- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- 1040x Total Tax < Total Payment but no refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040x Total Tax < Total Payment but no refund

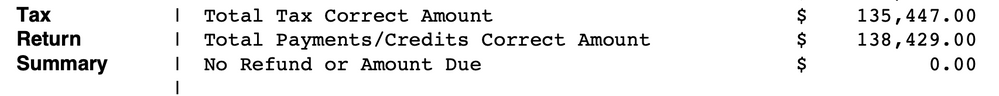

Hi, I'm filing 1040x for 2021. My Total Tax on the original 1040 was 138,429. Now on the 1040x, Total Payment is 138,429 which makes sense because I have paid all my 2021 tax due so it should equal the original 1040. But the problem is after the amendment, my Total Tax Correct Amount is only 135,447 and Turbotax says I'm not owed a refund.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040x Total Tax < Total Payment but no refund

Go by the actual 1040X. Line 18 should be your original refund amount and line 22 should be your additional refund. If you paid on your original return it will be on line 16. If there is an amount owed with the amendment, it will be on line 20.

If you have a tax due, do not send the 1040V. Just include a check with the 1040X. Ignore the 1040V. That is for the original return or what the original return would have been if it didn’t need correcting. Don’t pay the amount on the 1040V. Pay the amount on the actual 1040X.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040x Total Tax < Total Payment but no refund

Go by the actual 1040X. Line 18 should be your original refund amount and line 22 should be your additional refund. If you paid on your original return it will be on line 16. If there is an amount owed with the amendment, it will be on line 20.

If you have a tax due, do not send the 1040V. Just include a check with the 1040X. Ignore the 1040V. That is for the original return or what the original return would have been if it didn’t need correcting. Don’t pay the amount on the 1040V. Pay the amount on the actual 1040X.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040x Total Tax < Total Payment but no refund

Right, my question is not how much I currently owe, but actually why am I not owed a refund if Total tax is less than Total payment.(as shown in the screenshot) Sorry I wasn't clear.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040x Total Tax < Total Payment but no refund

review lines 16-22 to ascertain why you do not have an amount on Line 21.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040x Total Tax < Total Payment but no refund

According to 1040x line 10, there's a "other taxes" that I owe which Turbotax didn't take into account on the summary page. Looks like this is a bug in Turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1040x Total Tax < Total Payment but no refund

On the 1040-X Line 10, the Other Taxes is from Schedule 2 Line 21 which flows to Form 1040 Line 23.

Look at your original Form 1040 Line 23 and the Schedule 2 Part II for the type of other taxes being reported in Column A. And on the amended Schedule 2 Part II for Column B of the amended return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dougiedd

Returning Member

Kuehnertbridget

New Member

mulleryi

Level 2

mulleryi

Level 2

xcom747

New Member