- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

It does not sound like the IRS form 1099-R been entered into the Federal tax return.

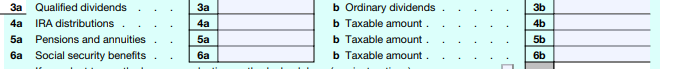

Does your 2022 Federal 1040 tax return show the pension distribution on line 5a? Does the Federal 1040 show a taxable amount on line 5b?

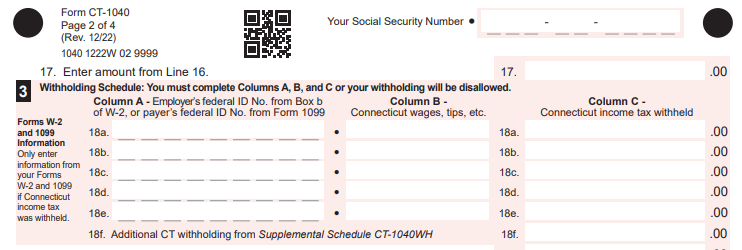

The income should be reported on the Federal tax return and flow to the Connecticut Form CT-1040.

If this is an IRS form 1099-R, what is the amount in box 1? Box 2a? Box 7? Is the IRA / SEP / SIMPLE box checked? Box 9b?

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 8, 2023

6:48 AM