- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

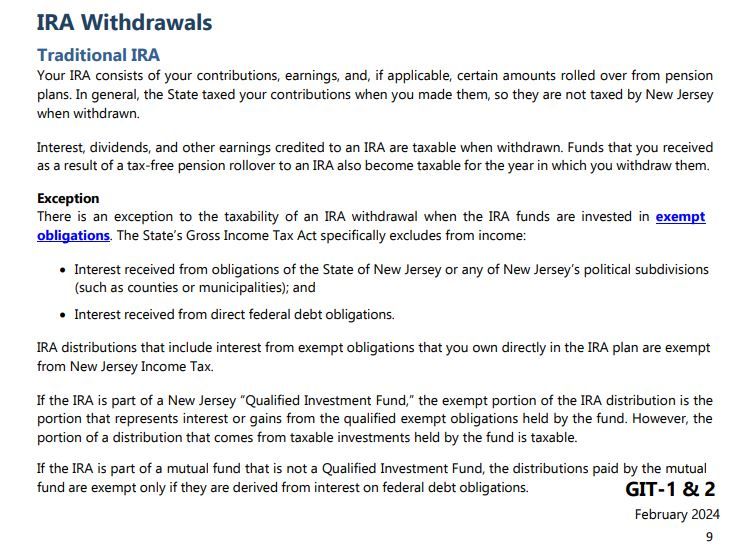

Thank you. To be clear this is specifically mentioned in NJ Publication GIT-1&2 Retirement Income. See page 9. This is the source one would cite.

I am not sure your proposed work-around would work if one does not have other non-wage income since to my knowledge New Jersey taxes gross income and you do not get benefit for “losses/negative income” as you suggest entering. The solution provided by MarilynG1 is what TurboTax needs to build into the New Jersey software as it clearly provides for an adjustment to taxable amounts of IRA distributions at the state level. Until then, I suggest overriding Line 20a, filing manually and keeping appropriate records.

April 2, 2024

8:31 PM