- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

I am referring to a distribution taken from the IRA which includes us government obligation dividends.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

Sorry, what you are invested in inside the IRA has no bearing on your distribution and whether it is state taxable or not.

Your IRA could contain all tax-exempt bonds from your own state, and the distribution wouldn't be exempt form taxation in your home state

.........whereas tax-exempt interest from the same bonds in an standard taxable brokerage account would not be taxed by your state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

Sorry, what you are invested in inside the IRA has no bearing on your distribution and whether it is state taxable or not.

Your IRA could contain all tax-exempt bonds from your own state, and the distribution wouldn't be exempt form taxation in your home state

.........whereas tax-exempt interest from the same bonds in an standard taxable brokerage account would not be taxed by your state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

*The real question is how to report this info in TurboTax? and keep a running tally of this each year you take RMD? If anyone knows, then please post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

NJ is creating a tax nightmare for it's residents.........Have no idea, at this point, if the TTX NJ software can handle it

.....how in the world would a NJ resident keep track of what sub-portion of their IRA RMD, is from US or NJ-bonds and update their own files properly every year. Only 1-out-of 1000 could even figure out how to keep track....unless they carefully kept the US/NJ bonds in an entirely separate IRA account. I suspect that TXT may not be able to support this.

IF the user is lucky, the new NJ pension exclusion will cover it all and keeping track will be unnecessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

No, distributions are considered to all be the same kind of money and are taxed as one distribution regardless of the source of the cash that was generated to pay the distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

"iansteiner1" is 100% correct on this for the state of New Jersey. However I cannot figure out how to input this information into TurboTax nor can I figure out of there is a way to make the adjustment manually. I need to figure out how to adjust the distributions taken from an IRA to reflect that a portion of this distribution is from US Government interest. I have both US Government interest from mutual funds and US Government interest from direct holdings of US Treasury bonds. If anyone has found a solution please respond.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

Were you able to resolve your issue here or are you still needing guidance?

Make sure you have ran all updates.

If using TurboTax Online: Clear your cache and cookies. See this FAQ, for your particular browser.

If using TurboTax Desktop: Please see this FAQ.

If you still are not able to solve this, please call TurboTax Customer service. Here is a link: Turbo Tax Customer Service

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

Thank you. I have not been able to resolve this issue. Other than using overrides and then having to manually file, I see no way for TurboTax to handle this properly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

Most state interviews have a way that you can adjust for state non-taxable income. In the 'Income' summary section, look for 'IRA or Pension Distributions', then for 'Adjustments', where you can note your adjustment and amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

Thank you Marilyn. While TurboTax for NJ has an Income and Adjustments section, unfortunately it has not been built out to handle these adjustments for US Government interest as you show for California. What you have highlighted would appear to be the fix that needs to be incorporated into the software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

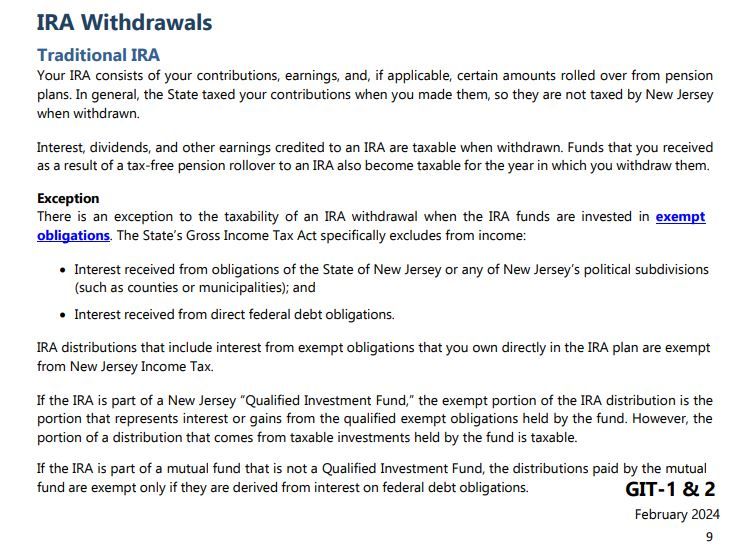

First of all let's go to IRA withdrawals in the State of NJ website. In the section with the heading Ira Withdrawals, it says, "There is an exception to the taxability of an IRA withdrawal when the IRA funds are invested in obligations that are exempt from New Jersey Income Tax. The Gross Income Tax Act specifically excludes from income:

• Interest received from obligations of the State of New Jersey or any of New Jersey’s political subdivisions; and

• Interest received from direct federal obligations. This would include interest received from IRA distributions even though this isn't specifically mentioned in the website. This is our cited source to exclude this interest."

Now are you ready to exclude this interest?

- Go to the State Tab in your Turbo Tax product.

- As you navigate in the program, you will see a section that says Other Non-Wage Income

- Make an entry within this section such as Excluded US obligation Interest Within IRA Distribution and then record it with a minus sign in front of it. See the screenshot at the end of this post.

Make sure you have the proper documentation that reports this amount just in case if NJ Dept of Revenue has questions.. It is usually found in a supplemental form that came with your 1099R to show how you reported this plus the citation from the website I provided above. Here is the screenshot.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I exclude dividends from state taxable income from investments in direct US government obligations within an IRA?

Thank you. To be clear this is specifically mentioned in NJ Publication GIT-1&2 Retirement Income. See page 9. This is the source one would cite.

I am not sure your proposed work-around would work if one does not have other non-wage income since to my knowledge New Jersey taxes gross income and you do not get benefit for “losses/negative income” as you suggest entering. The solution provided by MarilynG1 is what TurboTax needs to build into the New Jersey software as it clearly provides for an adjustment to taxable amounts of IRA distributions at the state level. Until then, I suggest overriding Line 20a, filing manually and keeping appropriate records.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

TLin1

Level 1

RobC3

Returning Member

taxfan123

New Member

maps4you

Level 3

mountainfern-gma

New Member