- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Are Social security net benefits paid to me or the total benefit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are Social security net benefits paid to me or the total benefit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are Social security net benefits paid to me or the total benefit

Enter your SSA1099 exactly as it appears. Go to Federal> Wages & Income>>Retirement Plans and Social Security to enter your SSA1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are Social security net benefits paid to me or the total benefit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are Social security net benefits paid to me or the total benefit

Enter your SSA1099 exactly as it appears. Go to Federal> Wages & Income>>Retirement Plans and Social Security to enter your SSA1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are Social security net benefits paid to me or the total benefit

The Turbo tax format says to enter "Total Net Benefits"

FORM SSA-1099 lists as follows:

A paid by check or direct deposit

B Medicare part B

C voluntary Fed income tax withheld

D Benefits for 20XX

The 1099 form does not have a "total net benefits" field. A is gross and D is a net figure.

So what do you enter in the Turbox tax field that says Total Net Benefits (A or D) ?

The "net" number is really D. A is gross

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are Social security net benefits paid to me or the total benefit

@tripleee wrote:

The Turbo tax format says to enter "Total Net Benefits"

FORM SSA-1099 lists as follows:

A paid by check or direct deposit

B Medicare part B

C voluntary Fed income tax withheld

D Benefits for 20XX

The 1099 form does not have a "total net benefits" field. A is gross and D is a net figure.

So what do you enter in the Turbox tax field that says Total Net Benefits (A or D) ?

The "net" number is really D. A is gross

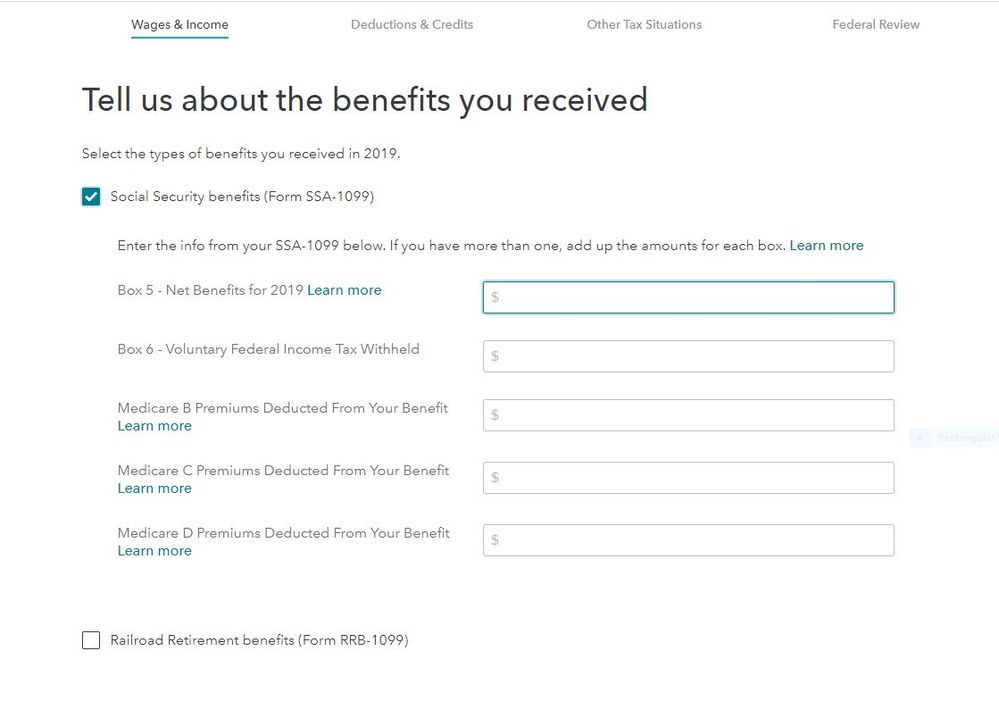

The program asks for the net from box 5 of the SSA-1099 and Federal Income taxes withheld from box 6 along with the other information reported on ths SSA-1099. See screenshot from the TurboTax online editions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are Social security net benefits paid to me or the total benefit

Yes the SSA-1099 has Net Benefits. It's Box 5 on the top line. Don't you have an actual SSA-1099? What form do you have?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

jmgretired

New Member

aarondm2000

New Member

rkwicks1958

New Member

srobinet1

Returning Member