in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

Your social security income is included in your Modified Adjusted Gross Income which is subtracted from your Threshold amount. The NIIT is not applied to the social security income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

Thanks for the Info MaryK1101. Just to clarify... The Threshold amount is subtracted from the MAGI amount (which includes taxable SS benefits according to you) which gives you the NIIT amount to be taxed at 3.8%. So how can you say the NIIT does not include taxable SS benefits? Taxable SS benefits are being included in MAGI amount which increases the MAGI amount which is used to determine the NIIT taxable amount. IRS says that SS benefits are not to be included in the NIIT but they are included when the taxable SS benefits are included in the MAGI amount aren't they? If taxable SS benefits aren't to be included in the NIIT amount then the taxable SS benefits should be excluded from the MAGI amount because if the taxable SS benefits are included then the MAGI amount increases and that then increases the Net Investment Income taxable amount after subtracting the Threshold amount? You could say the taxable SS benefits are being taxed twice... once as ordinary income then again by increasing MAGI which increases NIIT which increases tax debt? Thank-you for your time... I welcome your input!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

No, it would be incorrect to say that taxable social security benefits are being taxed twice. You’re only looking at part of the picture.

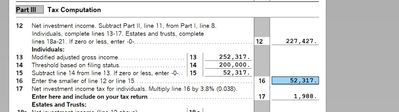

Net investment income tax is based on lines 12 through 16 of Form 8960; you’re only looking at line 13.

Let’s look at this, step by step.

Line 12 is your net investment income.

Line 13 represents your Modified AGI (MAGI) which, yes, does include wages and taxable social security.

Line 14 is the threshold amount.

Line 15 subtracts the threshold amount (line 14) from MAGI, line 13.

THEN… and this is important… Line 16 is the smaller of line 15 and line 12, your net investment income.

See what’s happening? If net investment income is smaller than MAGI minus the threshold, you compute NIIT based on net investment income.

If MAGI minus the threshold is smaller that net investment income, you pay NIIT based on an amount smaller than net investment income.

So, the maximum amount you can pay NIIT on is your net investment income, but in some cases, it’ll be based on an amount smaller than your net investment income.

Here’s the relevant portion of Form 8960:

**Say "Thanks" by clicking the thumb icon at the lower left

**Mark the post that best answers your question by clicking on “Mark as Best Answer”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

JohnW152... I understand what you are saying but maybe you can explain this... A single person has $200,000 in Capital Gains, Ordinary Income and IRA distribution plus 13,400 in taxable SS benefits which gives you a $213,400 AGI. Without any other deductions or credits that gives you a $213,400 MAGI. Less the single person Threshold of $200,000 gives you $13,400 to be included in the NIIT tax calculation at a rate of 3.8% which increases your tax debt by $509.20. So, by taxable SS benefits being included in the MAGI the taxable SS benefits have affectively increased investment income which has increased the NIIT amount to be taxed and the single person would pay another $509.20 in tax because taxable SS benefits are part of the NIIT tax calculation. If the taxable SS benefits were not included in the MAGI then the single person would not have exceeded the $200,000 Threshold which increased their tax debt. Thank you for your time. I look forward to hearing from you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

TT2023 Form 8960 is definitely including Social Security in the calculation for NII tax. As we see in this example, line 12 includes all dividends, interest and capital gains while line 13 include social security income. Social security income is obviously being used in the calculation for the NII tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

@marcschare - the actual tax is based on the lessor of:

MAGI minus $200,000 (filing single)

or

All unearned income (capital gains, interest, dividends, etc.)

times 3.8%

Taxable social security will impact the number in red, but not unearned income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

Thank you.

I can see that's the formula being used and I can read the instructions. What I can't reconcile is that the IRS says that Social Security Benefits are not subject to the NIIT. Since the benefits are included in MAGI then clearly, they are included. How can reconcile these two facts?

https://www.irs.gov/instructions/i8960

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

@marcschare - NIIT is 3.8% tax on the unearned incomes that exceeds $200,000. social security is NOT multipled by the 3.8%, but it can "push" unearned income above $200,000.

