- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@tripleee wrote:

The Turbo tax format says to enter "Total Net Benefits"

FORM SSA-1099 lists as follows:

A paid by check or direct deposit

B Medicare part B

C voluntary Fed income tax withheld

D Benefits for 20XX

The 1099 form does not have a "total net benefits" field. A is gross and D is a net figure.

So what do you enter in the Turbox tax field that says Total Net Benefits (A or D) ?

The "net" number is really D. A is gross

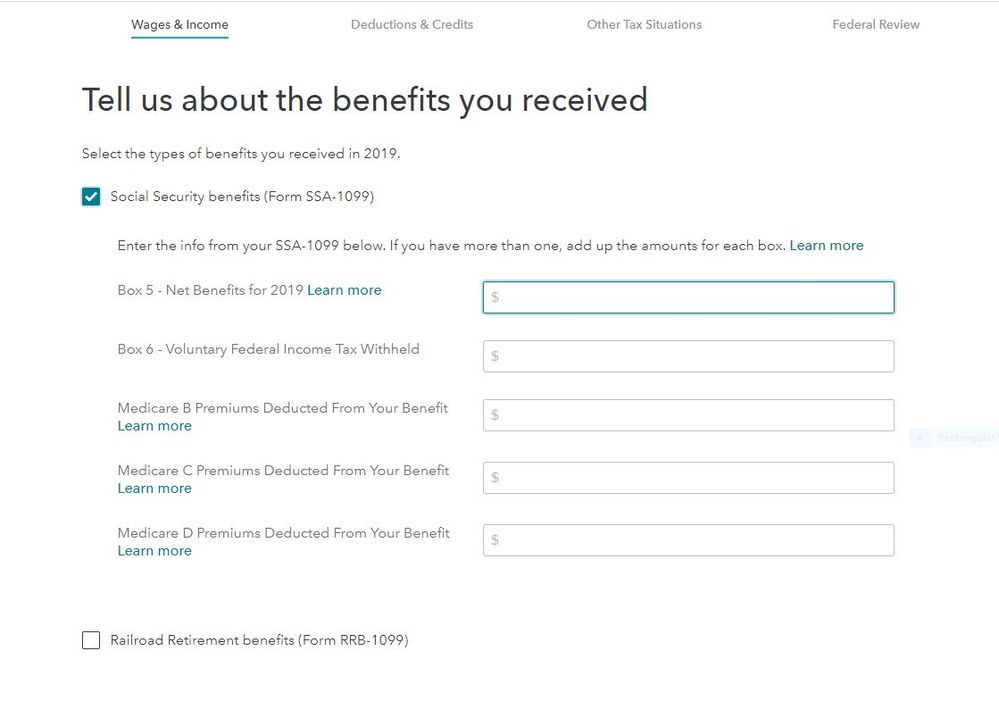

The program asks for the net from box 5 of the SSA-1099 and Federal Income taxes withheld from box 6 along with the other information reported on ths SSA-1099. See screenshot from the TurboTax online editions.

May 8, 2020

4:12 PM

1,912 Views