- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Military filers

- :

- Re: NC State Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC State Taxes

I am retired military with over 20 years of service.

I'm using Turbo Tax Deluxe and in the State Tax section it asks me to insert the 'Allowable US Uniformed Services retirement benefit deduction'. Where do I get that number from?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC State Taxes

It is "either" at least 20 years service, or medically retired if earlier than 20 years.

The $$ amount comes from box 2a of your DFAS 1099-R.

BUT

IF you have already claimed it under the Bailey Settlement, you cannot claim it again under the new Uniformed Services exemption...one or the other, not both.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC State Taxes

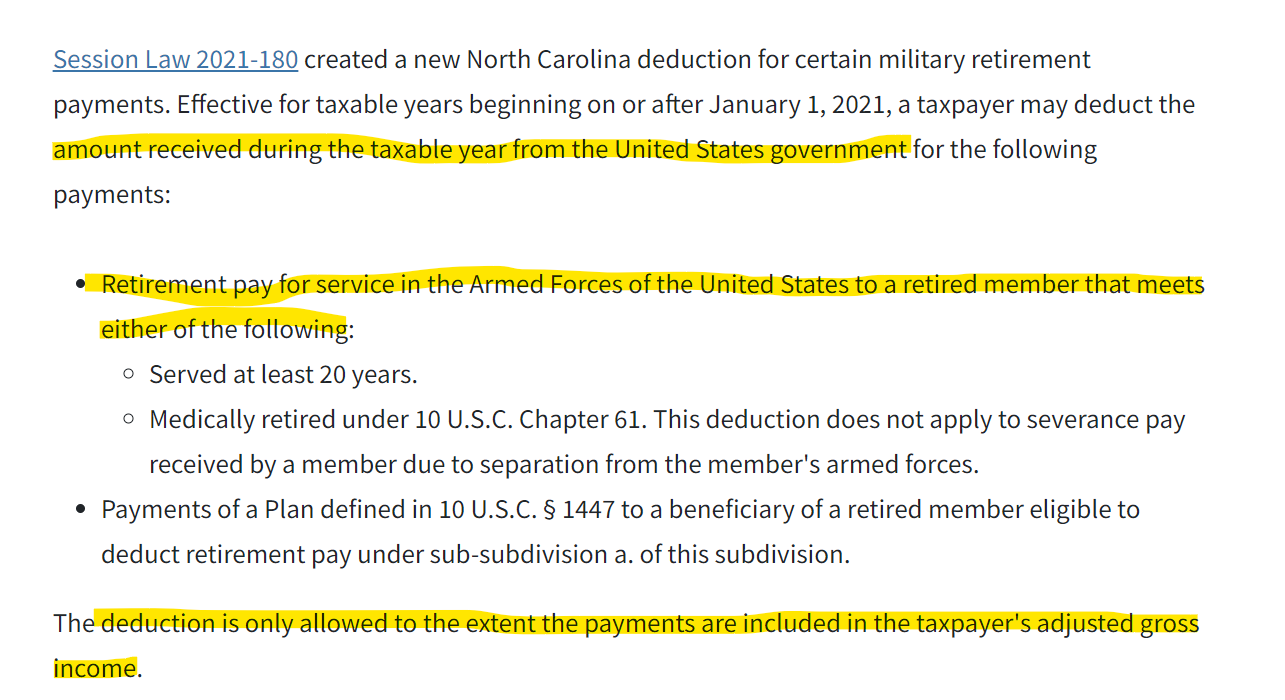

That would be the medical military retirement benefits you included in your gross income as per this from the North Carolina Department of Revenue:

Here is a link to the article: NC military pay exclusion

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NC State Taxes

It is "either" at least 20 years service, or medically retired if earlier than 20 years.

The $$ amount comes from box 2a of your DFAS 1099-R.

BUT

IF you have already claimed it under the Bailey Settlement, you cannot claim it again under the new Uniformed Services exemption...one or the other, not both.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ag822x

New Member

amybabybrady

New Member

zig1ha

New Member

tabithamorrison103015

New Member

georgeanndiaz

New Member