Let's use an example. Iet's say (and I am exaggerating to prove the point) that I have $160,000 of social security gross income (this is 85% of what I received for the year) and I have $40,000 of dividends and that is all!

The NIIT tax is zero - becase my MAGI is $200,000 less $200,000 as the thresshold so that is zero.

Now, let's say, the social security income is at $170,000 and the dividends remain at $40,000.

THe NIIT tax is the lessor of:

$40,000 (my unearned income)

or

$210,000 (MAGI) - $200,000 (Thresshold) = $10,000

So NIIT is $10,000*3.8%. or $380.

Yes, social security income is part of MAGI and it can "push" more of the unearned income beyond $200,000, but the 3.8% is never multipled by social security.

One more similar example: my social socurity income is $210,000 and my dividends are STILL $40,000

The NIIT tax is the lessor of:

$40,000 (my unearned income)

or

$250,000 (MAGI) - $200,000 (Thresshold) = $50,000

So NIIT is $40,000*3.8%. or $1520.

and no matter how much higher my social secuity goes, NIIT will still be $1520.

taht is because Social Security income is not part of NIIT 😀

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

This is very helpful. Thank you.

Is it accurate then to say that if your unearned retirement income from interest and dividends exceeds $200K as a single filer, than the 85% of social security that is taxable is also subject to the additional 3.8% tax because your modified AGI minus $200K is always going to be lower than the unearned retirement income. Expressed as a formula where x is the unearned retirement income and y is the taxable social security benefit:

(X+Y - 200,000) < X where X > 200000.

So if unearned retirement income is 250,000 and Social Security Income is 20,000 then,

200000 + 20000 - 200000 = 20000 which is less than 200,000 and therefore, the entire 20,000 of social security income is subject to the 3.8 tax.

So my statement that social security is subject to the 3.8% tax is accurate IF unearned retirement income is greater than 200,000.

Do I have that right?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

@marcschare - nope.....

let x = unearned income (which by definition does not include social security) - see lines 1-8 of form 8960 for the specific items.

let y = total income, which is Line 11 of Form 1040 (by definition this does include the taxable portion of social security) - see line 13 of Form 8960 for the unusual situations where AGI has to be adjusted. But for most AGI on Line 11 of Form 1040 is what is used to define 'total income'

let z = the income that is subject to NIIT

the IRS website is simply stating that even though social security is unearned income, it is excldued from x; it is not stating it is excluded from y.

z = min((y-200000),x)

so z*3.8% is the tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

I was speaking with tax expert Karen and got disconnected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

Why is the 1040, line 11 (adjusted gross income) the same number transfered tothe 8960 From, line 13, as this includes wages income. Accoordiing to the 8960 instructions, wages income is not taxed on the NIIT . Thx, David

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

@8960niit you are misreading it.

LIne 11 is being pulled over to determine if you are above $200,000 (or $250,000 if filing joint). The tax itself is 3.8% of the income over $200,000 (or $250,000) OR the investment income, which ever is less

Let's say your AGI is $225,000, and you are filing Single.

Let's further say your investment income is $40,000,

then the 3.8% is applied to

the lesser of

$25,000 (the part that exceeds $200,000)

or $40,000

so 3.8% times $25,000 would be the tax,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8960 is using my social security benefits to calculate Net Investment Income Tax. Anyone have this problem?

If an individual has income from investments, the individual may be subject to net investment income tax. Effective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

The statutory threshold amounts are:

- Married filing jointly — $250,000,

- Married filing separately — $125,000,

- Single or head of household — $200,000, or

- Qualifying widow(er) with a child — $250,000.

If I make more than 200,000 and some of it is investment income, then MAGI (which includes social security) is used to determine how much income is taxed.

The tax helps pay for Affordable Healthcare Act.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

gfalconero

Level 2

sonia-yu

New Member

user17539892623

Returning Member

Al2531

Level 2