- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- duplicate entries capital assets worksheet and 1099B worksheet

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

duplicate entries capital assets worksheet and 1099B worksheet

I am working on my turbo tax 2024 premier tax return and it appears that I may have entered information for the sales two different ways before I did the step by step approach and have a capital assets sales worksheet and a 1099 B worksheet for my bond and stock account sales.

How do I determine if I have duplicated the information

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

duplicate entries capital assets worksheet and 1099B worksheet

You may have to review and compare the individual entries.

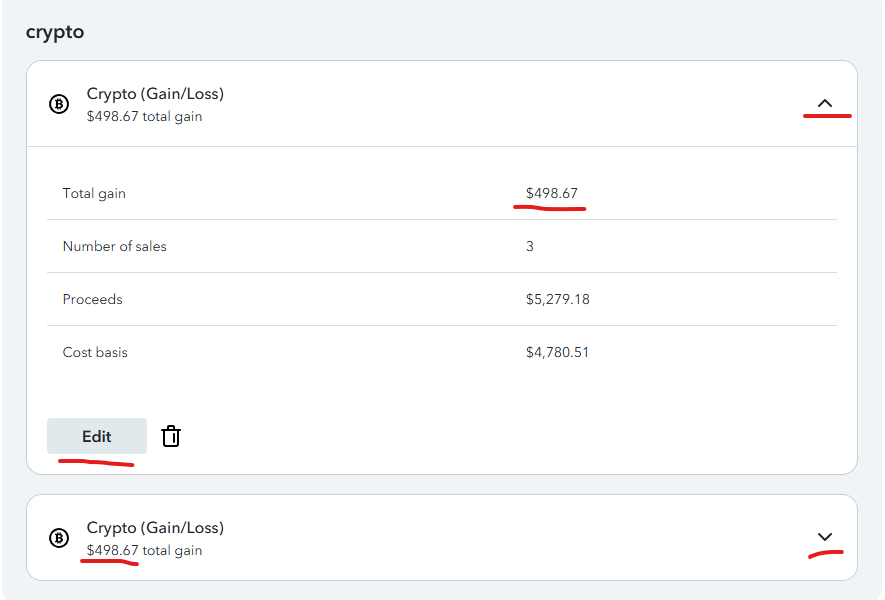

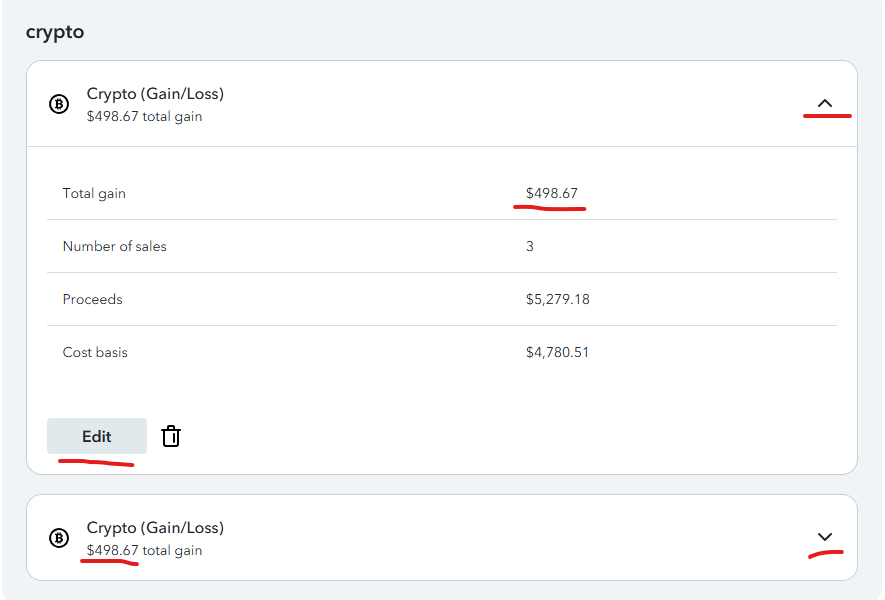

At the screen Let's finish pulling in your investment income, click the down arrow to the right and click Edit to see the individual transactions.

