- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

You may have to review and compare the individual entries.

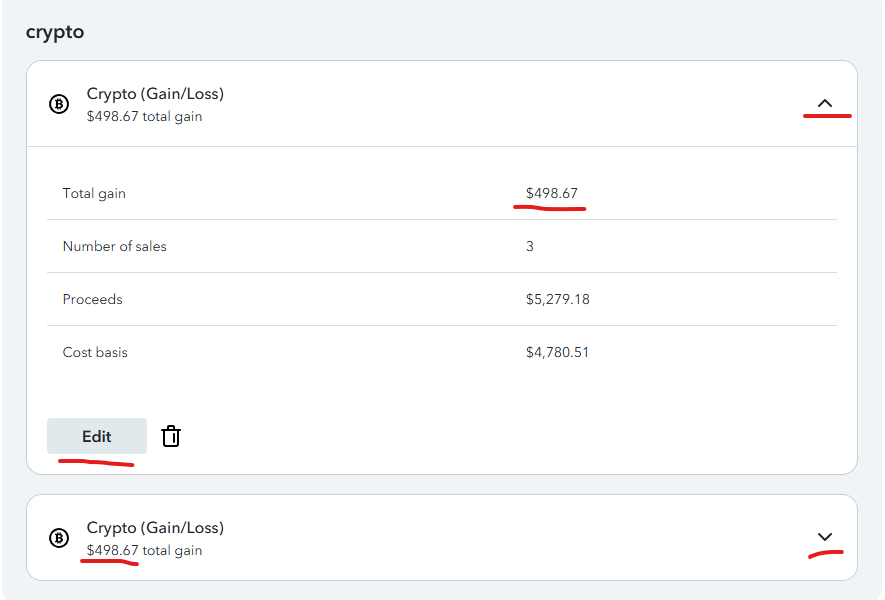

At the screen Let's finish pulling in your investment income, click the down arrow to the right and click Edit to see the individual transactions.

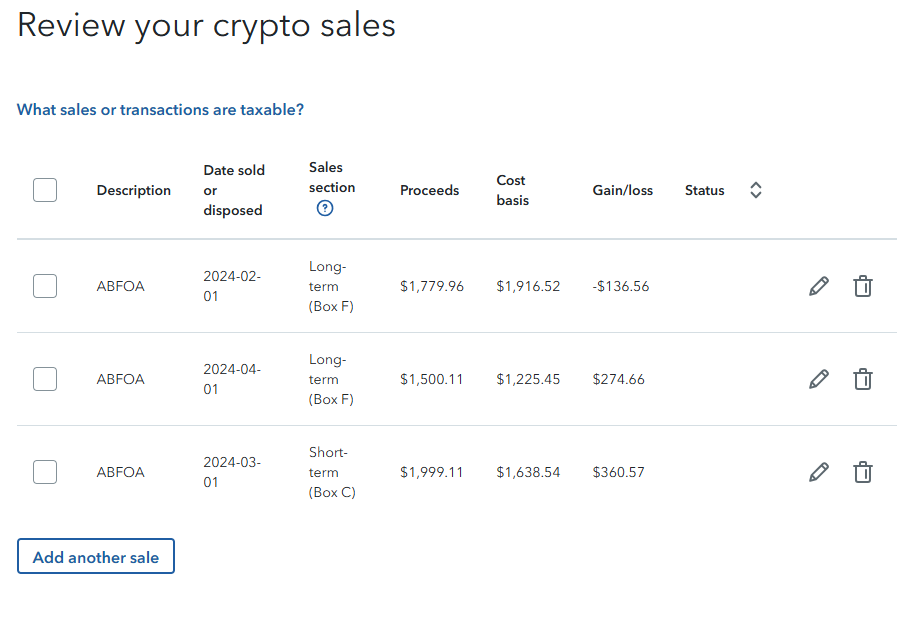

At the screen Review your sales, you may see the individual transactions.

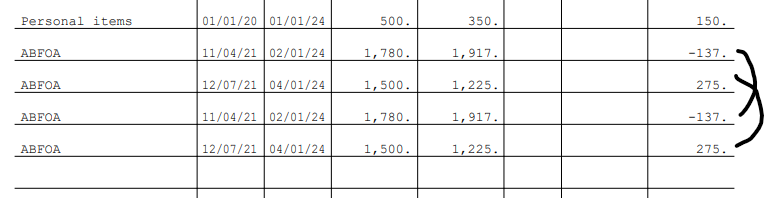

Or you may view the IRS form 8949 Sales and Other Dispositions of Capital Assets to see whether transactions have been duplicated.

You may print or view your full tax returns prior to filing after you have paid for the software.

- View the entries down the left side of the screen at Tax Tools.

- Select Print Center.

- Select Print, save or preview this year's return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 24, 2025

9:37 AM