITHHOLDINGS on a Social Security Form 1099-SSA. It keeps asking us to put in the EIN for SOCIAL SECURITY and there is NOT ANY EIN on that form for Social Security Administration! PLEASE GET THIS FIXED ON ALL OF YOUR SOFTWARE FOR 2020. We do NOT have to enter the EIN for SSA because it is ON THE 1099-SSA, NOT ON A 1099-MISC, or A 1099-NEC. A 1099-SSA is NOT THE SAME as those other two forms. PLEASE FIX THIS! NOW. TAX SEASON IS ALREADY UNDER WAY AND WE NEED THIS FIXED IMMEDIATELY!

You are using the wrong section of the program to enter a SSA-1099. It is NOT entered in the section for wages reported on a W-2 nor it is entered in the section for a Form 1099-R.

To enter Social Security benefits reported on form SSA-1099

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Scroll down to Retirement Plans and Social Security

- On Social Security (SSA-1099, RRB-1099), click the start or update button

Or enter ssa-1099 in the Search box located in the upper right of the program screen. Click on Jump to ssa-1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

In Turbo Tax there is a Separate spot for Social Security. Probably in LaCerte too.

If it's asking for an EIN number you are entering it in the wrong place. There is no EIN on social security SSA-1099.

Try going to the search box and type in SSA-1099 or Social Security Benefits. That will give you a Jump To link to take you directly to it.

OR

Enter a SSA-1099, SSA-1099-SM or RRB-1099 under

Federal Taxes on the left side or top

Wages and Income

Then scroll down to Retirement Plans and Social Security

Then the second line - Social Security (SSA-1099. RRB-1099) - click the Start or Revisit button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

The IRS has approved a work-around for this of using an EIN of 00-0000000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

If you are trying to enter social security income into TurboTax and you are being asked to enter EIN information, you are entering it in the wrong spot. Do not use 00-0000000 for social security income. You will get an error when you e-file and will most likely receive an inquiry from the IRS later. Social Security income is taxed in a completely different way than any other form. So, if you don't enter it in the correct spot, your taxes will not be calculated correctly. @T2qMom

To determine if your Social Security income is taxable, all you need to do is enter that income. TurboTax does the rest! At the state level, many states exempt Social Security from taxation, either partially or completely. Again, if your sole income is from Social Security, it's likely you don't need to file a state return either.

TurboTax will automatically figure out whether you need to pay federal and/or state taxes on your Social Security income. Just enter your SSA-1099 information in TurboTax and we’ll let you know!

Related Information:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

If it's asking for an EIN number you are entering it in the wrong place. There is no EIN on social security SSA-1099.

If you only get ssi or SS or SSDI it is not taxable and you do not have to file a return.

Try going to the search box and type in SSA-1099 or Social Security Benefits. That will give you a Jump To link to take you directly to it.

OR

Enter a SSA-1099, SSA-1099-SM or RRB-1099 under

Federal Taxes on the left side or top

Wages and Income

Then scroll down to Retirement Plans and Social Security

Then the second line - Social Security (SSA-1099. RRB-1099) - click the Start or Revisit button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

Turbo Tax continues to require a SSA TIN?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@cadamsz1 If you are trying to enter your Social Security benefits on a screen that is asking for a Tax ID or an EIN you are on the wrong screen. You do not enter a Tax ID when you enter your SSA1099.

Go to Federal> Wages & Income>>Retirement Plans and Social Security (SSA1099 and 1099RRB) to enter your SSA1099.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

How do you submit SSA-1099 information in Turbo Tax return. It doesn't work a a 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@iS2dollars wrote:

How do you submit SSA-1099 information in Turbo Tax return. It doesn't work a a 1099-R

To enter Social Security benefits reported on form SSA-1099

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Scroll down to Retirement Plans and Social Security

- On Social Security (SSA-1099, RRB-1099), click the start or update button

Or enter ssa-1099 in the Search box located in the upper right of the program screen. Click on Jump to ssa-1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

So what do I put in the box? TurboTax says I must enter a valid employer identification number to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@browyns wrote:

So what do I put in the box? TurboTax says I must enter a valid employer identification number to proceed.

READ the answers provided on this thread. You do NOT enter a SSA-1099 in the section for a W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

Huh? The part I was referring to was a Review Section which would not let me proceed without providing the TIN/EID for the Social Security Administration. I said nothing about W-2's, nor were they relevant to my question. Maybe you should pay more atte

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I can't seem to find the EIN for Social Security Administration

@browyns If you are trying to enter a SSA1099 someplace where it is asking for an employer ID or Tax ID then you are entering it in the wrong place.

Go to Federal> Wages & Income>>Retirement Plans and Social Security (SSA1099 and 1099RRB) to enter your SSA1099.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dsyhome0510

Level 3

bertkesj

New Member

godspropy

New Member

bluerabbit24

New Member

hjw77

Level 2