- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Foreign Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

I use two mutual fund companies, Fidelity Investments and Vanguard, and I imported the 1099-DIV information to TT. The Vanguard foreign tax credit is showing correctly on IRS Form 1116, Foreign Tax Credit and on the summary 1040-SR. However, the Fidelity foreign tax credit does not show on this form and nor on the summary form 1040-SR.

I have tried deleting the Fidelity 1099-DIV and re-importing it to TT. This did not correct the problem.

Does this sound familiar? Can anyone help so that the Fidelity foreign tax credit shows?

Thanks to anyone that could help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

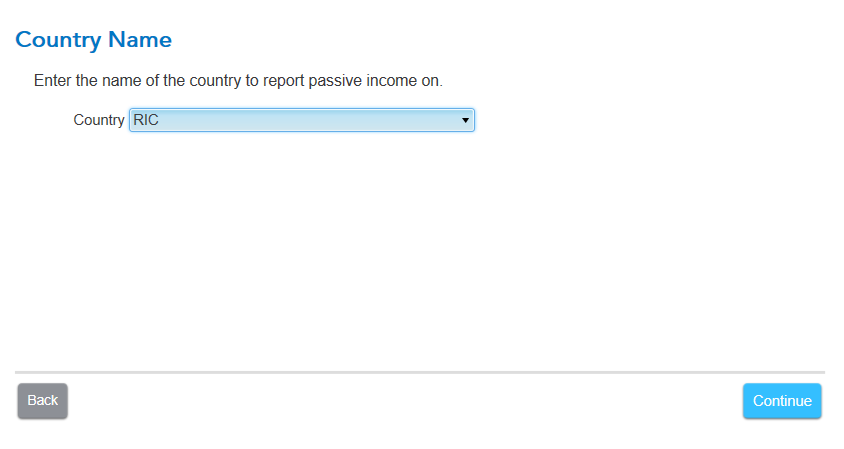

Is your credit limited? Edit your Form 1116 entries since the 1040 should have your correct totals. You should be showing RIC for the source and the country with the total tax paid in one entry.

Let me help you start the 1116.

- Log into your return

- Select Pick Up Where I Left Off

- In the top right corner, locate the Magnifying glass/search enter the exact words foreign tax paid

- Enter

- Select the first entry Jump to foreign tax paid

- Did you pay foreign tax, select yes

- Before we Begin screen, make sure all income is already entered before proceeding, select yes

- Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kcmli2

New Member

ElvaSam74

New Member

ske711

New Member

user17719824831

New Member

missunny1114

New Member