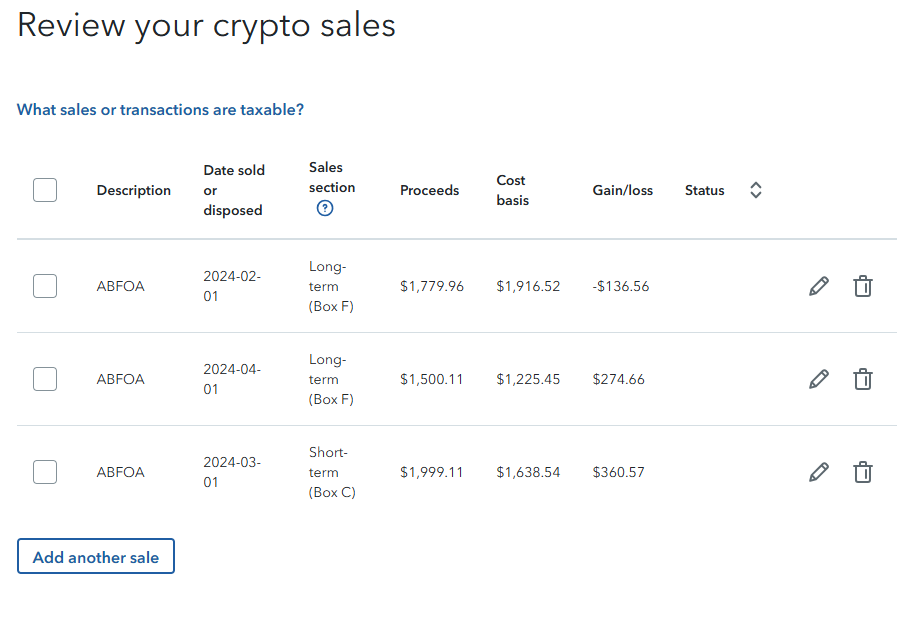

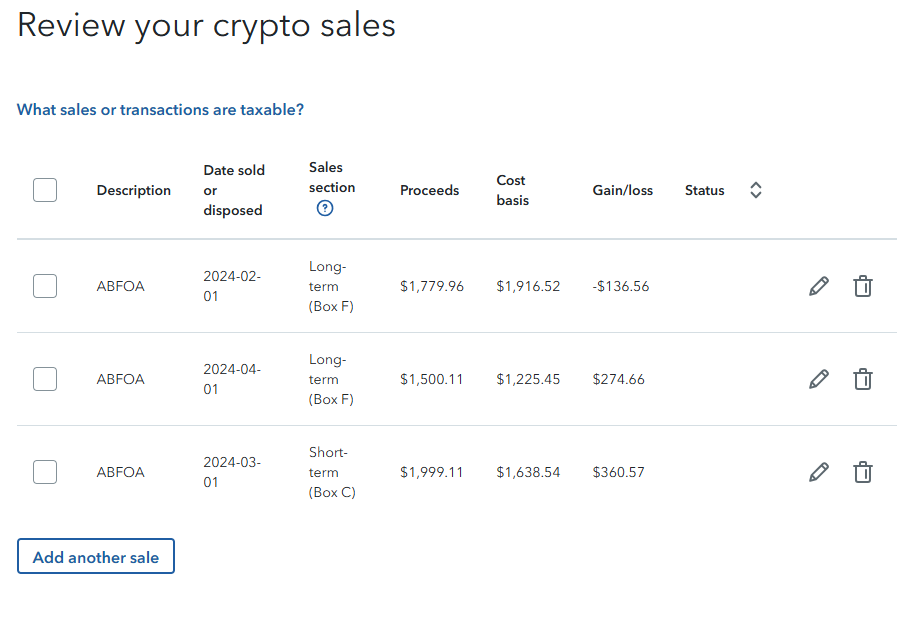

At the screen Review your sales, you may see the individual transactions.

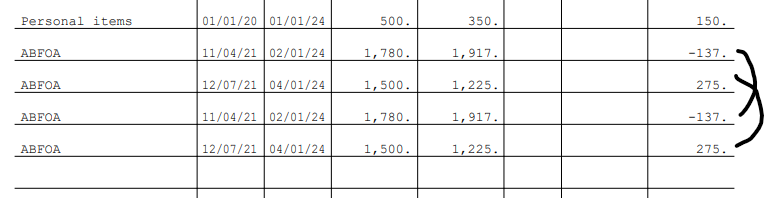

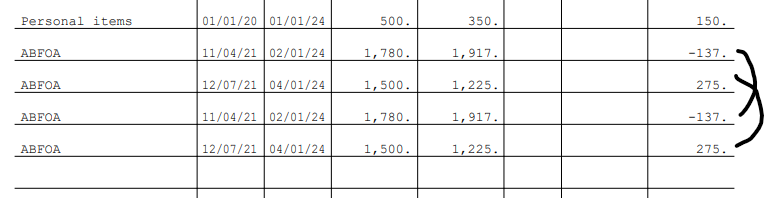

Or you may view the IRS form 8949 Sales and Other Dispositions of Capital Assets to see whether transactions have been duplicated.

You may print or view your full tax returns prior to filing after you have paid for the software.

- View the entries down the left side of the screen at Tax Tools.

- Select Print Center.

- Select Print, save or preview this year's return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

duplicate entries capital assets worksheet and 1099B worksheet

You may have to review and compare the individual entries.

At the screen Let's finish pulling in your investment income, click the down arrow to the right and click Edit to see the individual transactions.

At the screen Review your sales, you may see the individual transactions.

Or you may view the IRS form 8949 Sales and Other Dispositions of Capital Assets to see whether transactions have been duplicated.

You may print or view your full tax returns prior to filing after you have paid for the software.

- View the entries down the left side of the screen at Tax Tools.

- Select Print Center.

- Select Print, save or preview this year's return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nirbhee

Level 3

TEAMBERA

New Member

abcxyz13

New Member

ericbeauchesne

New Member

in Education

ProfDude

Level 1