- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

Thanks! Maria H.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

Where 1099-K from sales of personal items or for a business?

If they were for personal sales then you will need to enter information in the 1099-K section and 1099-B sections. Please review the entry steps:

- Click "Wages & Income" (under Federal) on the left

- Scroll down to "Other Common Income" and click "Show more"

- Click "Start" next to "Form 1099-K"

- On the "Choose which type of income your 1099-K is for" screen select "Personal Item"

- On the "Your 1099-K Summary" screen, select Done.

- On the "Wages & Income" screen

- Scroll down to "Investments and Savings" and click "Show more"

- Click "Start or Revisit" for "Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)".

- Click "Review" on "Personal item sales (1099-K)"

- Enter the information on the "Now, enter one sale…" screen

Please keep in mind this is a public forum. If you need more detailed help you can add TurboTax Live service. Please see What is TurboTax Live? for information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

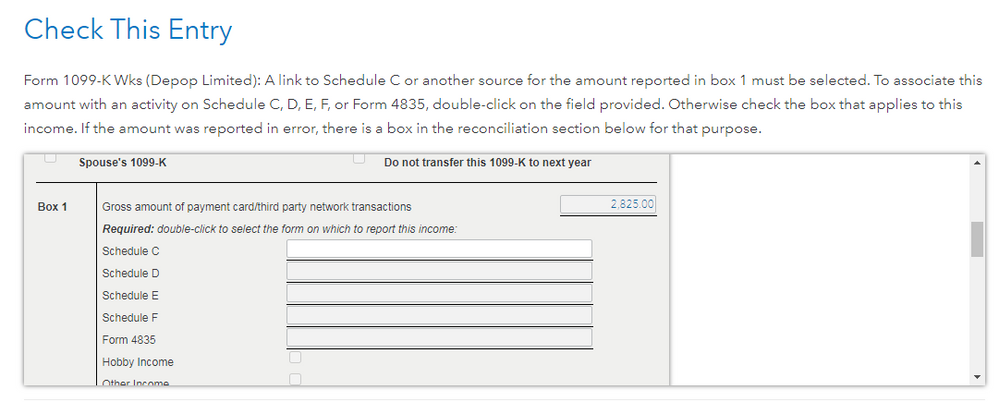

@DanaB27 What should I do when it says: "Check This Entry: Form 1099-B Worksheet: Amount from Form 1099-K has an amount from linked Form(s) 1099-K, but the sales proceeds on this worksheet don't match the payment amount from Form 1099-K. Add sale(s) on this worksheet with sales proceeds to match the amount reported on Form 1099-K.

Thanks,

Maria H.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

@DanaB27 I am following your advice in the first post and entering sales, am a little confused on how to determine purchase date for each item sold since I truly don't know! Can I leave this blank?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

If you click the radio button to Something other than a date, it will give you the option of Various in the dropdown.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

Thanks! So I would need to repeat this for every item I've sold? Would I need to repeat the same info for both my Paypal 1099-K and the one I received from ther platform which I am getting my sales from? Paypal is showing part of those earnings but they overlap.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

If you have two different 1099-K's that overlap earnings, then you would not enter both of them as they are. If one of them show ALL the income, just enter that one. Otherwise, you will overstate your income and likely pay too much in taxes.

If neither report ALL of your income, you will need to enter your income from your own records and not use the 1099K. This will allow you to report the correct amount. If you sold items and this is not a business, you will report it by taking the following steps:

- Federal

- Income

- Show More next to Investment Income

- Start next to Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Select Other

- Continue through and select Other again for the type of investment

- Answer how you obtained the items you sold

- You will need to enter the selling price, dates and the cost basis of the items

If this is a business, then you will report the income using TurboTax Self-Employed walking through the business income section.

Keep both 1099-K's for your records along with documentation/notes/etc. to prove that it is the same income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

What kind of income is this? Were you selling household items? Is this a business?

If it is a business it would be on Schedule C

If you are selling household items it would be on Schedule D

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

@Vanessa A It's only letting me fill in the blank for Schedule C. I would say it's a business, self-employment because I sell items through an app. This page comes up at the end when I go to file. No matter what number I put in it hasn't gone away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hi! I have a question regarding e-file. It is asking me to Fix Federal Return & put matching amounts for 1099-B and 1099-K. What should I do to fix it? Thanks! Maria H.

Ok, if this is a business then you go to the self-employed business section on TurboTax and then you enter the amount that you sold. If you sold more than the 1099-K then you enter the 1099-K in as well as any other money you may have made. The total of the sales for your business should equal the amount that you received - not greater which can happen if the 1099-Ks that you received overlap.

Then you have to enter in the costs of the items that you sold. Every item. You also have to enter the costs that you paid for shipping and the packages that you shipped in and any internet fees that you paid. You have to enter all of that to get the bottom line amount of how much you actually made and therefore how much you actually owe taxes on.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dr-dave3764

New Member

acnorwood

New Member

Michael16

Level 4

mhorinek

New Member

g2scott3500

New Member