- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- CT 1099 for retirement income is not populating the 1040 line 18 column B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

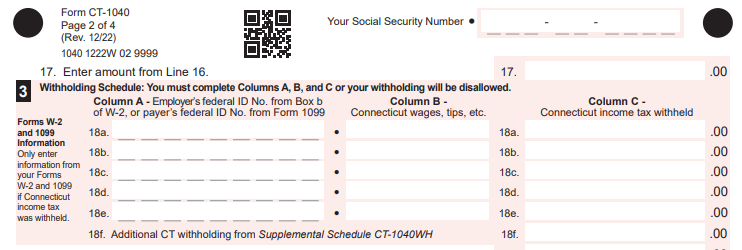

Been retired for several years, always have this 1099 but this year, column B is left empty and a red exclamation says the 1040 is incomplete. I was able to manually complete in "forms" mode but, not sure whats going on here. System also seems unfamiliar with this same 1099, questioning if it's a qualified plan and if thia is the first year distribution, etc.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

It does not sound like the IRS form 1099-R been entered into the Federal tax return.

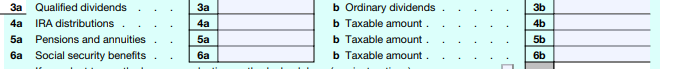

Does your 2022 Federal 1040 tax return show the pension distribution on line 5a? Does the Federal 1040 show a taxable amount on line 5b?

The income should be reported on the Federal tax return and flow to the Connecticut Form CT-1040.

If this is an IRS form 1099-R, what is the amount in box 1? Box 2a? Box 7? Is the IRA / SEP / SIMPLE box checked? Box 9b?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

Why would my issue be marked as "solved" and I'm supposed to check the best answer when there has been no solution or useful dialog ? Every year it's more of an effort to get TurboTax to own up to an issue and agree to fix it than it is to do the taxes. We should get our money back for purchasing this product that isn't ready to go until the customers review and requested fixes are actually fixed. Apparently this process is "your" quality control ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

It sounds like you had an issue and were able to solve it. However, if you would like I can take a deeper look at this. However, I need a diagnostic file which is a copy of your tax return - with the error - that has all of your personal information removed. You can send one to us by following the directions below:

TurboTax Online:

Sign into your online account.

Locate the Tax Tools on the left-hand side of the screen.

A drop-down will appear. Select Tools

On the pop-up screen, click on “Share my file with agent.”

This will generate a message that a diagnostic file gets sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

Open your return.

Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

Please provide the Token Number that was generated in the response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

Yea thanks, way too much work for me so that you can model-up what I've already described. I only care to know if my "fix" in forms mode will stay in place if/when I e-file.

I'd like to think that folks at Turbo Tax would seize this opportunity to fix the defect, not put the burdon on me. I deserve a refund for taking it this far.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

Yes, your override in forms mode will work. However, when you override the system your Accuracy Guarantee is voided.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

CT 1099 for retirement income is not populating the 1040 line 18 column B

Pretty sure leaving col B empty wasn't all that accurate. From my perspective, it's a new software error for 2022. The 1099 is accurate and is virtually same every year. Why TT failed to process is correctly this year is beyond me .. as I said, someone at TT would have to take an interest as I'm not working there, just reporting the problem and not interested in sharing my return for the study. Every year there's something that makes me feel I should get my money back for identifying an issue and then trying to convince someone there to believe me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

KI2024

New Member

benliwanag

New Member

Kpatterson

New Member

nmartens

Returning Member

rds055

New Member