- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

So I ended up switching to code D and it went through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

Has there been any update to the timeline on this? I see the advice telling us to change it to code D… but that seems like it is just begging for an audit and I’m 99% sure S was, indeed, the correct code for my employer anyway.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

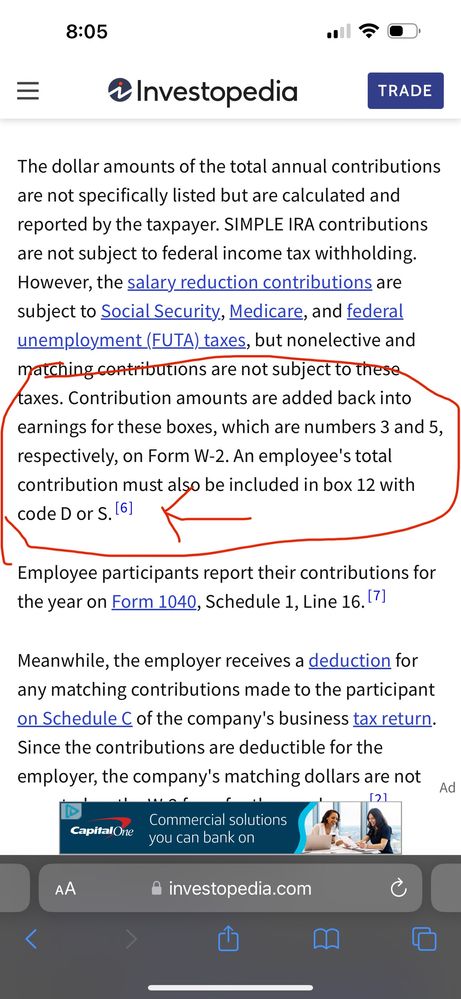

This is why I chose D.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

Any updates to this? It's the 29th and I'm still getting the same message. :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

I’m having the same issue. Any talk of a fix date?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

are you changing this on the W2 only?

Doesn't it still flag your 1099-R since it also indicates being a Simple IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

It won't let me change mine. I think because I uploaded mine by pdf and didn't enter it manually. Does this mean I need to start over? Any help appreciated!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

I believe that's what it's supposed to be also. Mine has S also. Don't want to do any sudden changes and it not be correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

it is supposed to be S, and has been S in past years. The issue is that TT is waiting on new guidance from the IRS -- see https://www.irs.gov/irb/2024-02_IRB under E. SECTION 117 OF THE SECURE 2.0 ACT

I just don't really see how this impacts me. My matches don't exceed 3% of my salary and this is supposed to apply in the future, not to TY2023 according to the bulletin.

"Section 117(h) of the SECURE 2.0 Act provides that the amendments made by section 117 of the SECURE 2.0 Act apply for taxable years beginning after December 31, 2023."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

So how do we know it will go through and nothing be wrong when changing the box 12 code because it will not match our w2 at that point

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

I spoke with someone last night who told me that they usually download updates, or are finished downloading updates, on the day that we are able to file, that being today. He suggested I try again this morning. I tried again this morning and it is still doing it. My question is, if I was to cancel out, since I have it set to come out of my refund, would I be able to switch to another tax program? And if so, would they have the same issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

I've been looking around at other product forums to see if this has been an issue and haven't seen any others reporting it so far, but I really don't want to redo everything, plus fight Intuit for a refund. I'm quite pissed that I got charged $102 today and then found out I couldn't file AFTER paying.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

I was advised NOT to change the forms just to push them through. The updates are expected on or before February 1st, so despite paying today and not being able to file I did lock in lower pricing, and I was advised to reach back out to support anytime before then for a full refund if I want to move elsewhere to file.

Hopefully Intuit gets moving and issues the update necessary pretty quickly. It sounds like they are getting a lot of calls about this, and have been all month and will likely lose business the longer they delay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

Official reply from Intuit

Est. date for SEP/SIMPLE error Jan 31.

There was new information from IRS Jan 8, 2024

SECTION 601 OF THE SECURE 2.0 ACT

Section 601(e) of the SECURE 2.0 Act provides that these amendments apply to taxable years beginning after December 31, 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting msg saying "we are updating how sep and simple plan contributions are reported on the tax return based on new guidance from the irs check back later" help plz?

Changing the letter to D is not a blanket fix (and frankly, not smart if it doesn't actually apply to you)

For me personally, my employer has a SIMPLE IRA. Code S is the correct one. So I am stuck waiting for TT to get their act together since they already took my money before notifying me of the issue. I will not be back. Completely unacceptable business practices. I don't care that I was "locked in at the lower price". It should have been MY choice and TT was too money hungry to see that.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17664993119

New Member

Lance31359

New Member

alishabrinson3

New Member

Delal

Level 3

Rjjem88

New Member