- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Form 3520 part III question

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3520 part III question

I lived and worked in the Netherlands till 1989 and then moved to the USA (I am now a citizen). My Dutch employer started a pension plan for me. I cannot see what it is invested in because my previous employer owns it and I am just the beneficiary. I am only told what I will receive every month, it is the only info I get. In 2022 I started receiving monthly distributions from that pension plan, but nothing before 2022. I reported the entire pension received as miscellaneous income on my 1040. I understand that I have to file a 3520 because it is a distribution from a foreign trust (I think a pension plan is a trust). I am stuck on part III schedule A. Question 31 is what I received this year, 33-36 are all zero, so 37 is again what I received this year, which would mean the total will be treated as accumulation distribution instead of ordinary income ( as I reported on 1040). In 3520, part III schedule C we calculate tax on the accumulation distribution using form 4970. That then gets reported as additional tax on your 1040 (question 52). It does not make sense to me that this would be treated other than ordinary income. Where did I make a mistake?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 3520 part III question

No, do not complete Form 4852. This is reported on a substitute 1099-R.

To enter foreign pension in TurboTax online program, you would NOT treat it as "other income," rather, you will create a mock form 1099-R.

On sidebar

- Select Federal

- Wages & Income

- Select Wages and Salaries, or Revisit

- Scroll to Retirement Plans and Social Security

- Select the type of income.

- IRA, 401(k), Pension Plan Withdrawals (1099-R)

- Social Security (SSA-1099, RRB-1099)

- Canadian Registered Pension Income

- Get Ready to be Impressed - Continue

- Select [Change how I enter my form]

- Select [Type it myself]

- Who gave you a 1099-R? Select and continue

- You will post your information the best you can and continue through the interview

- If your foreign issue does not have an ID number, you can try entering nine 9s.

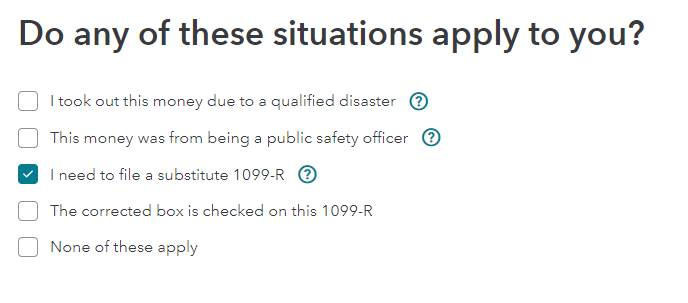

- You will come to a screen: Do any of these situations apply to you?

- Select I need to file a substitute 1099-R.

- Continue until you complete the process.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Walkman25

New Member

Mikeoliver1313

New Member

SK469

Level 1

cj5

Level 2

Mikeoliver1313

New Member